Even after reversing back from 123.60, EUR/JPY is still left to clear 124.15/20 resistance-confluence as it trades near 124.00 on early Monday.

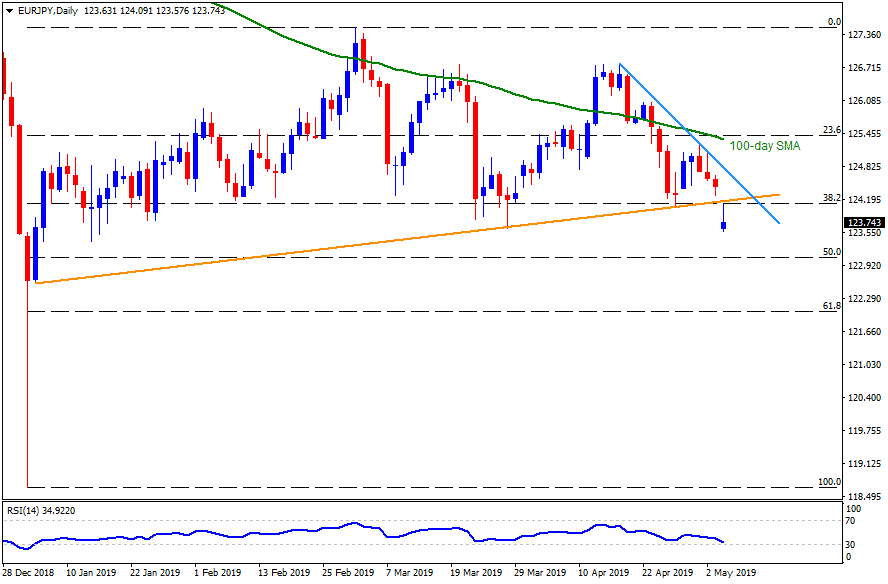

38.2% Fibonacci retracement of January to March upside and an upward sloping trend-line connecting lows since January 04 highlights the importance of 124.15/20 area.

Unless the quote rallies past-124.20, it can’t avoid revisiting 123.60, 123.40 and 123.00 consecutive supports.

During the pair’s additional declines under 123.00, January 04 low near 122.60 can try disappointing bears, if failed may open the doors for late-April 2017 bottoms around 122.00.

On the upside, a successful clearance of 124.20 can trigger price recovery towards 124.50 but a near-term descending trend-line near 124.85/90 might challenge buyers then after.

Given the presence of extra rise above 124.90, current month high near 125.25, 100-day simple moving average (SMA) at 125.40 can flash on the bulls’ radar.

EUR/JPY daily chart

Trend: Negative