- The pair remains under pressure today and tests lows near 1.1350.

- The greenback extends the rebound to the 96.85/90 band.

- German advanced CPI figures next of relevance.

After testing the boundaries of the 1.1400 area in early trade, EUR/USD has now come under selling pressure and drops to daily lows in the 1.1360/50 band.

EUR/USD looks to Italy, data

Spot faded part of yesterday’s Powell-sponsored advance to the boundaries of the critical 1.1400 the figure and situates in the 1.1360 region on Thursday amidst some concerns stemming from Italian politics.

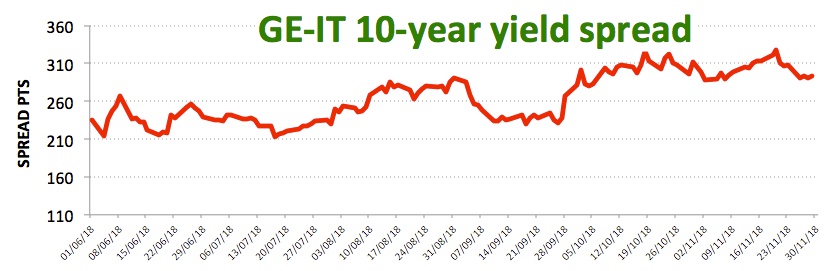

In fact, the Italian 2019 budget is back to the fore today after Lega’s M.Salvini stressed the country will not discuss a cut in the deficit target by more than 0.2%, prompting market participants to adjust their positions in the single currency and to look at the Italian fixed income markets.

Later in the session, flash German inflation figures for the current month are due, while PCE and the FOMC minutes should be the salient points in the US calendar.

Earlier, some results in Euroland noted Business Climate improved to 1.09 in November and German jobless rate ticked lower to 5.0%, while the Unemployment Change dropped more than expected by 16K.

EUR/USD levels to watch

At the moment, the pair is losing 0.11% at 1.1354 facing the next support at 1.1267 (low Nov.28) followed by 1.1214 (2018 low Nov.12) and finally 1.1188 (61.8% Fibo of the 2017-2018 rally). On the other hand, a break above 1.1392 (high Nov.29) would target 1.1434 (high Nov.22) en route to 1.1473 (high Nov.20).