- EUR/USD has been extending its losses as the dollar lifted its head again.

- A US bond auction and Fed speakers hold the key to the next moves.

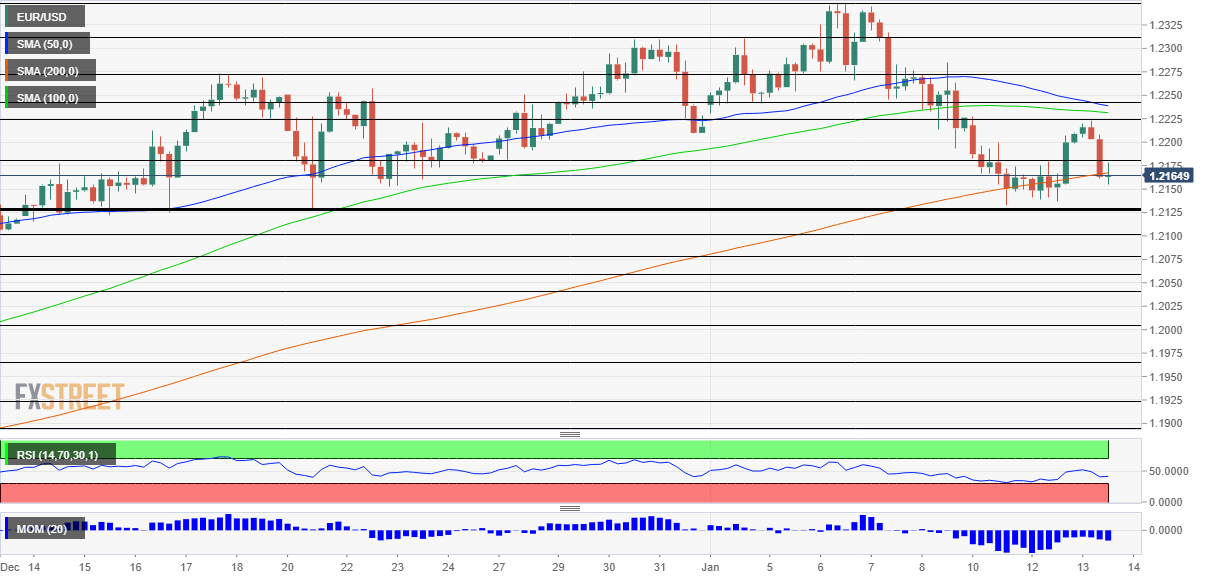

- Wednesday’s four-hour chart is pointing to further falls for the pair.

The greenback comeback is alive and kicking – EUR/USD has already dropped some 60 pips from the peak of 1.2222, and more may be in store. The dollar is gaining ground as Treasury yields stabilize from Tuesday’s fall. How low can the pair go?

There are three keys to the next move:

1) 30-year bond auction: The US currency dived on Tuesday after investors rushed to buy ten-year Treasuries. The consequent fall in yields triggered the downfall – צש×ןמע Wednesday’s 30-year auction more important than usual. High demand could weigh on the greenback, but long-term debt could attract less enthusiasm.

2) Fed speeches: Federal Reserve Governor Lael Brainard and Vice-Chairman Richard Claudia will both speak later in the day. The two permanent voters on the bank’s committee may provide guidance about the Fed’s bond-buying plans. If they mention tapering – even by denying it – the dollar has room to advance. Fewer dollars printed mean higher yields and a stronger dollar.

3) The Beige Book: Two weeks before the Fed announces its rate decision, it publishes a document consisting of anecdotal reports from its regions. If the report – usually a low key event – includes optimism about fiscal stimulus and the vaccine, it would also boost the greenback.

What about coronavirus? As mentioned earlier, the US is ahead of Europe in vaccinations, and that is unlikely to change anytime soon. That also gives the greenback an edge. US inflation figures, which marginally beat with 1.4%, add a tad more to the case for favoring the world’s reserve currency.

Five factors moving the US dollar in 2021 and not necessarily to the downside

EUR/USD Technical Analysis

Euro/dollar is slipping below the 200 Simple Moving Average on the four-hour chart and downside momentum is intensifying – showing that bears are gaining ground. The Relative Strength Index is above 30, thus outside oversold conditions.

Critical support awaits at 1.2125 – the triple-bottom initially tackled in mid-December and tackled in recent days. There are several support lines below, but these are weaker – 1.21, 1.2075, 1.2160 and 1.2040.

Some resistance awaits at 1.2180, which temporarily capped EUR/USD on Tuesday. It is followed by 1.2222, the recent high, followed by 1.2240, which provided support last week.

EUR/USD Price Forecast 2021: Euro-dollar long-term bullish breakout points to 1.2750