- EUR/USD finally reaches the 1.2200 barrier on Thursday.

- The greenback continues to lose ground and supports the upside.

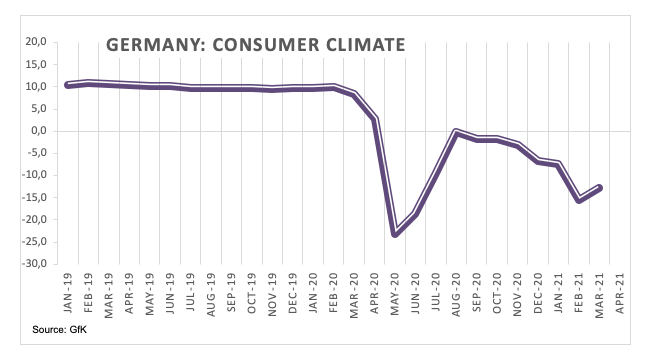

- German GfK Consumer Climate improved to -12.9 in March.

The single currency trades on a firm note and pushes EUR/USD beyond the key 1.22 barrier for the first time since mid-January.

EUR/USD in monthly tops above 1.2200

EUR/USD clears the 1.2200 hurdle and advances to multi-week highs on the back of the now increasing selling pressure surrounding the greenback.

The reflation/vaccine trade plus rising bets of a strong recovery in the global economy in the second half of the year continues to give legs to the rally in the risk complex and underpins the pair’s move back above 1.22 the figure.

The persistent downside in the buck drags the US Dollar Index (DXY) to levels last seen in early January near 89.80. In fact, the dollar saw its decline accelerated after Chief Powell reiterated once again the mega-accommodative stance from the Federal Reserve and ruled out any modification of the ongoing QE programme until the economy approaches the Fed’s targets for inflation and employment.

In the docket, the German Consumer Climate tracked by GfK bettered to -12.9 for the month of March (from -15.5), while the ECB’s M3 Money Supply expanded at an annualized 12.5% and Private Sector Loans rose 3.0% from a year earlier.

Across the pond, the usual Claims come up next followed by Durable Goods Orders and another estimate of the Q4 GDP.

What to look for around EUR

EUR/USD finally surpasses the 1.2200 barrier, clinching new monthly peaks at the same time. The bullish sentiment in the euro now looks improved and could be supportive of extra strength in the short-term horizon. This, in turn, remains supported by the prospects of extra fiscal stimulus in the US, real interest rates favouring Europe vs. the US and hopes of a solid economic rebound in the next months.

Key events in Euroland this week: European Council meeting (Thursday and Friday). ECB’s Lagarde will participate in the G20 meeting of central bank governors and finance ministers on Friday

Eminent issues on the back boiler: EUR appreciation could trigger ECB verbal intervention, always on inflation issues. EU Recovery Fund. Huge long positions in the speculative community.

EUR/USD levels to watch

At the moment, the index is gaining 0.46% at 1.2218 and a breakout of 1.2272 (weekly high Dec.17) would target 1.2349 (2021 high Jan.6) en route to 1.2413 (monthly high Apr.17 2018). On the downside, the next support at 1.2098 (21-day SMA) followed by 1.2023 (weekly low Feb.17) and finally 1.2013 (100-day SMA).