- EUR/USD is trading off the lows amid coronavirus concerns.

- US data, Lagarde’s speech, and further COVID-19 figures are set to move the currency pair.

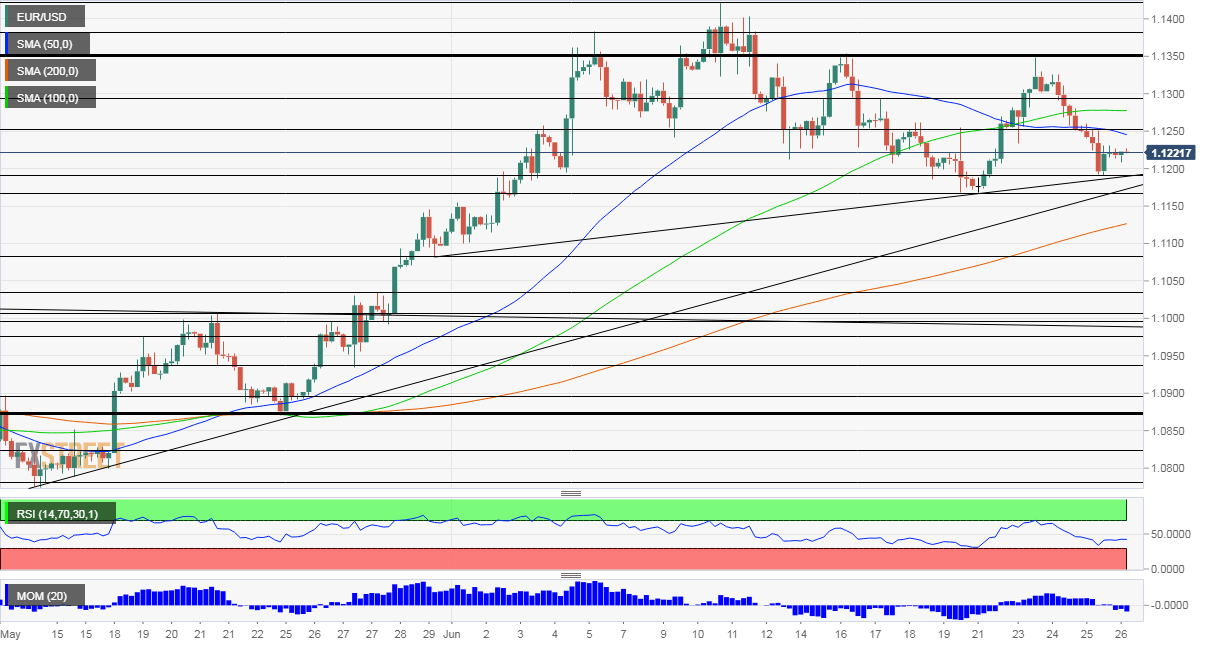

- Friday’s four-hour chart is showing two uptrend support lines are converging.

Down but not out – the world’s most popular currency pair is struggling to recover but still holds its ground. EUR/USD’s resilience comes amid a late rally in US stocks on Thursday as investors defied a record number of coronavirus cases in America and also a warning by the Federal Reserve. The safe-haven dollar came under pressure, but will it continue?

Texas Governor Greg Abbott halted the reopening of the state amid an acceleration in COVID-19 hospitalizations which is putting pressure on health systems. Cases continue rising in Florida, California, and most US states. Moreover, the Center for Disease Control said that the real number of infections is probably 23 million – ten times the current count.

However, President Donald Trump stated the US will not impose shutdowns and that economy will roar forward. The Federal Reserve does not seem to share the same optimism, as it ordered banks to refrain from increasing dividends for the second quarter and refrain from buyouts in the third one. The Fed wants commercial banks to have more funds in case of a downturn.

Nevertheless, stocks found their feet and bounced. The same Fed also provides massive support to markets, and perhaps investors were also encouraged by some of the data points. Durable Goods Orders surged by 15.8% in May, beating expectations and showing a substantial rebound after April’s downfall.

Jobless claims were mixed, with initial claims remaining stubbornly high around 1.5 million and continuing applications dipping below 20 million. Friday’s figures are also of interest. Personal Income – which leaped by over 10% in April – has likely dropped in May. On the other hand, Personal Spending probably took the other direction, surging in May after tumbling in April.

See US Personal Income and Spending May Preview: Markets look ahead and behind

Christine Lagarde, President of the European Central Bank, delivers a speech later in the day and may comment on the current economic situation and potential further stimulus. The ECB defied the German Constitutional Court’s partial rejection of the bank’s bond-buying scheme and expanded its purchases earlier this month.

Lagarde will likely reiterate the Frankfurt-based institution’s commitment and will also call on politicians to play their part. Ursula von der Leyen, the President of the European Commission, urged leaders to agree on her proposed EU Fund – an ambitious plan including €500 billion in mutually funded grants – before the summer holidays. However, disagreements have resulted in leg dragging.

Coronavirus cases – and fear of worse figures over the weekend – many trigger a risk-off mood favoring the dollar late in the day. Will euro/dollar remain resilient?

EUR/USD Technical analysis

Zooming out on the four-hour chart all the way to early May shows a long-term uptrend support line that is now hitting chart close to the current price. A more moderate uptrend dating back to late May is also providing support. Will this convergence prevent EUR/USD from falling?

Momentum remains to the downside while this week’s slide from the highs sent euro/dollar below the 100 and 200 Simple Moving Averages. However, the pair is still above the 200 SMA.

Support awaits at the recent low around 1.1190, followed by Friday’s low of 1.1165. The next line to watch is 1.1080, which was a stepping stone on the way up in early June.

Resistance is 1.1250, a swing high from last week, followed by 1.1295, another such line from several days earlier. The next cap is at 1.1350, which held EUR/USD down twice during this month.

More What to watch out for and why the dollar is king in the US coronavirus comeback