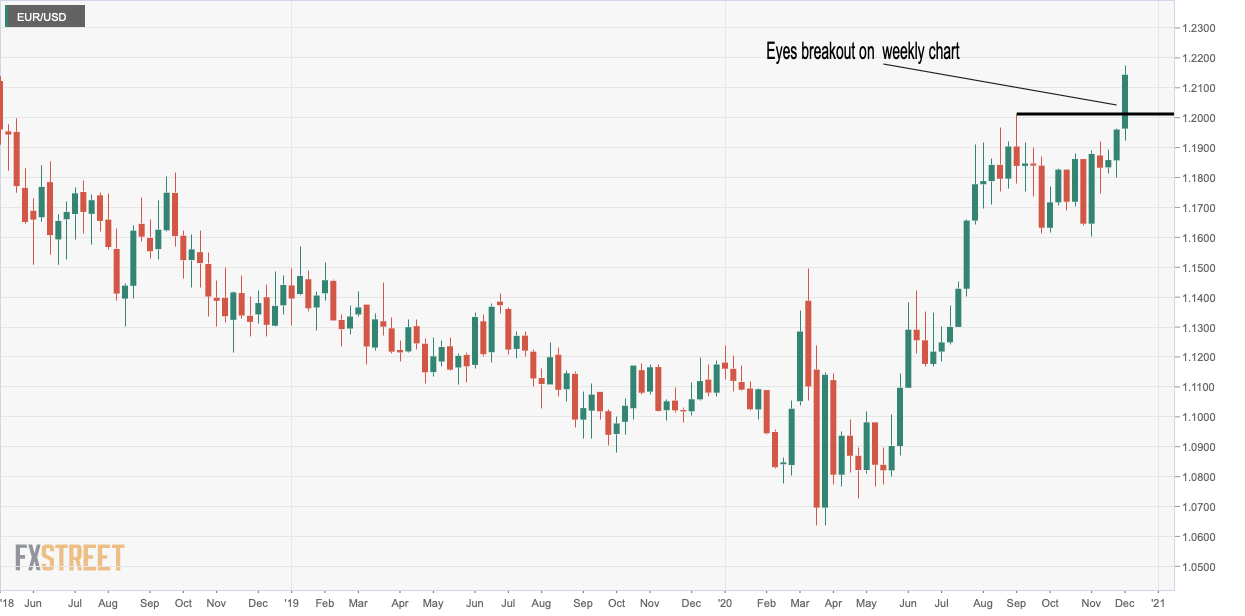

- EUR/USD looks set to end the week above the September high of 1.2011.

- Rising US yields may weigh over stock markets, boosting demand for the US dollar.

- The US Nonfarm Payrolls data could show the economy added 469K jobs in November.

EUR/USD looks set to end the week in a bullish manner above a crucial resistance. However, the pair’s rally may run out of steam if the US treasury yields continue to rise.

The pair is currently trading above 1.2140, representing a 1.5% weekly gain, and well above the horizontal resistance of $1.2011 (Sept. 1 high). If the gains above 1.2011 are held through Friday’s close, a bullish breakout would be confirmed on the weekly chart.

That would expose the next resistance located at 1.2556 (February 2018 high). A move to higher resistance levels cannot be ruled out, as sentiment around the US dollar is bearish, courtesy of expectations for additional US fiscal stimulus and increased hopes for coronavirus vaccine-led recovery in the global economy.

That said, the US treasury yields are rising. The 10-year clocked a high of 0.96% earlier this week, having bottomed out near 0.5% in August. Investors may rotate money out of the overbought stocks and into bonds if the yields continue to rise. The resulting risk-off would lift the US dollar, putting brakes on EUR/USD’s ascent.

The US yields may chart a more significant rally later today if the US Nonfarm Payrolls for November blow past expectations, squashing fears of a double-dip recession. Ahead of the payrolls, the focus will be on the German Factory Orders for October scheduled for release at 07:00 GMT.

- Nonfarm Payrolls Preview: Another dollar’s disappointment underway

Technical levels