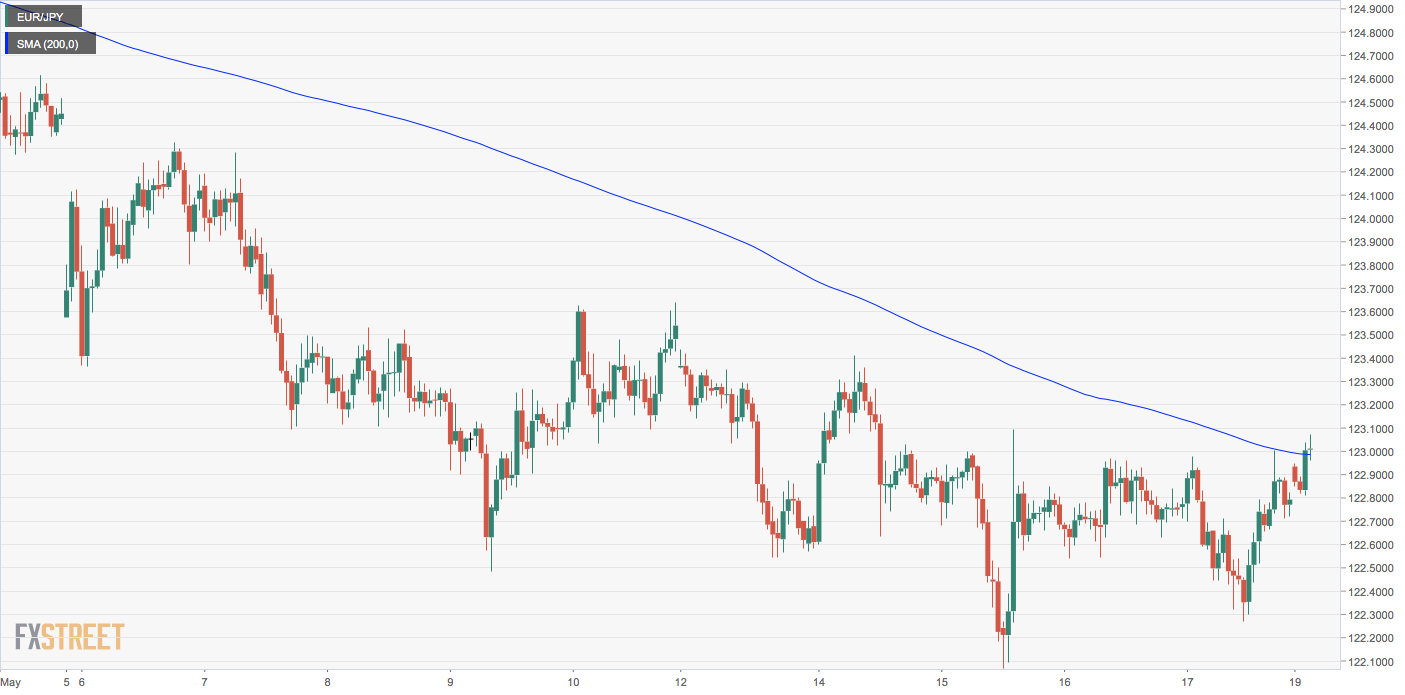

- EUR/JPY has found acceptance above the 200-hour moving average in Asia.

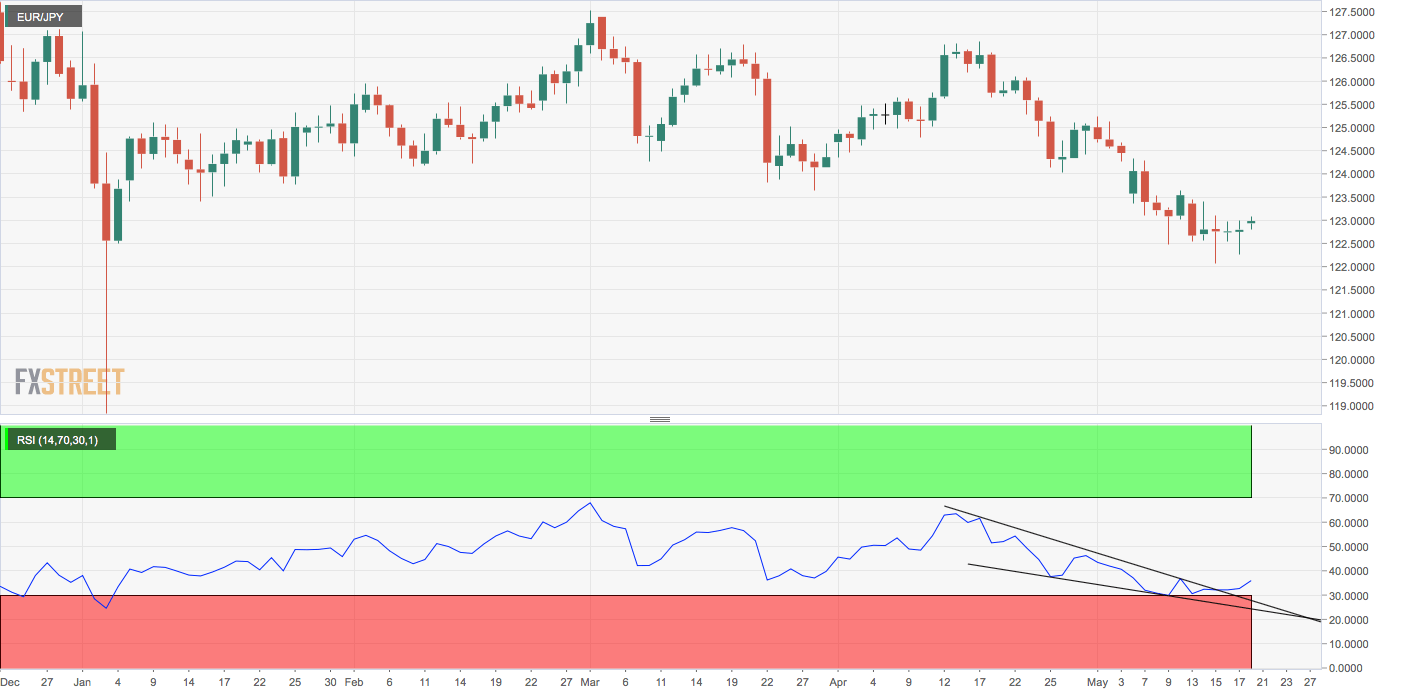

- The pair could rise further with signs of seller exhuastion on the daily chart.

EUR/JPY is trading above the 200-hour moving average (MA) for the first time since early May and further gains could be seen as the break above the key average is backed by signs of seller exhaustion.

To start with, the pair created doji candle for the third straight day on Friday. The Doji is widely considered a sign of bearish exhaustion if it appears following a prolonged sell-off, which seems to be the case with EUR/JPY.

Further, the 14-day relative strength index (RSI) is reporting a bullish divergence.

As a result, a rally to 123.65 (March 28 low) could be in the offing. At press time, the pair is trading just above the 200-hour MA of 122.98, having clocked a high of 123.07 earlier today.

Hourly chart

Daily chart

Trend: Bullish

Pivot points