- EUR/USD has kicked off the new week under immense pressure.

- Coronavirus concerns and German economic weakness are set to dominate trading.

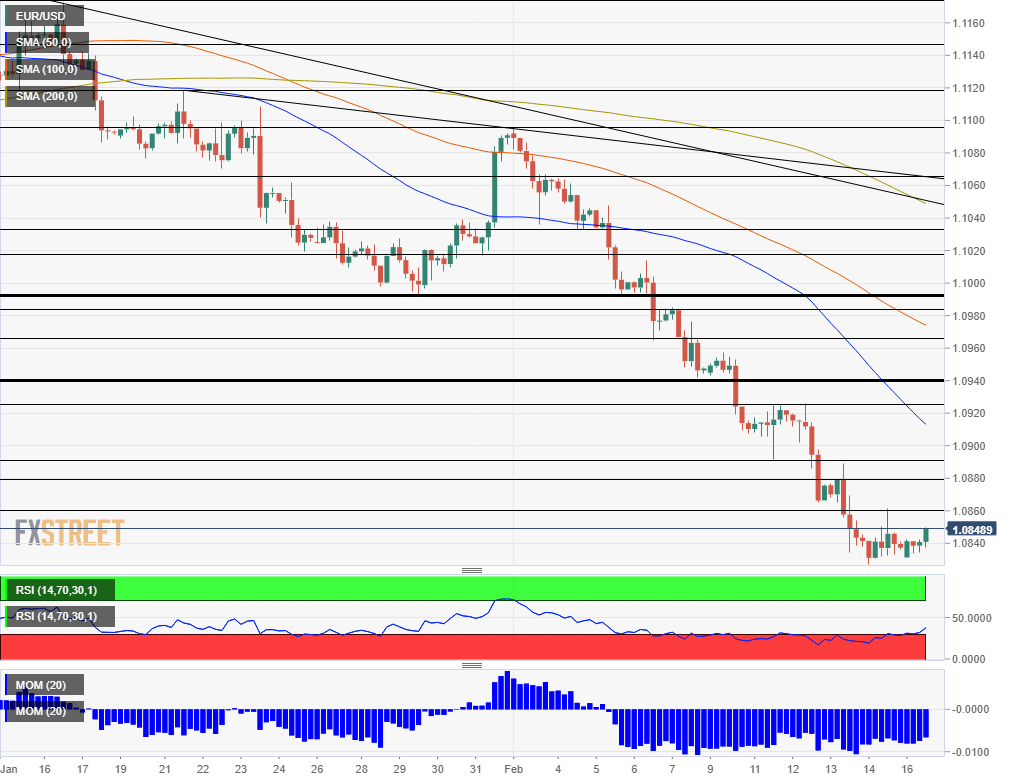

- Monday’s four-hour chart is pointing to further falls for the pair.

