- EUR/USD has been advancing amid hopes for imminent Brexit and US stimulus deals.

- The Fed’s commitment to do support the economy is the third cheerful booster.

- The grim virus reality may spark a much-needed correction.

- Thursday’s four-hour chart is showing the pair is overbought.

Too good to be true? EUR/USD is nearing 1.2250, the highest since 2018, and while it has convincing reasons to rise, the pair may have gone too far, too fast, and may suffer a downside correction.

First, here are updates on the pair’s three reasons to rise:

Three EUR/USD boosters

1) Fed support: The Federal Reserve refrained from adjusting its bond-buying scheme, disappointing some that had expected imminent action. However, Chairman Jerome Powell reiterated his commitment to do what is necessary and pledged to continue with low rates through 2023 and with Quantitative Easing for an extended time. After an initial rise, the dollar dropped once again. Powell added that there is a “very strong case” for more relief from the government.

- Powell’s charm offensive soothes markets, but a Santa Rally depends on Congress

- Federal Reserve Rate Decision: Changing policy targets alters very little

2) US fiscal stimulus: With or without Powell’s words, lawmakers in Washington are making progress toward signing off on a $900 billion package that President-elect Joe Biden calls a “downpayment” – ahead of more spending in 2021. The encouraging news weighs on the safe-haven dollar.

3) Brexit talks: EU and UK negotiators remain quiet – and that is a positive sign of progress. Both sides are at loggerheads over fisheries, a politically sensitive issue, yet a minuscule one that can be resolved. The pound’s rise is dragging the euro higher.

Things to worry about

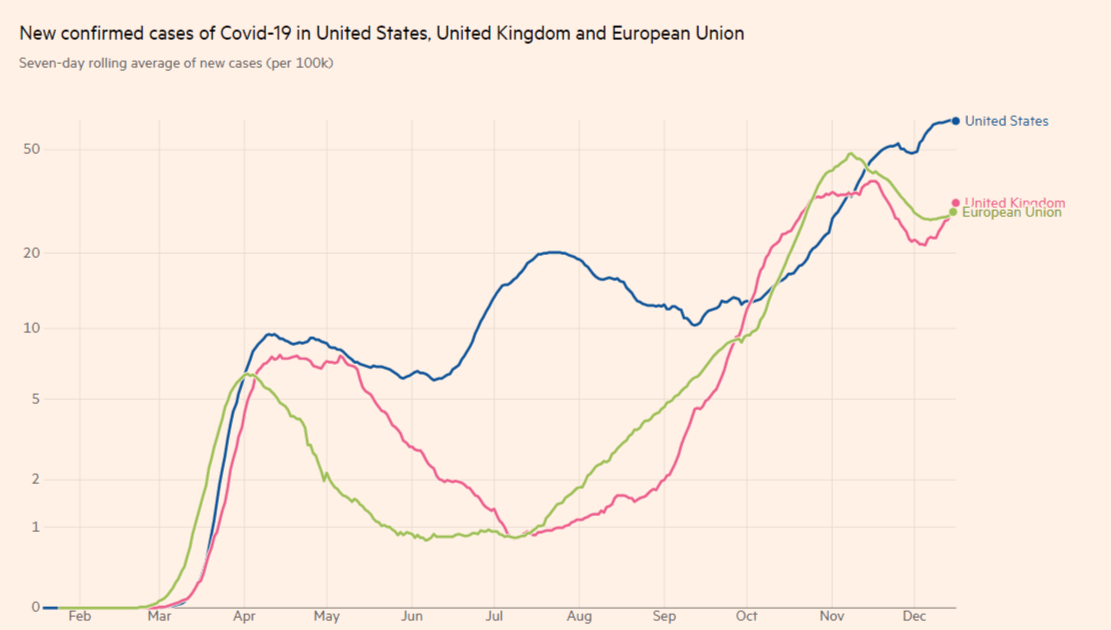

1) The virus: Coronavirus continue spreading and has hit French President Emmanuel Macron among many in the old continent. European countries are announcing Christmas restrictions instead of easing around the holidays. US deaths, hospitalizations, and cases remain on the rise. Moreover, a person that received the Pfizer/BioNTech vaccine developed a serious allergic response. Additional snags are likely.

Source: FT

2) Weak economic data: The winter wave is taking an economic toll. US Retail Sales fell by 1.1% in November, worse than expected – and on top of a downward revision. Thursday’s weekly jobless claims are forecast to drop, yet after leaping last week.

See US Initial Jobless Claims Preview: Not the right direction at all

Overall, markets are seeing the glass half-full – for good reasons – but the empty party may strike back, at least temporarily.

EUR/USD Technical Analysis

The Relative Strength Index on the four-hour chart is touching 70 – entering overbought conditions. While momentum is to the upside, a downside correction cannot be ruled out.

Initial resistance awaits at 1.2244, the new 2020 peak, followed only by 1.24, a level that played a role back in 2018. Further above, 1.2470 and 1.2550 are eyed.

Support awaits at 1.22, a round number, followed by 1.2177, the previous 2020 peak, and then by 1.2060 and 1.2040.

-637437922001821665.png)