- EUR/USD fails again around 1.1400 and drops back to the 1.1370 area.

- US dollar reverses across the board as equity prices move off highs.

The EUR/USD pair peaked at 1.1408 after the release of the latest US economic report and then reversed sharply, falling 30 pips in an hour. It dropped to the 1.1370 area, erasing gains.

The move to the downside took placed maid a rally of the US dollar across the board and a decline in Wall Street. The greenback is now among the top performer. The Dow Jones is still in positive territory (+0.20%) but lost more than a hundred points over the last hours.

The greenback recovered strength despite weak US data. Numbers released today included the core PCE price index that stayed unchanged at 1.9% in December, while personal income and spending showed negative numbers. Also, the Manufacturing PM and the ISM came in below expectations.

Higher US yields continue to support the US dollar. The 10-year is up for the third-day in-a-row and recently reached 2.75%, the highest level since January 29.

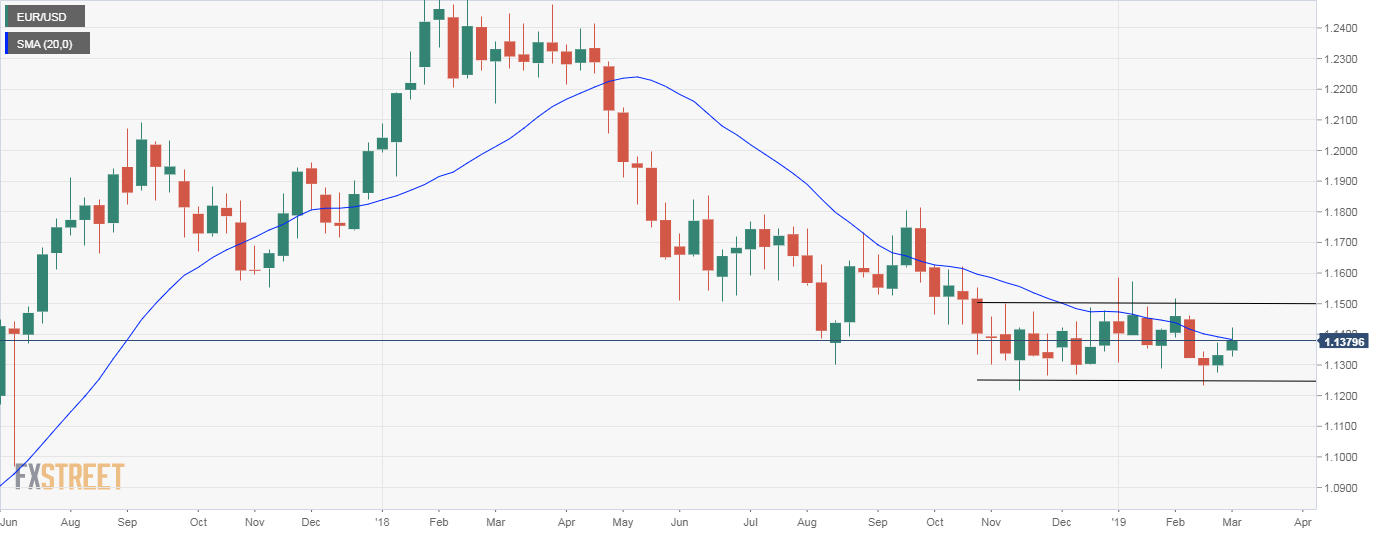

Despite being unable to hold above 1.1400, EUR/USD heads for the second consecutive weekly gain. It is trading just below the 20-week moving average, as it continues to move sideways.

EUR/USD weekly chart

EUR/USD

Overview:

Today Last Price: 1.1378

Today Daily change: 0.0005 pips

Today Daily change %: 0.04%

Today Daily Open: 1.1373

Trends:

Daily SMA20: 1.1349

Daily SMA50: 1.1391

Daily SMA100: 1.1389

Daily SMA200: 1.1509

Levels:

Previous Daily High: 1.1422

Previous Daily Low: 1.1359

Previous Weekly High: 1.1373

Previous Weekly Low: 1.1276

Previous Monthly High: 1.1489

Previous Monthly Low: 1.1234

Daily Fibonacci 38.2%: 1.1398

Daily Fibonacci 61.8%: 1.1383

Daily Pivot Point S1: 1.1348

Daily Pivot Point S2: 1.1322

Daily Pivot Point S3: 1.1286

Daily Pivot Point R1: 1.141

Daily Pivot Point R2: 1.1447

Daily Pivot Point R3: 1.1473