- EUR/USD trades within a tight range in the mid-1.1200s.

- Risk-of sentiment returns to the market and supports the dollar.

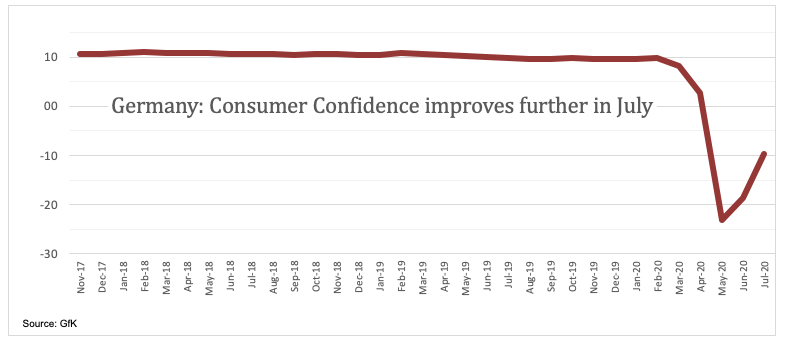

- German Consumer Confidence rebounds to -9.6 in July.

EUR/USD capped by the 200-hour SMA near 1.1260

EUR/USD is adding to Wednesday’s retracement following the better tone in the greenback amidst the pick-up in the risk aversion sentiment.

In fact, renewed trade jitters – this time on the US-EU front – added worries to the already fragile trade war scenario, insofar dominated by the omnipresent US-China effervescence.

Also collaborating with the prevailing risk aversion mood, the coronavirus pandemic continues to expand at alarming rates mainly in America and with some US states reporting record of infected cases. In Europe, and despite the recent outbreaks in Germany and Spain, the pandemic looks under control.

Data wise, earlier on Thursday the German Consumer Confidence tracked by GfK improved further to -9,6 for the month of July. Later, the ECB will publish its Accounts (minutes) of the latest meeting. Across the ocean, the focus of attention will once again be on the week Claims, seconded by another estimate of the GDP for the January-March period and May’s Durable Goods Orders.

What to look for around EUR

EUR/USD appears to have met some important resistance in the 1.1350 region so far this week. In the meantime, investors continue to look to the gradual return to some sort of normality in the Old Continent as well as rising concerns over the probability of a second wave of coronavirus contagion. The constructive view in the euro, however, remains well sustained by the gradual and relentless re-opening of economies in Europe and by the ongoing monetary stimulus announced by the ECB, Germany and the European Commission. On top, the solid performance of the region’s current account is also adding to the attractiveness of the shared currency.

EUR/USD levels to watch

At the moment, the pair is losing 0.11% at 1.1237 and faces the next support at 1.1168 (monthly low Jun.19) seconded by 1.1147 (high Mar.27) and finally 1.1031 (200-day SMA). On the upside, a breakout of 1.1348 (weekly high Jun.23) would target 1.1422 (weekly/monthly high Jun.10) en route to 1.1448 (50% Fibo of the 2017-2018 rally).