- EUR/USD adds to Monday’s gains and targets 1.2300.

- German jobless rate stayed unchanged at 6.1% in December.

- US ISM Manufacturing, politics take centre stage later in the session.

The single currency keeps the bid tone unaltered so far this week and now pushes EUR/USD to the 1.2280 region, or daily peaks.

EUR/USD still capped by 1.2300

EUR/USD trades on a positive note on turnaround Tuesday although a more sustainable breakout of the key barrier at 1.2300 the figure still looks elusive for EUR-bulls despite the persistent weakness surrounding the greenback.

The upbeat sentiment around the pair remains well and sound for the time being, always with the weakness in the dollar as the main driver of the recent uptick. Later on Tuesday, the focus of attention is expected to shift to the US political scenario, where the voting in Georgia takes centre stage.

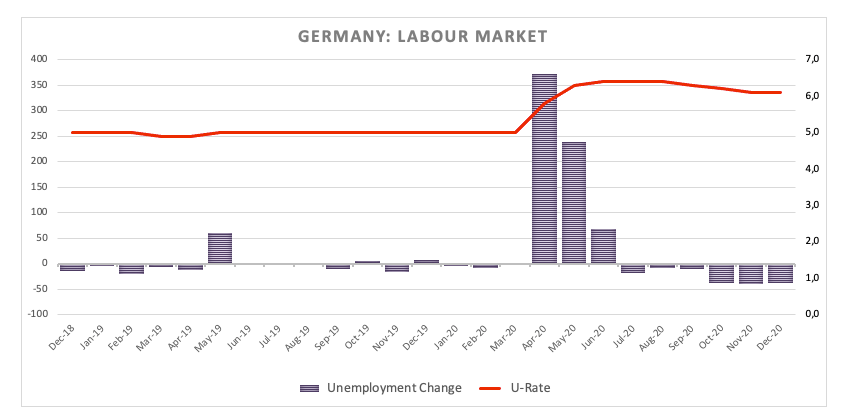

In the euro calendar, German Retail Sales expanded at a monthly 1.9% during November, while the Unemployment Rate stayed unchanged at 6.1% and the Unemployment Change dropped by 37K for the month of December. Data from the ECB showed M3 Money Supply expanded 11.0% on a year to November and Private Sector Loans expanded 3.1% YoY.

In the US docket, the December’s ISM Manufacturing is due later seconded by speeches by FOMC’s Evans and Williams and the API’s report on crude oil inventories.

What to look for around EUR

The upside momentum in EUR/USD regains fresh oxygen at the beginning of 2021 and is now focused on the 1.2300 mark. So far, EUR/USD appears supported by prospects of a strong recovery in the region (and abroad), which is in turn underpinned by extra fiscal stimulus by the Fed and the ECB. In addition, real interest rates continue to favour the euro area vs. the US, which is also another factor supporting the EUR.

EUR/USD levels to watch

At the moment, the pair is gaining 0.24% at 1.2272 and a breakout of 1.2310 (2020 high Dec.30) would target 1.2413 (monthly high Apr.17 2018) en route to 1.2476 (monthly high Mar.27 2018). On the other hand, the next support emerges at 1.2129 (weekly low Dec.21) seconded by 1.2058 (weekly low Dec.9) and finally 1.2032 (23.6% Fibo of the 2017-2018 rally).