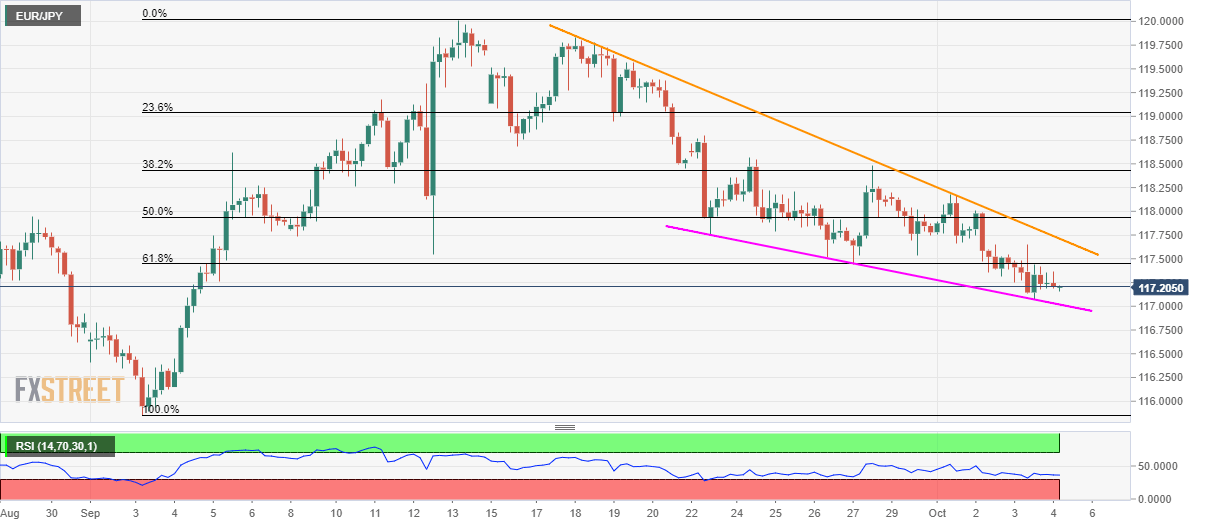

- EUR/JPY trades below 61.8% Fibonacci retracement, follows 12-day long descending resistance-line.

- Oversold RSI signals intermediate jumps off immediate support-line.

With the sustained trading below 61.8% Fibonacci retracement and multi-day old resistance-line, EUR/JPY extends declines to 117.18 by the press time of pre-European open on Friday.

However, oversold conditions of 14-bar relative strength index (RSI) signals pair’s bounce from a nine-day-old falling trend-line, at 117.00 now, if not then 116.80 and 116.40 can entertain bears ahead of drawing them to September month lows nearing 115.85.

On the contrary, an upside clearance of 61.8% Fibonacci retracement of September month’s run-up, at 117.48, could propel prices to near-term falling resistance-line, at 117.70.

In a case buyers manage to conquer 117.70, 118.30 and 118.80 should act as buffers during the rise to 119.30 and 120.00 numbers to the north.

EUR/JPY 4-hour chart

Trend: bearish