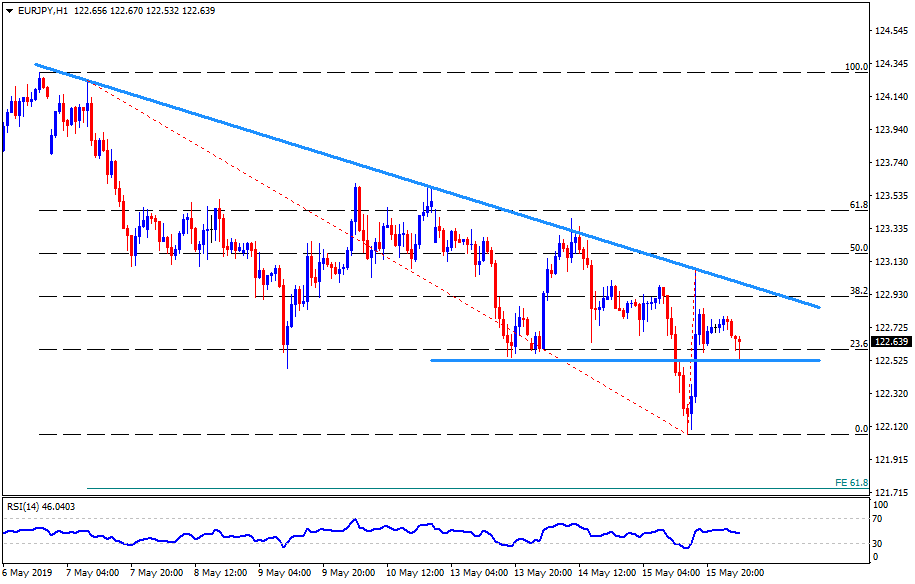

- A one weeklong trend-line limits the pair’s upside.

- Immediate horizontal-support and latest lows can question sellers during further declines.

Failure to surpass a downward sloping trend-line since May 07 drags the EUR/JPY pair towards re-testing 122.50 horizontal-support during the early Asian session on Thursday.

While short-term resistance-line caps the quote’s upside, break of 122.50 becomes necessary to revisit Yesterday’s lows surrounding 122.00.

If at all prices keep trading southward below 122.00, 61.8% Fibonacci expansion (FE) of latest moves, at 121.75, could appear on the chart.

Given the pair’s ability to cross 123.00 trend-line resistance, it’s rise to 123.40 and 123.65 can’t be denied.

Also, the pair’s successful trading above 123.65 enables it to challenge 124.00 and 124.30 numbers to the north.

EUR/JPY hourly chart

Trend: Pullback expected