- The pair trades without clear direction near 1.1660.

- The greenback remains parked around the 94.70 region.

- German advanced CPI figures are next on tap.

The single currency alternates gains with losses at the beginning of the week and prompts EUR/USD to stay sidelined around the 1.1660 area for the time being.

EUR/USD looks to data

Spot is navigating the lower bound of the recent range following Thursday’s bearish outside day, all amidst lack of volatility in the global markets and a steady performance of the greenback after recent US GDP figures.

Later in the session, EUR should closely follow the German preliminary inflation figures for the month of July as the salient event of the day seconded by several confidence/sentiment gauges in the euro bloc.

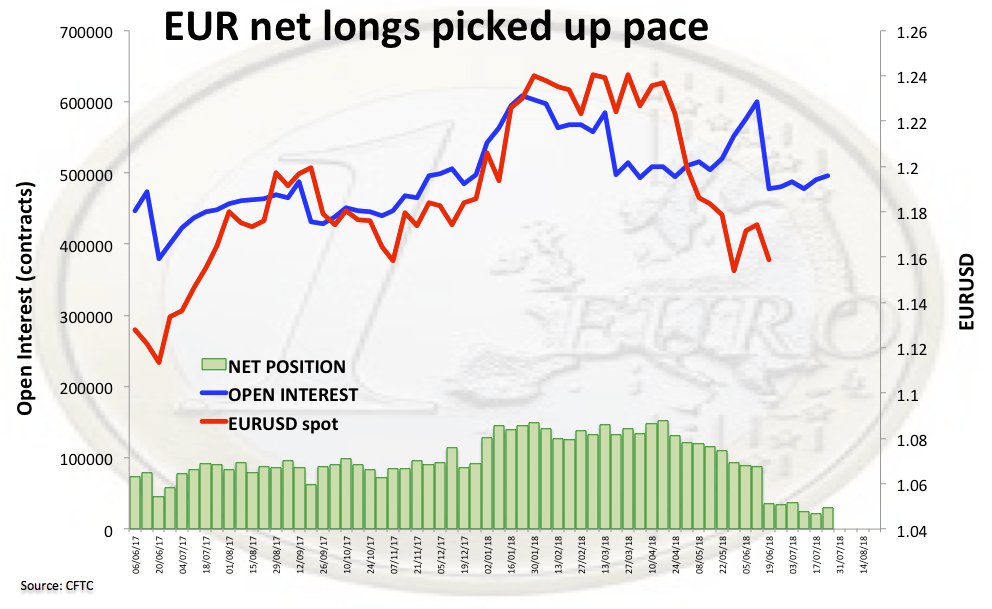

From the speculative community, EUR net longs resumed the upside after two consecutive weeks losing ground and climbed to 3-week highs during the week ended on July 24, according to the latest CFTC report.

Data across the pond include June’s Pending Home Sales and the Dallas Fed manufacturing index.

EUR/USD levels to watch

At the moment, the pair is down 0.02% at 1.1656 facing immediate support at 1.1625 (low Jul.27) followed by 1.1575 (low Jul.19) and then 1.1527 (low Jun.28). On the upside, a breakout of 1.1749 (high Jul.23) would open the door to 1.1792 (high Jul.9) and finally 1.1853 (high Jun.14).