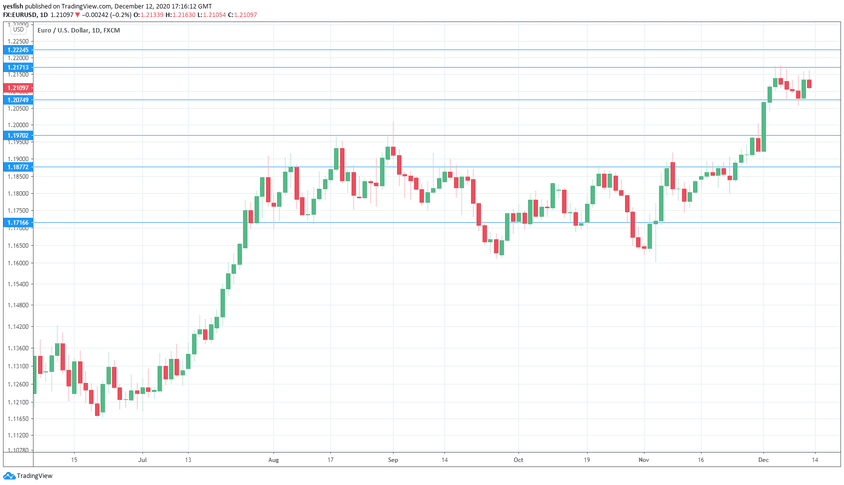

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

In the US, headline and core inflation both rose slightly, from 0.0% to 0.2%. PPI was also weak, with the headlined and core releases coming in at a negligible 0.1%. Unemployment claims surged to 853 thousand last week, up from 712 thousand. This points to weakness in the labor market, as the economy continues to struggle. The week wrapped up on a positive note, as UoM Consumer Sentiment improved to 81.4 in December, up from 77.0 beforehand.

- Eurozone Industrial Production: Monday, 10:00. The indicator fell by 0.4% in September, the first decline in five months. However, a strong rebound is projected for October, with a consensus estimate of 1.8%.

- French Final CPI: Tuesday, 7:45. Inflation remains very low in the eurozone. The second-largest economy in the bloc has not posted a gain in inflation in four months. The estimate for November stands at 0.2%.

- PMIs: Wednesday, 8:15 in France, 8:30 in Germany, and 9:00 for the whole eurozone. German and eurozone manufacturing PMIs continue to point to expansion, with readings above the neutral 50-level. The November readings are expected to dip slightly, with readings of 56.2 and 53.0, respectively. France is expected in at 49.7, which shows stagnation. The services sector has been in contraction and little change is expected in November. The forecasts for Germany is 44.1, for the eurozone 41.21 and for France 39.1.

- Inflation Report: Thursday, 10:00. The specter of deflation remains a major headache for eurozone policymakers. Headline inflation has fallen by 0.3% for the two past months, and an identical drop is projected in November. Core inflation has been in positive territory, and is expected to post a gain of 0.2% for a third successive month.

- German Ifo Business Climate: Friday, 9:00. Business confidence has been dipping, as the number one economy in the eurozone struggles with a resurgence of Covid-19. The indicator is expected to slow to 90.2 in December, down from 90.7 beforehand.

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.2478.

1.2328 is next.

1.2224 has held in resistance since April 2018.

1.2171 remains under pressure.

1.2074 is the first support line.

1.1970 is next.

1.1877 (mentioned last week) has held in support since late November.

1.1716 is the final support level for now.

.

I remain bullish on EUR/USD

The euro continues to gain ground against the US dollar. With the approval of Covid vaccines and continuing talks over a massive US stimulus package, the US dollar could find itself under further pressure this week.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!