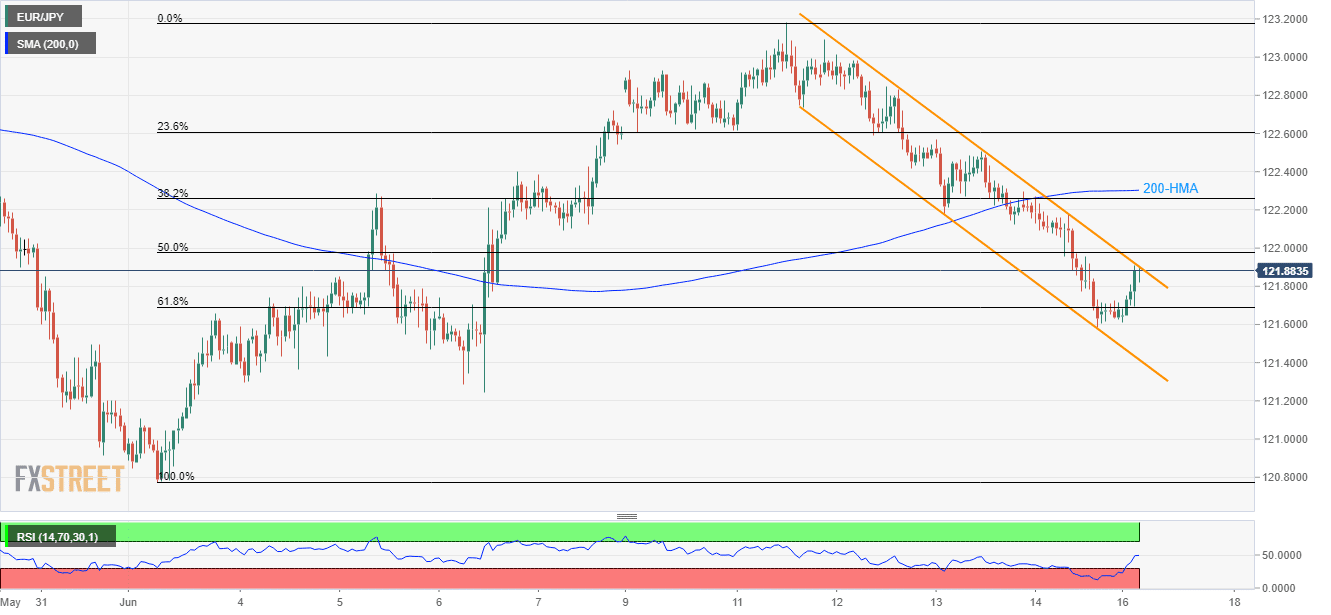

- Break of immediate channel resistances opens the gate to the fresh upside towards 200-HMA.

- Pullbacks can highlight 61.8% Fibo. for sellers.

Despite bouncing off 61.8% Fibonacci retracement of current month upside, the EUR/JPY pair struggles with the short-term descending trend-channel resistance while trading near 121.85 during early Monday.

As a result, pair’s pullback to 121.70 mark comprising 61.8% Fibonacci retracement and then to the latest low near 121.59 can’t be denied. However, support-line of the channel at 121.41 could question further declines.

In a case where prices slip under 121.41, 121.25 and present month bottom around 120.78 could flash on bears’ radar.

Meanwhile, pair’s sustained a break of channel resistance figure of 121.91 can trigger its fresh upside to 122.10 ahead of aiming the 200-hour moving average (200-HMA) level of 122.30.

Should there be further upside past-122.30, 23.6% Fibonacci retracement near 122.61 and latest top near 123.18 could become bulls’ favorites.

EUR/JPY hourly chart

Trend: Bearish