- Fails to gain momentum despite breaking short-term resistance-line.

- Upward sloping RSI offers another reason to be positive.

- A break of 2-week old support-line can trigger a fresh downside.

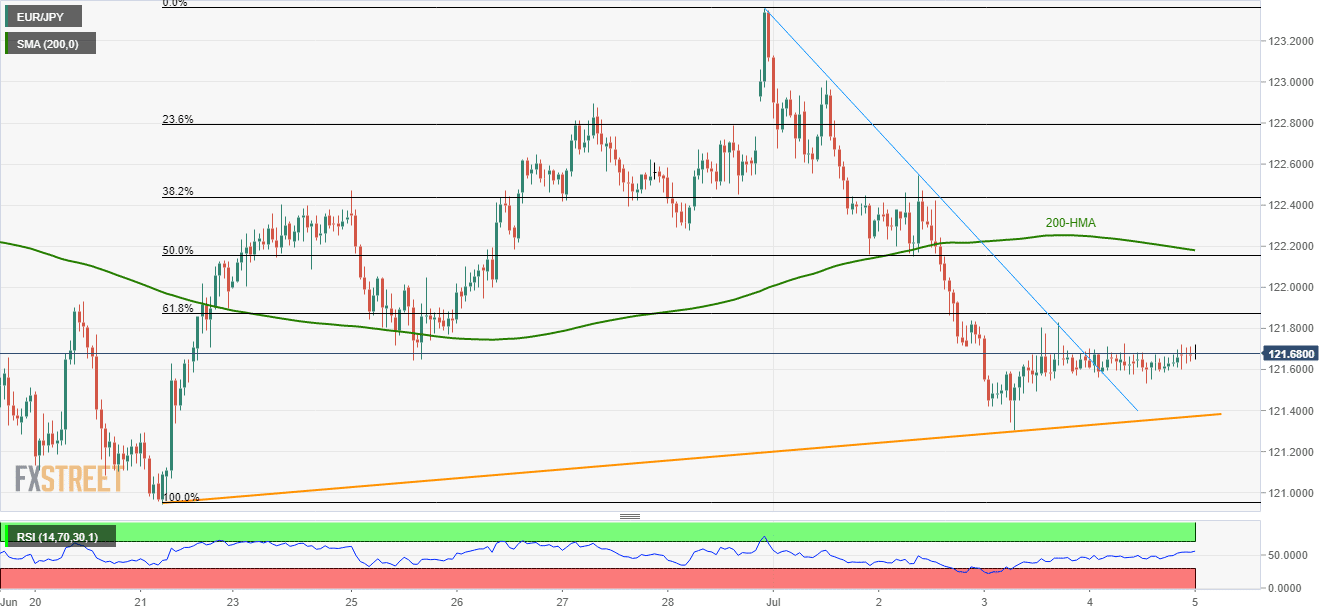

Even after breaking 4-day long trend-line resistance the previous-day, EUR/JPY remains modestly flat around 121.70 during early Friday.

Buyers await a sustained upside beyond 61.8% Fibonacci retracement of late-June rise, at 121.87, to question the 122.16/18 resistance-confluence comprising 50% Fibonacci retracement and 200-hour moving average (200-HMA).

During the additional increase above 122.18, 122.60 and 123.00 can please the bulls.

Meanwhile, the latest low surrounding 121.53 and immediate ascending support-line at 121.37 may limit the quote’s near-term declines.

In a case where sellers dominate past-121.37, June 21 low near 120.95 may become their favorites.

EUR/JPY hourly chart

Trend: Sideways