EUR/USD was pressured by a stronger dollar, Draghi, and Italian headlines. What’s next? PMI data stand out in the first week of December. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Italy remained a source of concern as the European Commission wants to bring forward disciplinary measures against the country. On the other hand, ministers in the continent’s third-largest economy have been more conciliatory and are willing to compromise. In the US, the Fed remains on course to raise rates in December and beyond. Moreover, Trump has toughened his stance on trade, and this supports the safe-haven USD.

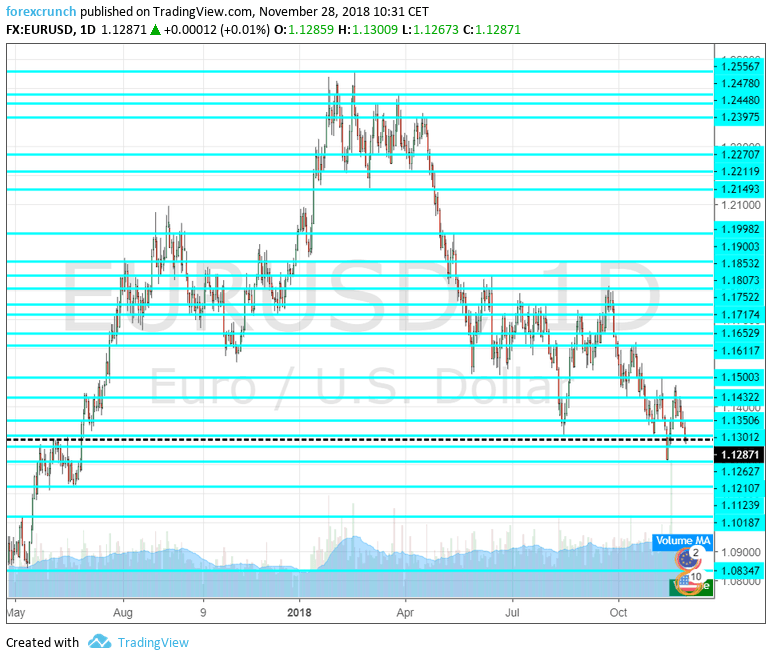

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Manufacturing PMI’s: Monday: 8:15 for Spain, 8:45 for Italy, final French figure at 8:50, final German one at 8:55, and final euro-zone number at 9:00. Markit’s forward-looking purchasing managers’ index for Spain’s manufacturing sector stood at 51.8 in October, only slightly above the 50-point threshold that separates expansion from contraction. Italy, the third-largest economy, had a score of 49.2 points, indicating a squeeze. The preliminary assessment for France for November stood at 50.7 points. Germany had a score of 51.6 and the euro-zone 51.5. The initial figures will likely be confirmed in the final read.

- Sentix Investor Confidence: Monday, 9:30. This broad survey of 2,800 investors and analysts disappointed in November with a fall to 8.8 points, albeit still in positive territory, indicating optimism. The fresh figure for December may further fall.

- Spanish Unemployment Change: Tuesday, 8:00. The fourth-largest economy still suffers from a high level of unemployment and its timely report about the number of the unemployed is watched closely. An increase of 52.5K was recorded in October, as the tourism season was winding down.

- PPI: Tuesday, 10:00. The Producer Price Index showed an increase of 0.5% m/m back in September. The figure for October will likely be more moderate. Prices at factory gates feed into consumer prices.

- Services PMI’s: Wednesday, 8:15 for Spain, 8:45 for Italy, final French figure at 8:50, final German one at 8:55, and final euro-zone number at 9:00. Services sector numbers have generally been better than those in the manufacturing one. Spain had a score of 54 in October. Italy had 49.2. The initial read for France for November stood at 55, for Germany it was 53.3 and for the euro-zone 53.1. No changes are expected in the final versions.

- Retail Sales: Wednesday, 10:00. Consumers fell short of expectations for many months this year. Retail sales remained unchanged in September. A moderate rise is likely in October.

- German Factory Orders: Thursday, 7:00. The euro zone’s locomotive saw an increase of 0.3% in factory orders back in September. The figure for October will likely see another modest increase.

- German Industrial Production: Friday, 7:00. Similar to factory orders, also industrial output rose at a modest pace: 0.2% in September.

- French Industrial Production: Friday, 7:45. Contrary to Germany, the continent’s second-largest economy saw a substantial drop in its output back in September: 1.8%. A bounce is likely now.

- French Trade Balance: Friday, 6:45. France suffers from a chronic trade deficit. This deficit stood at 5.7 billion euros in September. A similar figure could be seen for October.

- GDP: Friday, 10:00. According to the previous releases, the euro-zone grew by a meager 0.2% q/q in Q3. Germany’s contraction and Italy’s stagnation weighed. We will now get an update which will likely confirm the previous publications.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar dropped below 1.1300 (mentioned last week) and struggled to recover.

Technical lines from top to bottom:

1.1650 was a swing low in late August and is very closely followed by 1.1615 which played a pivotal role.

1.1500 is a very round level and also capped the pair’s advance in early November. 1.1430 separated ranges during October and later capped the pair in late November.

1.1325 was a low point in mid-November. 1.1300 is a round number that held the pair in mid-August and late October |double-bottom) and also held the pair down in June 2017.

1.1215 is the low point it reached in November. Lower, we are back to levels last seen in 2017. 1.1110 was a low point back in June. 1.1025 was a stubborn cap back in May 2017.

I am bearish on EUR/USD

The European Central Bank may end QE as expected but a rate hike is still far away. On the other side of the Atlantic, the Fed is keen on raising rates despite some bumps in the economy.

Our latest podcast is titled Are stocks free falling or is it a buying opportunity?

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!