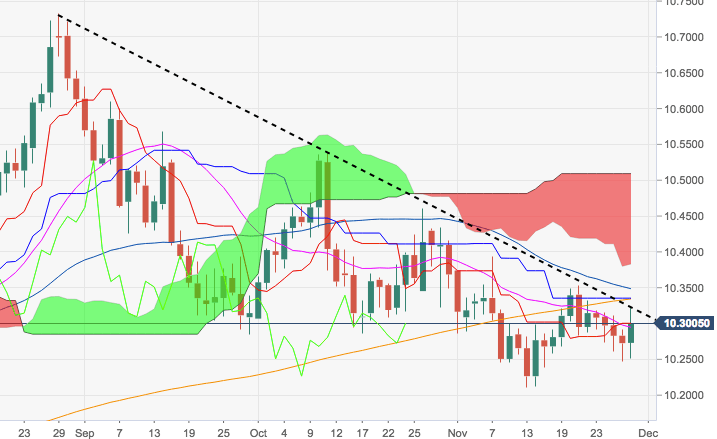

- The Swedish Krona debilitated to fresh lows in the 10.3200 area vs. its European peer in the wake of poor figures from Q3 GDP in Sweden.

- The cross rebounded from the 10.2500 region although the bullish attempt run out of legs just ahead of the short-term resistance line, today at 10.3219.

- While capped by this resistance line, EUR/SEK is expected to test the area of July/November low near 10.20. Further south emerges 10.10, home of June troughs.

- In addition, and reinforcing the bearish view, the cross continues to navigate below the daily cloud.

EURSEK daily chart

EUR/SEK

Overview:

Today Last Price: 10.3006

Today Daily change: 2.8e+2 pips

Today Daily change %: 0.273%

Today Daily Open: 10.2726

Trends:

Previous Daily SMA20: 10.294

Previous Daily SMA50: 10.3418

Previous Daily SMA100: 10.3868

Previous Daily SMA200: 10.3295

Levels:

Previous Daily High: 10.291

Previous Daily Low: 10.2471

Previous Weekly High: 10.3507

Previous Weekly Low: 10.2676

Previous Monthly High: 10.5375

Previous Monthly Low: 10.2863

Previous Daily Fibonacci 38.2%: 10.2639

Previous Daily Fibonacci 61.8%: 10.2742

Previous Daily Pivot Point S1: 10.2495

Previous Daily Pivot Point S2: 10.2264

Previous Daily Pivot Point S3: 10.2056

Previous Daily Pivot Point R1: 10.2934

Previous Daily Pivot Point R2: 10.3141

Previous Daily Pivot Point R3: 10.3372