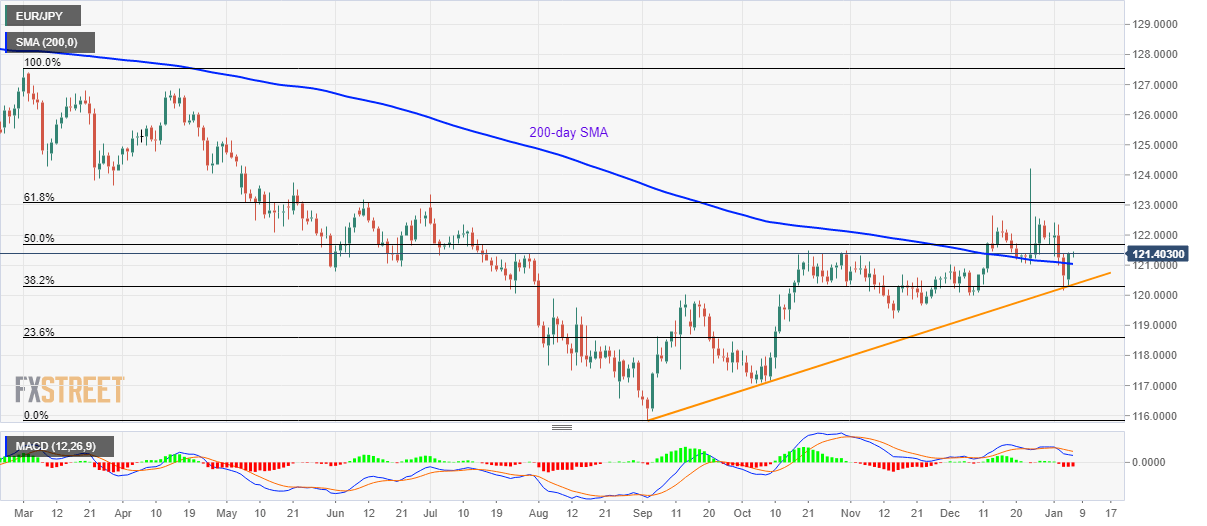

- EUR/JPY aims for 50% Fibonacci retracement after bouncing off the multi-month-old support trend line, also clearing 200-day SMA.

- September high, November low can question sellers looking at the Bearish MACD.

EUR/JPY takes the bids to 121.41 while heading into the European open on Tuesday. The pair took a U-turn from an upward sloping trend line since early September and also crossed 200-day SMA on Monday.

With this, buyers are aiming at 50% Fibonacci retracement of March-September 2019 fall, at 121.70, as the immediate resistance.

Given the quote’s sustained rise beyond 121.70, mid-December tops near 122.65/70 and 61.8% Fibonacci retracement around 123.10 will be in focus.

On the contrary, 200-day SMA and the aforementioned support line, near 121.00 and 120.35, respectively, limit the pair’s short-term declines.

In a case where sellers concentrate on the bearish signals from 12-bar MACD, September month high around 120.00 and November month low near 119.20 can return to the charts

EUR/JPY daily chart

Trend: Bullish