- EUR/USD keeps the positive note unchanged above 1.1700.

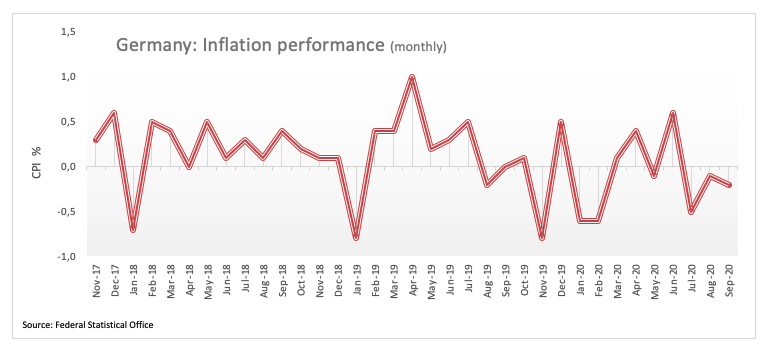

- German flash CPI came in at -0.2% MoM in September.

- Attention stays on the presidential debate, US key data.

EUR/USD remains well into the positive territory and manages to reclaim the key barrier at 1.1700 the figure and above on Tuesday.

EUR/USD now looks to US data, politics

EUR/USD adds to the optimism seen at the beginning of the week and pushes further north of the key resistance region around the 1.1700 mark.

The renewed offered tone in the buck is helping the sentiment not only around the euro but also in the rest of its riskier peers.

In the meantime, investors’ focus of attention stays on the rising cases of coronavirus across the world and the potential impact on the economy, as many countries have already resumed partial lockdowns and social restrictions.

In the domestic calendar, German flash inflation figures now see the CPI contracting at a monthly 0.2% in September. Year-on-year, consumer prices are also expected to drop 0.4%. Earlier in the session, the final print of the Consumer Confidence in the euro area measured by the European Commission matched the first estimate at -13.9 for the month of September, while the Spanish CPI is seen rising 0.2% inter-month and contracting 0.4% from a year earlier.

Across the pond, the focus of attention will be on the presidential debate between President Donald Trump and Democrat candidate Joe Biden. In the data space, the Conference Board will publish its always-relevant Consumer Confidence measure. Further data will see the S&P/Case-Shiller Index, advanced Trade Balance results and speeches by New York Fed John Williams (permanent voter, centrist) and Philadelphia Fed Patrick Harker (voter, hawkish).

What to look for around EUR

EUR/USD is looking to extend the rebound from 2-month lows in the 1.1610 region so far this week. Despite the move, the pair’s outlook still remains constructive and bearish moves are deemed as corrective only. Further out, the positive bias in the euro remains underpinned by auspicious results from domestic fundamentals (which have been in turn supporting further the view of a strong economic recovery after the slump in the activity during the spring), the so far calm US-China trade front and the steady – albeit vigilant- stance from the ECB. The solid position of the EMU’s current account coupled with the favourable positioning of the speculative community also lends support to the shared currency.

EUR/USD levels to watch

At the moment, the pair is advancing 0.33% at 1.1702 and a breakout of 1.1714 (weekly high Sep.29) would target 1.1760 (55-day SMA) en route to 1.1917 (high Sep.10). On the flip side, immediate contention is seen at 1.1612 (monthly low Sep.25) seconded by 1.1495 (monthly high Mar.9) and finally 1.1447 (50% Fibo of the 2017-2018 rally).