EUR/USD traded higher in the last week before the holidays. Will it continue higher in the last week of 2017? We have some inflation figures just before the New Year. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The final read of inflation for November did not move the needle: core inflation is still stuck at 0.9%. This weighed on the euro in the initial publication but did not have any effect now. Consumer confidence continues rising in the euro-zone and French consumers bought more. Only Germany’s IFO business climate fell slightly short of projections but still looks robust. Data in the US was mixed and the tax cuts that Trump signed into law were already priced in. It seemed that dollar bulls took profits ahead of Christmas.

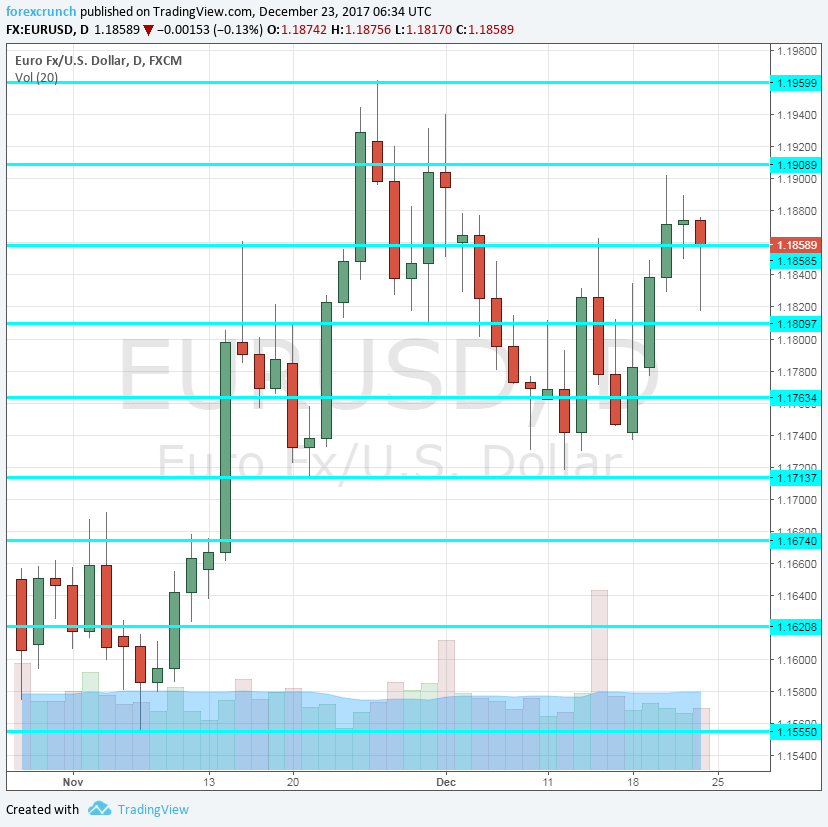

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- ECB Economic Bulletin: Thursday, 9:00. The European Central Bank publishes data that it uses in its rate decision, providing further insights about the state of the euro-zone economies.

- German CPI: Friday, during the European morning with the final release coming at 13:00. Prices in Europe’s third-largest economy rose by 0.3% in November and its early publication will shape the numbers for all the euro-zone. Draghi’s dovishness is based on poor inflation in the euro-zone. We’ll now get an early look while liquidity is super-low just ahead of the New Years’ Party.

- Spanish Flash CPI: Friday, 8:00. The fourth-largest economy in the euro-zone saw a bump up in inflation back in November, with 1.7% y/y. A slide back to 1.5% is on the cards in the first release for December.

- Monetary data: Friday, 9:00. M3 Money Supply, or the amount of money in circulation, stood at a stable annual growth rate of 5% y/y. A small drop to 4.9% is on the cards. Growth in private loans stood at 2.8% and is now predicted to pick up to 2.8%. In theory, a higher velocity of money implies higher inflation in the future.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar had a slow start to the week, but it eventually made a move to the upside, challenging resistance at 1.1910 (mentioned last week).

Technical lines from top to bottom:

The cycle high of 1.2090 looms above. 1.20 is the obvious round level and also worked as resistance in September.

1.1950 was the high level seen in November and a stepping stone towards 1.20. 1.1860 capped the pair in August and in October while working as support in September.

1.1820 worked as a cushion to the pair in late November and works as weak support. 1.1760 served as a cushion in November and also played a role beforehand.

1.1710 was the high of August 2015 and also worked as support in November. 1.1670 was a swing low in October. and hasn’t worked too well.

The 2016 high of 1.1620 slowed down the pair also in October. 1.1555 was the low point in November and works as a cushion. It is followed by the round number of 1.15.

1.1445 is the June 2017 peak and immediate resistance. The next level of support is only 1.1370.

I remain bullish on EUR/USD

The euro-zone economies look good and the good news in the US is already priced in. In a quiet week, the regular flows of imports and exports favor a higher EUR/USD.

Our latest podcast is titled What does 2018 have in store for financial markets?

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!