- EUR/SEK moves higher and records 5-week tops.

- Sweden GDP surprised to the downside in Q2.

- Manufacturing PMI next of relevance later in the week.

The Swedish Krona is depreciating to fresh monthly lows vs. its European peer on Tuesday, lifting EUR/SEK to fresh tops near the 10.6500 area.

EUR/SEK up on poor GDP figures

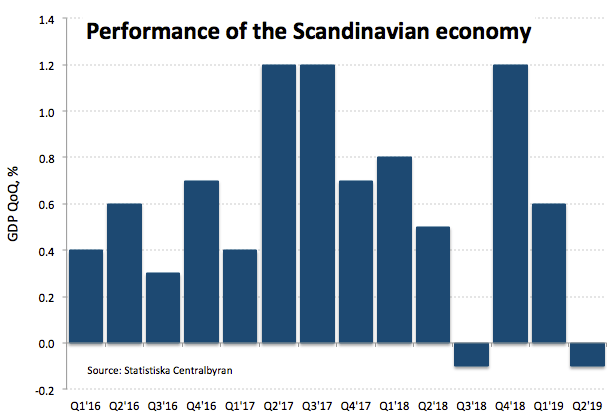

SEK gained sudden and strong selling pressure after advanced GDP figures showed the Scandinavian economy is seen expanding at an annualized 1.4% in Q2 while it is expected to contract 0.1% inter-quarter, both prints coming in short of estimates.

These results came in short of the Riksbank’s projections and could also motivate the central bank to revise lower its rate path at the next meeting, particularly in response to the impact of weaker sentiment indicators on future economic growth.

Moving forward, the only scheduled release in the Nordic calendar will be June’s Manufacturing PMI on Thursday.

What to look for around SEK

June’s lower-than-expected inflation figures are unlikely to be a game changer for the Riksbank vs. its plans of tightening the monetary conditions later in the year. However, this view is most likely to be challenged in the medium term amidst the recent shift from the majority of G10 central banks to a more accommodative stance, particularly after the ECB has announced its plans to pump further monetary stimulus in the near term (September?).

EUR/SEK levels to consider

As of writing the cross is gaining 0.74% at 10.6450 and a breakout of 10.6787 (23.6% Fibo of the 2019 up move) would open the door to 10.7167 (high Jun.12) and finally 10.8008 (high May 21). On the downside, the next support emerges at 10.4869 (low Jul.3) seconded by 10.4620 (200-day SMA) and finally 10.4018 (61.8% Fibo of the 2019 up move).