There was only one eurozone release during a quiet Christmas week. Spanish CPI came in at -0.5%. The inflation indicator has now posted a decline for nine straight months.

In the US, the Chicago PMI rose to 59.5 in December, up from 58.2 and beating the forecast of 56.6 points. Pending Home Sales declined for a third straight month, with a reading of -2.6%. The week ended on a positive note, as unemployment claims dropped for a second straight week, falling to 787 thousand.

- Manufacturing PMIs: Monday, 8:15 in France, 8:30 in Germany, and 9:00 for the whole eurozone. The German and eurozone manufacturing sectors remain well into expansionary territory, and the upcoming PMIs are expected to confirm the initial estimates of 58.6 and 55.5, respectively. The PMIs for Spain, Italy and France are also above the 50-line, which points to expansion.

- German Retail Sales: Tuesday, 7:00. Retail sales rebounded in October with a gain of 2.6%, but analysts are braced for a sharp downturn in November, with an estimate of -2.0%.

- French CPI: Tuesday, 7:45. Inflation came in at 0.2% in November, ending a nasty streak of three straight declines. The upturn is extended to continue in December, with a forecast of 0.4%.

- Monetary Data: Tuesday, 9:00. M3 Money Supply accelerated to an annual growth rate of 10.5% in October, up from 10.4% beforehand. The estimate for November stands at 10.5%. Private Loans is projected to rise from 3.1% – 3.3%.

- German Prelim CPI: Wednesday, All Day. Inflation in the largest economy in the bloc slumped to -0.8% in November, its lowest level in12 months. The index is expected to bounce back in December, with an estimate of 0.6%.

- Service PMIs: Wednesday, 8:15 in France, 8:30 in Germany, and 9:00 for the whole eurozone. Services remain in contraction, with readings below the 50-level. The second-estimate PMIs for Germany and the eurozone are expected to confirm the initial readings, at 47.7 and 47.4, respectively. After a soft release of 38.8, France is projected to improve to 49.2 points.

- German Factory Orders: Thursday, 7:00. