- The pair keeps the bid tone unchanged around 1.1280.

- German flash Q4 GDP figures came in flat today.

- US Retail Sales, Producer Prices due across the ocean.

The buying interest have returned to the shared currency in the second half of the week and is now lifting EUR/USD to the 1.1280 region in the wake of German releases.

EUR/USD bid after data, looks to US docket

The pair is partially reverting yesterday’s deep pullback and has managed to regain some traction after bottoming out in fresh 2019 lows at 1.1248 during overnight trade.

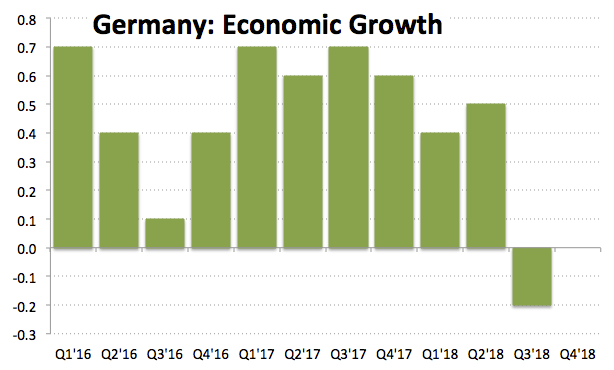

Some extra oxygen flowed into the European currency today after advanced German GDP figures noted the economy avoided entering into recession in H2 2018. In fact, flash data showed the German economy is now expected to have posted no growth on a quarterly basis during the October-December period, while it is seen expanding at an annualized 0.9%, matching expectations.

In the meantime, spot is benefitting from the correction lower in the greenback after printing fresh YTD lows in the 1.1250/45 mark during early trade.

In the data space, EMU flash GDP figures are coming in next, while Retail Sales, Producer Prices and Initial Claims are expected across the pond.

What to look for around EUR

EUR has come under strong selling pressure in past sessions against the backdrop of rising concerns over the slowdown in the region and speculations that the ECB could refrain from acting on rates this year and extend further, instead, the current ‘pause-mode’. Additionally, political concerns remain well and sound in Euroland as we get closer to the EU parliamentary elections: snap elections in Spain, the still unresolved issue of the ‘yellow vests’ in France and the omnipresent effervescence in the Italian political scenario seem to be preparing the scenario for an increasing presence of populism in the Old Continent.

EUR/USD levels to watch

At the moment, the pair is gaining 0.19% at 1.1282 facing the next hurdle at 1.1345 (10-day SMA) seconded by 1.1356 (23.6% Fibo of the September-November drop) and then 1.1385 (55-day SMA). On the other hand, a break below 1.1248 (2019 low Feb.14) would target 1.1215 (2018 low Nov.12) en route to 1.1118 (monthly low Jun.20 2017).