- EUR/USD moves higher to the 1.1055/60 band.

- German headlines point to the probability of fiscal stimulus.

- EMU Sentix Index bettered to -11.1 for the current month.

The bid tone around the European currency has been supported further following German news and lifted EUR/USD to fresh daily highs near 1.1060.

EUR/USD bid on German news, data

The pair recorded fresh 2-day highs in the boundaries of 1.1060 after the German government hinted at the likeliness of extra fiscal stimulus via an adjustment in the 2020 budget to increase public investment.

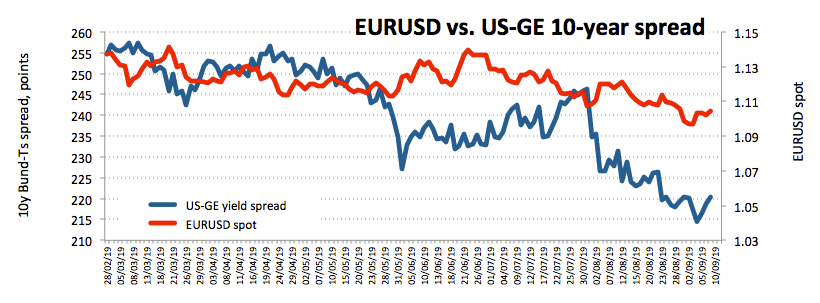

German 10-year Bund yields jumped to the vicinity of -0.58% following the headlines, shrinking the US-GE yield spread differential and favouring the upside in spot.

Earlier in the session, Investor Confidence in the euro area gauged by the Sentix index improved to -11.1 for the current month. Early this morning, German trade surplus ticked higher to €20.2 billion during July.

What to look for around EUR

The pair is expected to stabilize at current levels as markets get closer to the ECB gathering on Thursday. The recent up move to the upper 1.10s is still seen as corrective only, as results from the domestic docket keep the pressure intact on the single currency and support the need for ECB stimulus. This view is also expected to keep occasional bullish attempts well contained for the time being. On the political front, Italian effervescence looks dissipated for the time being, while uncertainty over UK politics and Brexit could add to the current inconclusive price action.

EUR/USD levels to watch

At the moment, the pair is gaining 0.20% at 1.1046 and faces the next barrier at 1.1084 (high Sep.5) followed by 1.1163 (high Aug.26) and finally 1.1165 (55-day SMA). On the flip side, a breach of 1.0925 (2019 low Sep.3) would target 1.0839 (monthly low May 11 2017) en route to 1.0569 (monthly low Apr.10 2017).