- EUR/USD has been advancing toward 1.13 as China encourages a bull market.

- Optimism about Europe joins the bullish case while US coronavirus cases and uncertainty about data may weigh.

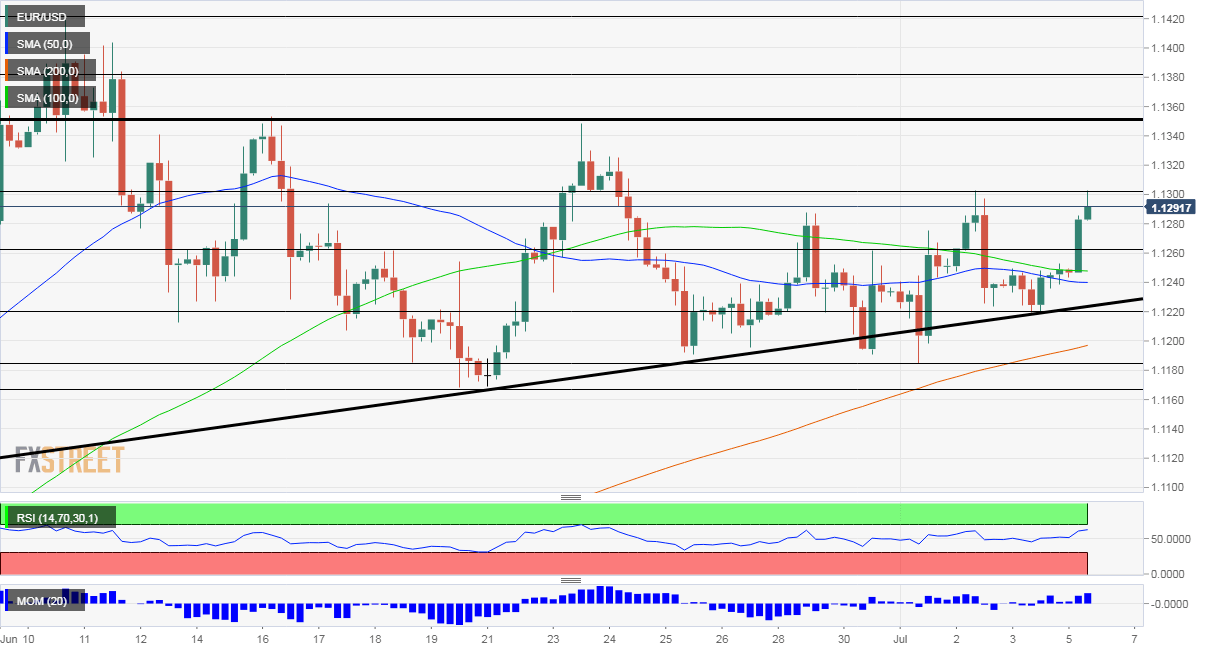

- Monday’s four-hour chart is showing the pair is hitting resistance.

After a long US weekend, bulls have returned with rage – kicking it off in China. The media in the world’s second-largest economy has been touting a rising stock market to follow on the economic recovery. According to a ranking by Baidu, the leading search engine in China, mentions of rising stocks are up ten times in comparison to the past 90 days. State media has a significant influence.

Stocks in Shanghai and other equity markets have surged, carrying along with S&P futures and weighing on the safe-haven dollar. Beijing seems to have coronavirus under control and that can support an increase in values and in trading volume – which has hit the highest since 2015.

However, back in the summer of 2015, shares in the Asian giant surged and then crashed. Will it happen again? Probably not in the next few days.

Another positive factor for EUR/USD comes from optimism about the old continent’s prospects. Goldman Sachs and officials at the Bank of France have expressed satisfaction about the bounce in economic activity as the old continent seems to have COVID-19 under control.

Europe may be already benefiting from the EU Fund – which has yet to be approved and will kick in only in 2021. The signal from policymakers encourages investment. Moreover, support from the European Central Bank is also boosting sentiment. Christine Lagarde, President of the ECB, reiterated her commitment to supporting the economy and also battle disinflation.

It is essential to note that the reopening of the European economies is not without risks. Two areas in Spain have been put under a localized lockdown encompassing some 270,000 people due to flare-ups in coronavirus cases. The population’s size is 46 million and as long as outbreaks are under control, investors remain upbeat.

Americans return from a long Independence Day weekend. While markets were closed in the past three days, coronavirus cases continued rising, nearing three million. Deaths are close to 130,000 and hospitals in Houston are bringing bad memories of those in New York in April – losing control.

The raging disease lowered spending in the world’s largest economy and later triggered new restrictions by governors. President Donald Trump insisted that the US is winning, that most cases are mild, and that the increase is only due to testing – but the positive hit rate remains elevated in many states.

Opinion polls continue showing Trump trailing behind rival Joe Biden by over nine points, with a chance that Democrats take a clean sweep. The president delivered an election speech focusing on his base.

More: If the US presidential election were today? But it’s not.

New COVID-19 figures form Texas, California, and Florida may weigh on sentiment later on. However, figures published on Monday are for Sunday, when the absence of some administrative staff causes figures to temporarily fall – the “weekend effect” – before catching up later in the week.

Another reason that may weigh on sentiment and boost the safe-haven greenback stems from skepticism about the data, which is not keeping up with the surge of coronavirus. Non-Farm Payrolls showed a leap of 4.8 million jobs in June – but the surveys were held early in the month, before the recent increase in cases.

The ISM Non-Manufacturing Purchasing Managers’ Index is due out on Monday and may also surprise to the upside – yet draw the same shrugging off. Higher-frequency figures such as gasoline consumption, restaurant reservations, and weekly jobless claims are more timely.

Overall, fundamentals are pointing to a tie between bulls and bears.

EUR/USD Technical Analysis

EUR/USD is battling the round 1.13 level, which capped it earlier this month and serves as resistance. Will it break or bounce? Buyers seem to have the wind in their backs, as euro/dollar trades above the 50, 100, and 200 Simple Moving Averages on the four-hour chart and enjoys upside momentum. The Relative Strength Index is still below 70, thus outside overbought conditions.

Above 1.13, the next line to watch is the double-top of 1.1350, last seen in late June. It is followed by 1.1385 and 1.1410.

Support awaits at 1.1265, a swing high from late June, followed by 1.1225, a support line from late last week. Further down, 1.1180 and 1.1165 await EUR/USD.