- NOK appreciates to the 9.75 area vs. EUR on Monday.

- Norway inflation figures surprised to the upside in February.

- Norges Bank’s Regional Network Survey due on Tuesday.

The better tone in the Norwegian currency is now forcing EUR/NOK to drop and record fresh multi-day lows in the 9.7500 neighbourhood.

EUR/NOK lower on solid data

The cross is extending the leg lower from last week’s tops near 9.8800, down for the second session in a row in response to today’s better-than-expected inflation figures in the Scandinavian economy during last month.

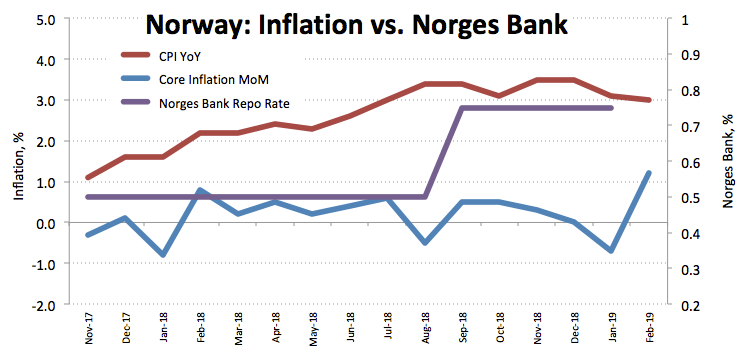

In fact, inflation figures tracked by the CPI rose 0.8% MoM and 3.0% from a year earlier, while Core CPI YTD advanced 2.6% and Core Inflation gained 1.2% inter-month, all prints coming in above prior surveys. In addition, Producer Prices rose 8.0% on a yearly basis, up from January’s 4.9% gain.

Also sustaining today’s upside, the barrel of European reference Brent crude is trading on a firmer note beyond the key $66.00 mark. Looking ahead, the always key Regional Network Survey is due tomorrow, closing the thin weekly calendar.

What to look for around NOK

The mood around the risk complex and Brent-dynamics continue to be the main drivers for the Norwegian currency for the time being. In the broader picture, fundamentals in the Nordic economy remain strong and the Norges Bank is expected to hike rates twice this year. This view has been reinforced by the December Regional Network Survey, which stressed the growth outlook for the economy remains strong. In addition, the first quarter is usually NOK-positive reinforced by tighter conditions in structural liquidity.

EUR/NOK significant levels

As of writing the cross is losing 0.47% at 9.7662 and a break below 9.7492 (low Mar.11) would aim for 9.7164 (100-day SMA) and finally 9.7022 (low Feb.28). On the other hand, the initial hurdle aligns at 9.8411 (high Feb.11) seconded by 9.8803 (high Mar.8) and then 9.9600 (2019 high Jan.3).