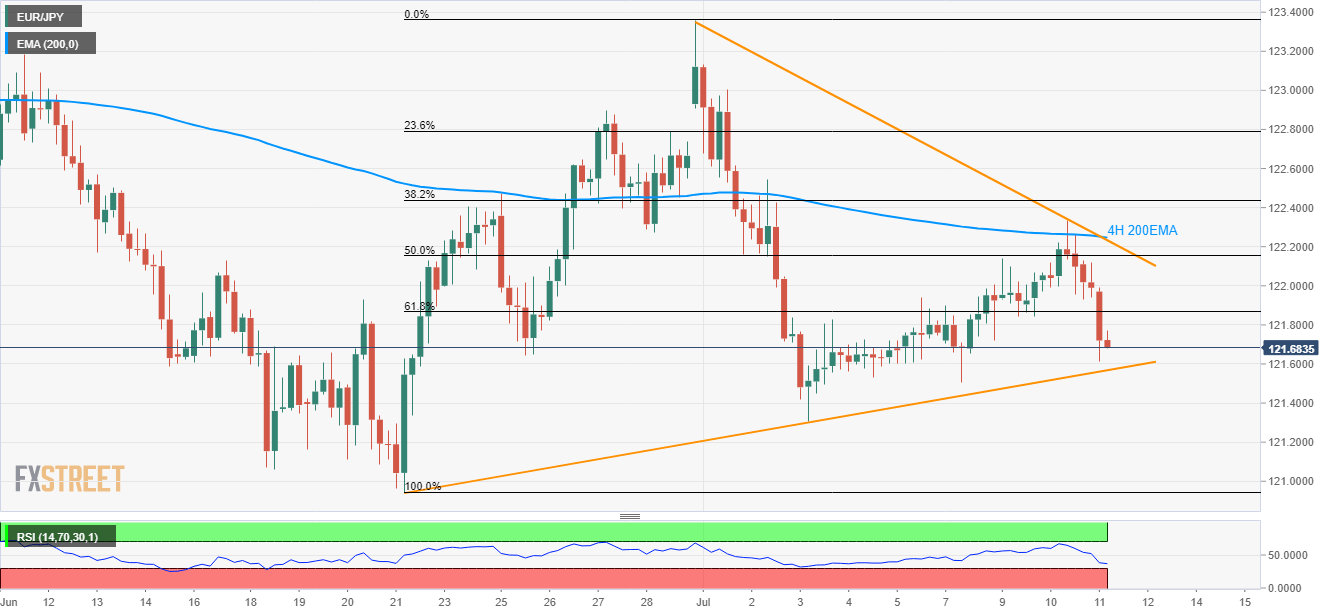

- EUR/JPY buyers fall short of clearing 4H 200EMA while sellers exit around 20-day old ascending trend-line.

- 122.23/25 becomes the key resistance-confluence amid close to oversold RSI.

Even after the sustained trading beneath 200-bar exponential moving average on the 4-hour chart (4H 200EMA), EUR/JPY sellers fail to conquer short-term ascending trend-line as the quote takes the bids near 121.76 ahead of the European open on Thursday.

Adding to the chances of the pullback is near to oversold conditions of 14-bar relative strength index (RSI) that highlights the importance of 61.8% Fibonacci retracement of a range between June swing lows to July top, around 121.87.

Should prices rally past-121.87, 50% Fibonacci retracement near 122.15 can offer an intermediate halt ahead of pushing bulls to confront the 122.23/25 confluence including 4H 200EMA and near-term descending trend-line resistance.

On the downside, pair’s break of 121.57 support can trigger fresh declines to current month low near 121.31 whereas late-June bottom around 120.95 and the 120.00 round-figure can please bears then after.

EUR/JPY 4-hour chart

Trend: Pullback expected