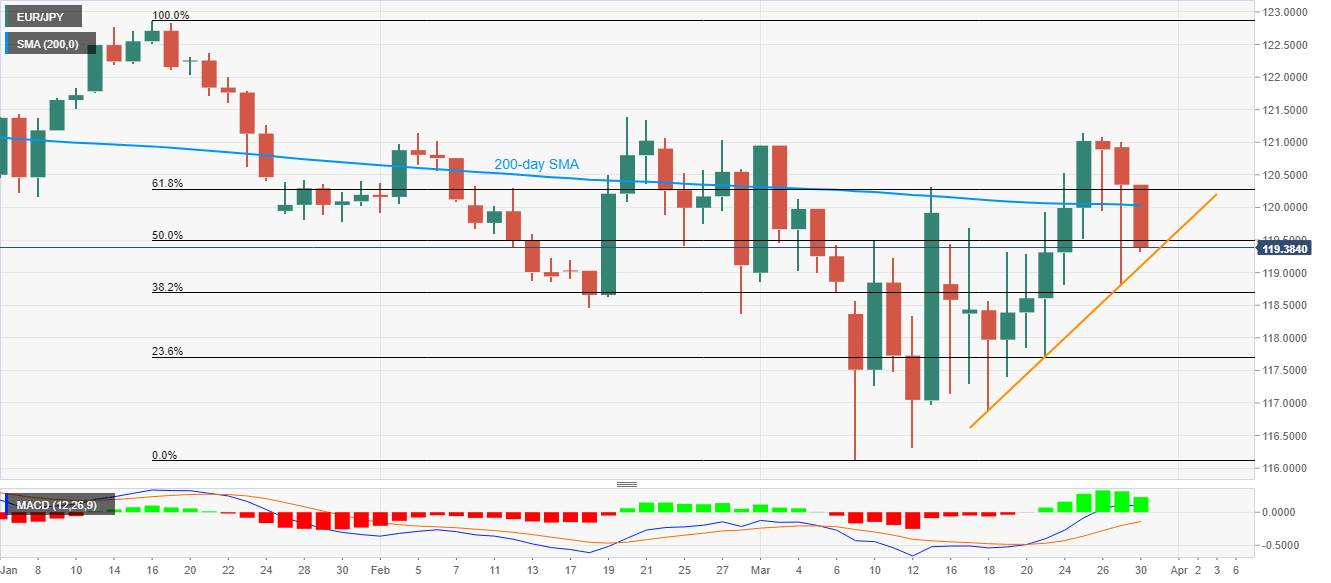

- EUR/JPY remains on the back foot below 200-day SMA, the key Fibonacci retracement levels.

- Bullish MACD, an eight-day-old rising trend line will check immediate declines.

While extending its declines below 200-day SMA, EUR/JPY flashes 119.40 as a quote during the Asian session on Monday. With this, the pair drops below 50% Fibonacci retracement of its declines from January 16, 2020.

Even so, an upward sloping trend line since March 18, currently around 119.10, could restrict the quote’s immediate downside amid the bullish MACD.

If at all the bears refrain to respect the support line and MACD signals, February 18 low near 118.50 and 23.6% Fibonacci retracement close to 117.70 may entertain the sellers.

Alternatively, a daily closing beyond a 200-day SMA level of 120.00 could push the buyers to cross 61.8% Fibonacci retracement level, at 120.30.

Although the pair’s sustained run-up beyond 120.30 enables it to question the monthly top near 121.15, the further upside can be questioned by the February month high surrounding 121.40.

EUR/JPY daily chart

Trend: Pullback expected