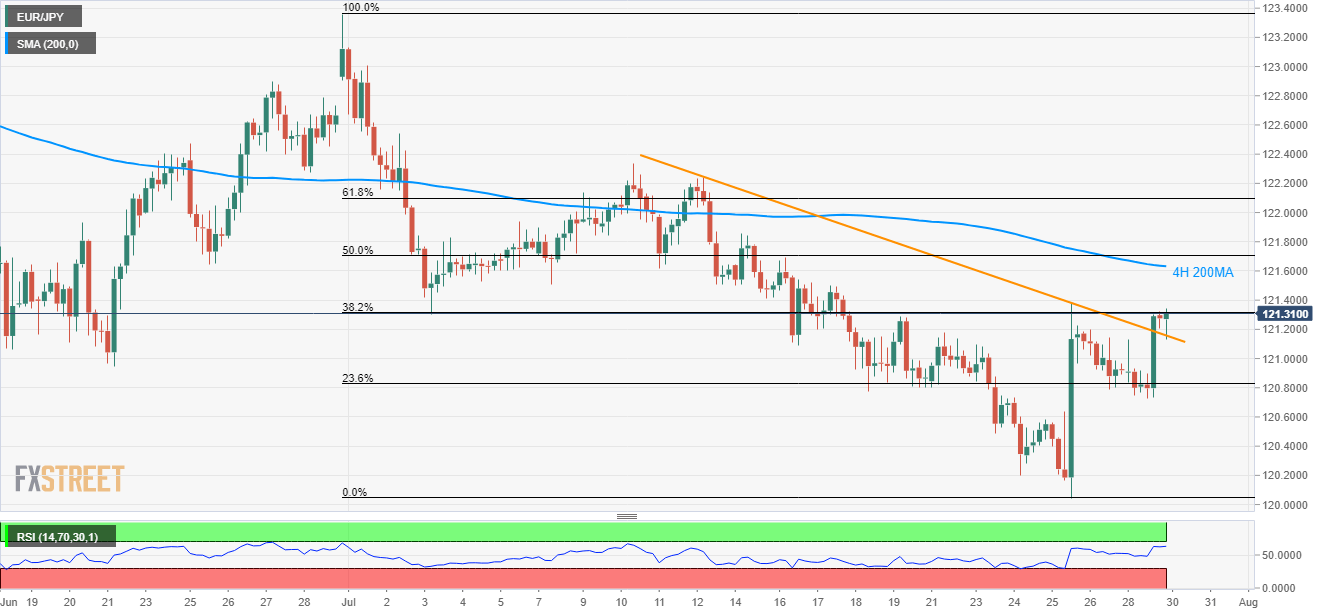

- 38.2% Fibonacci retracement of a month-old decline, overbought RSI question the EUR/JPY pair’s further upside.

- Latest low close to 120.7250 becomes immediate support to watch.

EUR/JPY struggles around 38.2% Fibonacci retracement of June-end to July bottom downpour as it takes the bids to 121.33 during early Tuesday.

Not only the Fibonacci retracement level but overbought conditions of 14-bar relative strength index (RSI) also highlights buyers’ exhaustion despite breaking an eleven-day long descending trend-line on Monday.

As a result, odds are high for the pair’s pullback to 121.00 and then to a recent low surrounding 120.7250. However, July 24 high near 120.58 and the monthly low surrounding 120.00 could challenge bears afterward.

Alternatively, 200-bar moving average on the 4-hour chart (4H 200MA) at 121.63 becomes the next target for buyers whereas 122.00 and July 10 high near 122.3350 may lure them during further advances.

EUR/JPY 4-hour chart

Trend: Pullback expected