- EUR/JPY trades a shade lower than 126.00 during initial Asian trading on Tuesday.

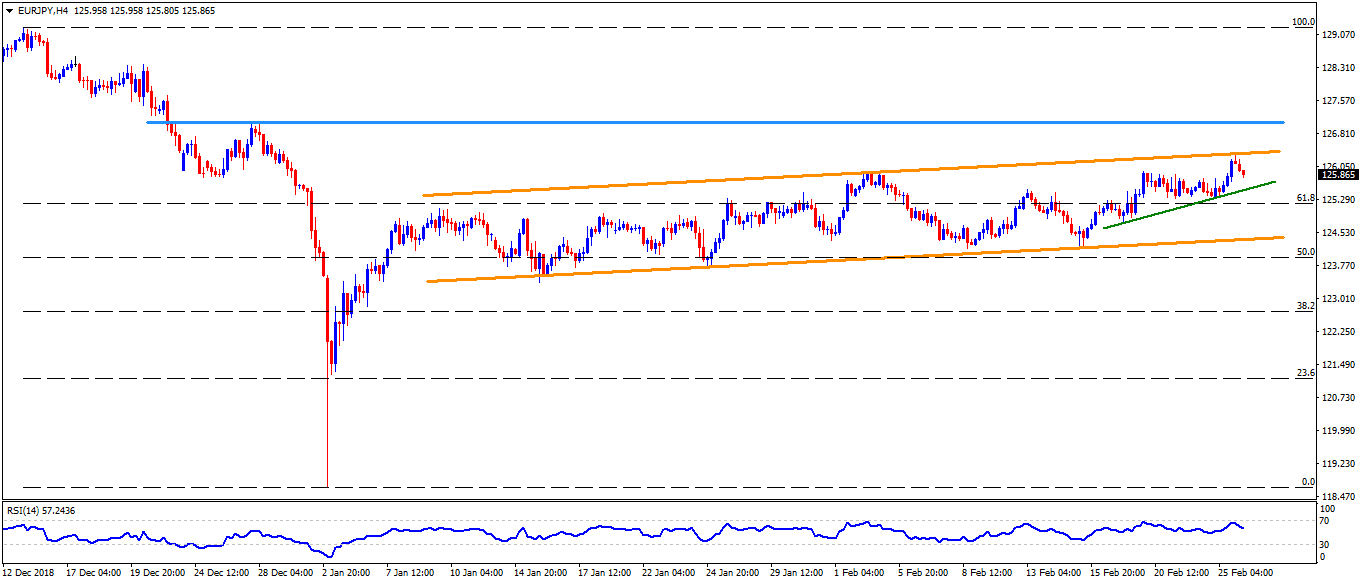

- The pair took a U-turn from an upward sloping trend-channel formation connecting the lows marked since mid-January.

- With the gradually declining 14-bar relative strength index (RSI), 125.50 level comprising an immediate ascending support-line that joins the lows of February 19 and 22 gains market attention.

- Should the pair drops under 125.50, 61.8% Fibonacci retracement of mid-December to early-January, at 125.15, followed by 124.70, can please the sellers.

- However, the channel-support figure of 124.30 might confine the pair’s downside past-124.70, if not then 123.70 and 123.40 could become bears’ favorites.

- On the flip side, an uptick beyond 126.40 channel resistance can trigger the pair’s recovery toward 127.00 – 127.10 horizontal region comprising late-December highs.

- If at all buyers refrain to respect 127.10, 127.70 and 128.40 are likely following numbers to appear on the chart.

EUR/JPY 4-Hour chart

EUR/JPY

Overview:

Today Last Price: 125.91

Today Daily change: -0.23 pips

Today Daily change %: -0.18%

Today Daily Open: 126.14

Trends:

Daily SMA20: 125.15

Daily SMA50: 125.16

Daily SMA100: 126.96

Daily SMA200: 128.16

Levels:

Previous Daily High: 126.31

Previous Daily Low: 125.38

Previous Weekly High: 125.94

Previous Weekly Low: 124.7

Previous Monthly High: 127.07

Previous Monthly Low: 118.84

Daily Fibonacci 38.2%: 125.95

Daily Fibonacci 61.8%: 125.73

Daily Pivot Point S1: 125.58

Daily Pivot Point S2: 125.01

Daily Pivot Point S3: 124.64

Daily Pivot Point R1: 126.51

Daily Pivot Point R2: 126.88

Daily Pivot Point R3: 127.45