- PMIs: Monday, 8:15 for France, 8:30 for Germany, eurozone number at 9:00. These are the initial releases for services and manufacturing PMIs. The Services PMIs continue to point to expansion in France, Germany and the eurozone, but the same cannot be said about manufacturing, which has been hit hard by weak global conditions. Manufacturing PMIs are projected to be in contraction territory in the eurozone and Germany. The estimate for France is better, with an estimate of 51.9, which indicates weak expansion.

- German PPI: Wednesday, 7:00. This inflation gauge declined by 0.2% in October, shy of the estimate of 0.0%. The estimate for November stands at +0.1%.

- German Ifo Business Climate: Wednesday, 9:00. Business confidence improved to 95.0 in November, marking a 4-month high. The upward movement is expected to continue in December, with a forecast of 95.6 pts.

- Eurozone CPI: Wednesday, 10:00. Eurozone CPI dipped to 0.7% in October, down from 0.8% a month earlier. CPI is expected to climb to 1.0% in November.

- German GfK Consumer Climate: Friday, 7:00. Consumer confidence rose to 9.7 in November, matching the forecast. The indicator is projected to climb to 9.8 in December.

- Eurozone Current Account: Friday, 9:00. The current account surplus continues to climb and reached EUR 28.2 billion in September. However, the markets are braced for the surplus to fall to EUR 23.6 billion in October.

- Eurozone Consumer Confidence: Friday, 15:00. Consumers remain pessimistic about economic conditions in the eurozone. The indicator came in at -7 in November and no change is expected in the December release.

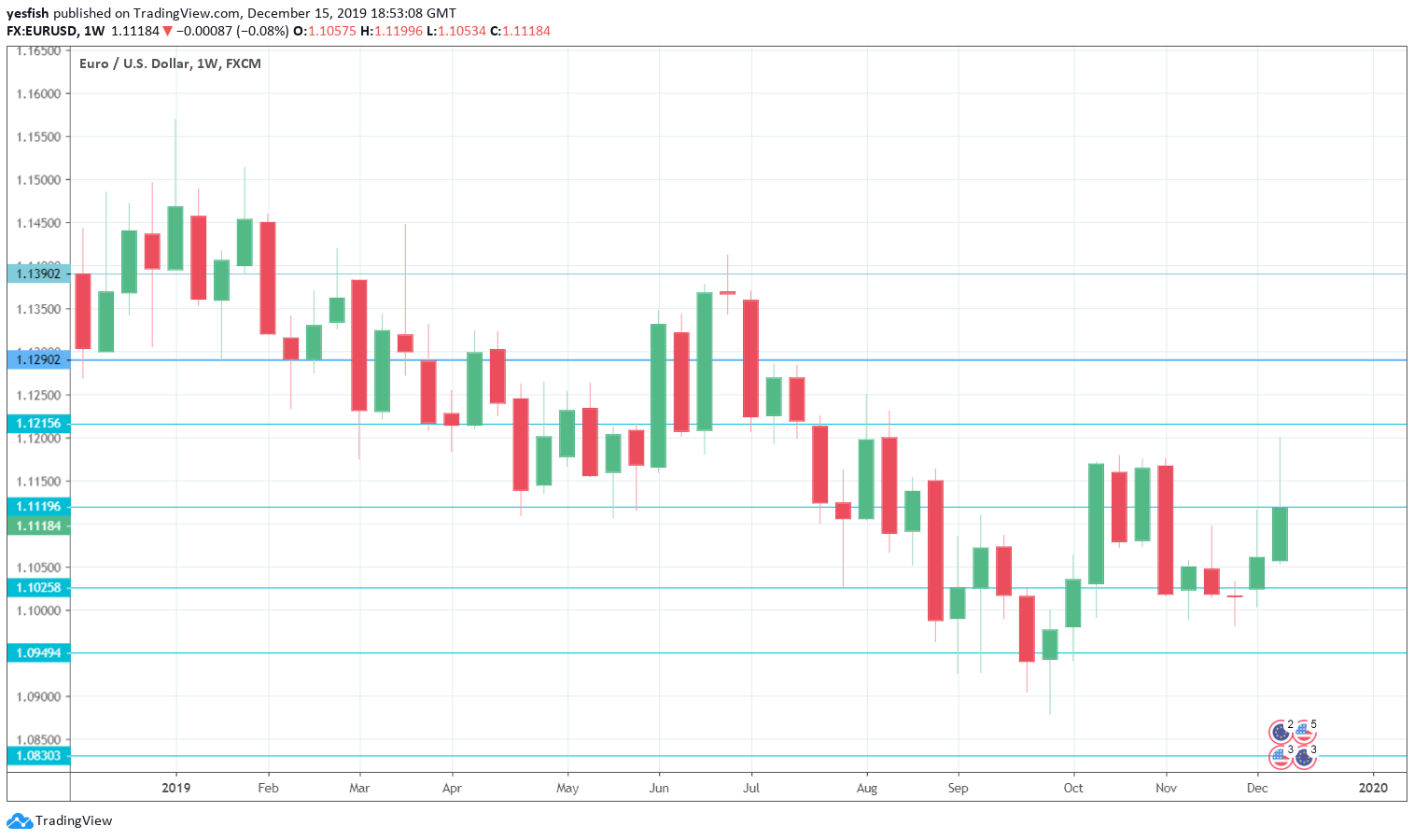

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.1515, which was a high point at the end of January.

1.1435 was a low point at the beginning of February.

1.1390 has held firm in resistance since June. This is followed by 1.1345.

1.1290 was last tested in early July. 1.1215 is next.

1.1119 is fluid, as EUR/USD is starting the trading week at this level.

1.1025 (mentioned last week) has switched to a support role after gains by EUR/USD last week. 1.0925 is next.

1.0829 has held in support since April 2017.

1.0690 is the final support level for now.

I am bearish on EUR/USD

Economic activity in the eurozone remains soft, and the German locomotive is also showing signs of weakness. The trade agreement between the U.S. and China could raise investor sentiment towards the greenback.

Follow us on Sticher or iTunes

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!