The shared currency rallied hard on Wednesday, helping the EUR/USD pair to stage a solid rebound from 10-month lows. The political crisis in Italy abated after the 5-Star Movement reportedly called for a withdrawal of Paolo Savona’s candidacy for economy ministry in an effort to form a coalition government and avoid a snap election.

The recovery move was further supported by generally positive data from the Euro-zone, particularly stronger than expected German CPI print that should ease some of the ECB policymakers’ worries. From the US, weaker ADP report on private sector employment and a downward revision of the Q1 GDP growth figures exerted some additional downward pressure on the already weaker US Dollar and provided an additional boost to the pair’s corrective rally.

The pair was now seen consolidating overnight strong gains and oscillated within a narrow trading range, above mid-1.1600s through the Asian session on Thursday. Today’s key focus would be on the release of preliminary Euro-zone inflation figures for May, which if betters estimates should assist the pair to build on the strong recovery move.

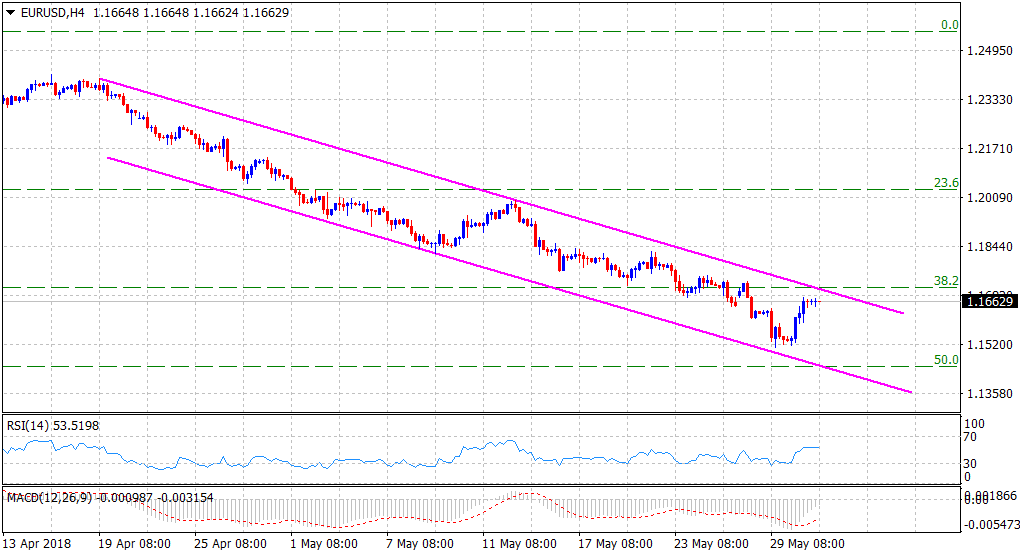

From a technical perspective, the pair has now moved closer to an important confluence region near the 1.1700 handle, comprising of 38.2% Fibonacci retracement level of the 1.0341-1.2556 up-move and a resistance marked by short-term descending trend-channel formation on hourly charts. Should the pair fail to decisively break-through the mentioned hurdle, yesterday’s strong up-move would now be categorized as a ‘dead-cat bounce’ and turn the pair vulnerable to resume with its prior depreciating slide.

Meanwhile, any meaningful retracement is likely to find immediate support near the 1.1625-20 region and is closely followed by the 1.1600 handle, below which the pair is likely to head back towards challenging the key 1.1500 psychological mark with some intermediate support near the 1.1535 area.

Alternatively, a convincing move beyond the 1.1700 handle would negate near-term bearish bias and trigger a fresh bout of short-covering move, which could lift the pair initially towards 1.1740-45 supply zone en-route its next major hurdle near the 1.1785-90 region.