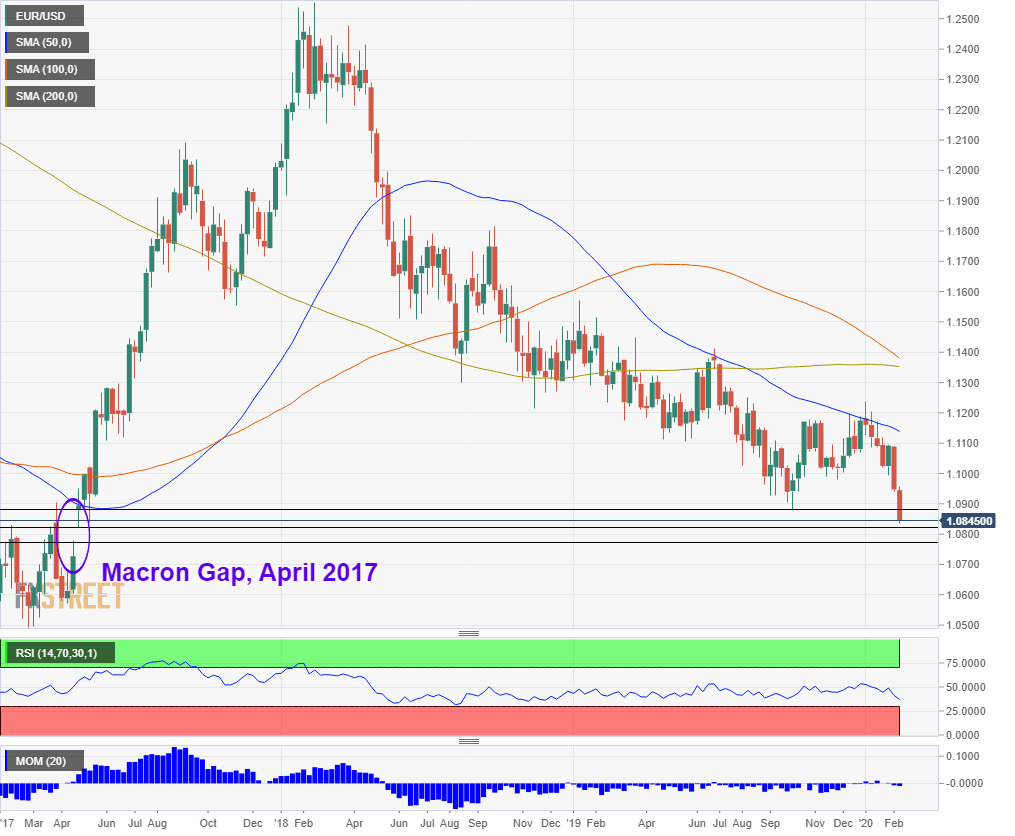

EUR/USD has hit the brakes just before the cliff – but it may still accelerate and take the plunge. The world’s most popular currency pair hit a 34-month low at 1.0820 – just above the “Macron Gap” from April 2017 and is attempting a recovery. Nevertheless, fundamentals and technicals are pointing lower.

The common currency remains under pressure after Germany – the eurozone’s “locomotive” – stagnated in the fourth quarter. Moreover, the economy grew by a meager 0.4% in 2019, compared to over 2% in the US.

The economic divergence continues pushing euro/dollar down even if not all American figures are shining. US Retail Sales figures missed expectations as the all-important Control Group grinding to halt in January. On the other hand, the University of Michigan’s preliminary Consumer Sentiment gauge for February exceeded estimates by topping the 100 level. Better confidence implies higher sales.

While the US is on holiday today – celebrating Presidents’ Day – the German Bundesbank is set to provide an updated view on the economy in its monthly report, potentially adding pressure on the common currency. The central bank may provide comments on the coronavirus outbreak that has hit China.

Coronavirus news

In recent years, the driving force for the German economy has been its exports to the world’s second-largest economy. Extended new year holidays in most Chinese provinces have already taken their economic toll and the ongoing lockdown of Hubei province – the epicenter of the disease – is weighing on the automotive sector.

Beijing has announced it would take additional measures to stimulate the economy as the death toll surpassed 1,700 and the number of cases topped 70,000.

Outside China, the biggest hotspot of infections is on the Princess Diamond cruise ship harboring in Yokohama, Japan. Several countries, including the US, are evacuating citizens from the ship, and this move causes fears of broader contagion. Big events such as the Tokyo Marathon and Barcelona’s Mobile World Congress have been canceled.

Markets remain relatively calm amid the worrying headlines, seeming to price in short-lived fall in global growth followed by a V-shaped rebound. However, new coronavirus developments may sour the mood.

Overall, euro/dollar remains at risk of falling further down.

EUR/USD Technical Analysis

The Relative Strength Index of the four-hour chart has risen above 30 – exiting oversold conditions – and allowing for fresh falls. Downside momentum is significant and the currency pair trades well below the 50, 100, and 200 Simple Moving Averages.

After the recent dead cat bounce, bears remain in control.

Critical support awaits at 1.0820, which is the recent low and also the upper end of the “Macron Gap” – a weekend “hole” in the chart dating back to April 2017, when Emmanuel Macron won the first round of the French presidential elections.

The other side of the gap is 1.0770, followed by 1.0720.

Resistance awaits at 1.0860, a swing high from late last week, followed by 1.0879. the 2019 trough. Next, 1.0890 separated ranges and 1.0925 capped a recovery attempt beforehand.

The Macron Gap: