- EUR/USD is edging lower as coronavirus cases are rising in the US and other places.

- Europe’s gradual opening up is encouraging but could be insufficient in weathering the storm.

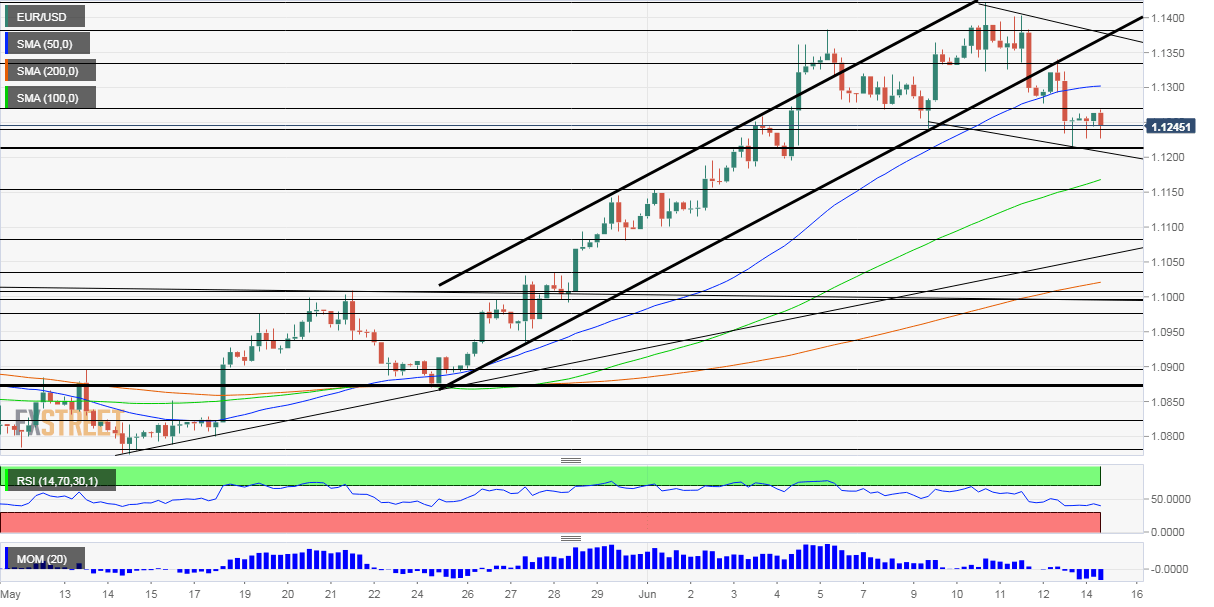

- Monday’s four-hour chart is showing that bears are gaining ground.

Germans are getting ready to flood Spanish islands Paris’ famous cafes are reopening – but the growing sense of normality in Europe is insufficient against the safe-haven dollar. After holding up against the mighty greenback, the euro is beginning to crack down.

The main downward driver of markets – and dollar booster – comes from the US Sun Belt. COVID-19 infections and hospitalizations continue rising in Florida, Texas, Arizona, California, and over a dozen other states. While rising testing capacity can explain increased infections, admissions to medical facilities is undeniably bad news.

US deaths from the disease are falling in the greater New York area faster than they are rising in other places. Nevertheless, the specter of states or cities imposing new lockdowns that sent stocks crashing on Thursday is taking its toll once again.

Nevertheless, senior White House adviser Larry Kudlow insisted America does not face new restrictions and continued touting the V-shaped recovery theory. He claimed the Federal Reserve’s downbeat outlook is too pessimistic. His interviews, coming amid another weekend of protests against racial discrimination, do not seem to inspire markets.

The gloomy mood is compounded by concerning news from China. The world’s second-largest economy – where coronavirus originated from – is suffering from an outbreak in Beijing. Authorities closed several markets and neighborhoods in the capital.

Moreover, Chinese industrial output and retail sales both missed expectations – painting a picture of a slower recovery than had been anticipated.

The depressing news from overseas is outweighing positive developments in the eurozone. Spain will open up to tourism from next week as it continues easing the lockdown. French President Emmanuel Macron declared that all of the countries is now a “green zone” – allowing for Parisians “Joie de vivre” to return.

The hard-hit old continent seems to have COVID-19 at low levels, with the potential to keep local outbreaks under control – at least for now.

Eurozone trade balance and the New York State Manufacturing Index are of interest, yet coronavirus headlines will likely have the upper hand.

EUR/USD Technical Analysis

The four-hour chart is showing that after falling off the uptrend channel, euro/dollar is setting lower lows and lower highs – a bearish trend. The currency pair dropped below the 50 Simple Moving Average and momentum turned negative. On the other hand, it is still holding well above the 100 and 200 SMAs.

Support awaits at the daily low of 1.1225, followed by 1.1150, a stepping stone on the way up. The next levels to watch are 1.1080 and 1.1040.

Resistance is at the daily high of 1.1270, followed by 1.1340 was a temporary high on Friday, and it is followed by 1.1380 and 1.1425.