- EUR/USD has been sliding as the dollar amid a brighter outlook for the US economy.

- Nonfarm Payrolls are projected to show a fresh gain in jobs, but may trigger profit-taking.

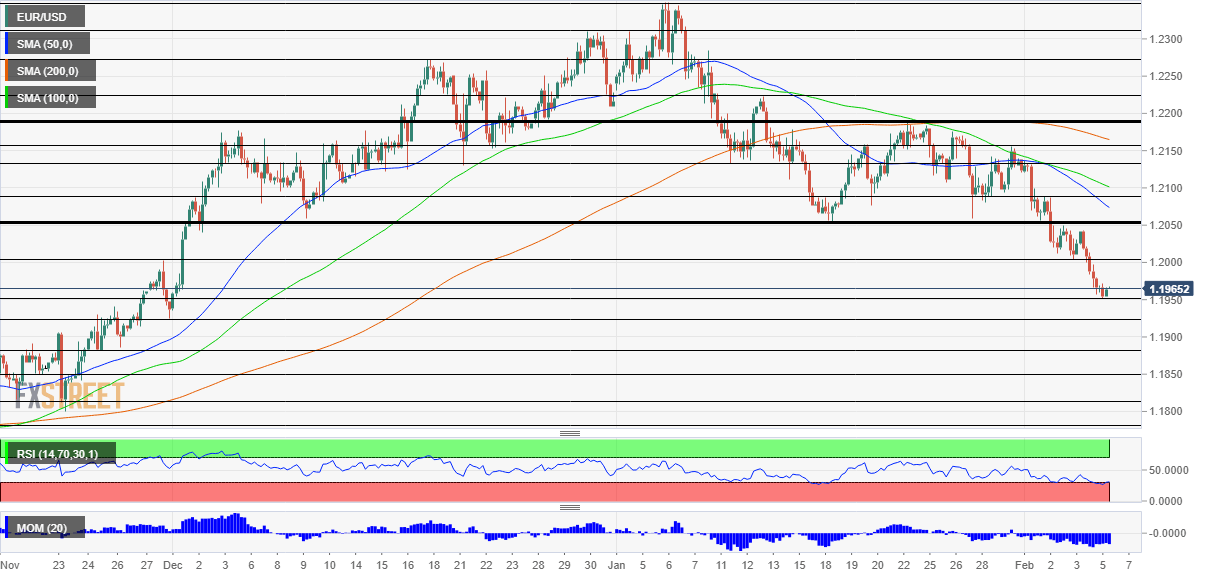

- Friday’s four-hour chart is pointing to oversold conditions, signaling a bounce.

What are the real expectations for the upcoming Nonfarm Payrolls report? That is the critical question for EUR/USD traders ahead of the first US jobs report for 2021. The US dollar has been on the rise and may suffer a setback if the figures fall short of elevated estimates. A “buy the rumor, sell the fact” response could send the currency pair back up.

The greenback has been gaining ground alongside US yields, responding to higher changes that Democrats push through a large stimulus package without support from Republican moderates. The prospects of higher US growth and more debt issuance have been causing a sell-off in bonds, and the resulting higher yields make the dollar more attractive.

Upbeat data leading to the NFP also supported the dollar. Weekly jobless claims dipped below 800,000, a third consecutive decline that is pointing to a rebound. Thursday’s release joined encouraging figures from ADP’s labor market figures and ISM’s Purchasing Managers’ Indexes for January.

Overall, while the economic calendar is pointing to an increase of 50,000 jobs, the “whisper” estimates are probably significantly higher, perhaps at around 200,000. If the actual figures fail to amaze investors, profit-taking on dollar longs may follow.

See

- Nonfarm Payrolls Preview: Dollar needs a strong number to keep rallying

- Nonfarm Payrolls January Preview: Waiting for the dollar bid

Contrary to the US, Europe’s latest economic figures have been mixed at best, with Germany reporting a fall of 1.9% in factory orders in December.

Another factor weighing on EUR/USD is the gap in vaccination campaigns on both sides of the Atlantic. The US has ramped up its pace while Europe is moving at a snail’s pace, and awaiting more shipments. Johnson and Johnson, which makes a single-shot covid vaccine, has filed for regulatory approval in the US.

All in all, the downtrend is set to continue as the US is headed for a quicker exit from the crisis while Europe lags. However, NFP expectations may be too high and lead to a bounce.

EUR/USD Technical Analysis

After breaking below 1.20, euro/dollar is clearly trending down, and suffering from downside momentum on the four-hour chart. However, the Relative Strength Index is just at 30, signaling oversold conditions.

Support awaits at the fresh 2021 low of 1.2050, and it is followed by 1.1925, 1.1880 and 1.1850 – all were stepping stones on the way up in November 2020.

Resistance is at 1.20, followed by 1.2050, a former triple-bottom. Further above, 1.2090 and 1.2130 are in play.

EUR/USD Price Forecast 2021: Euro-dollar long-term bullish breakout points to 1.2750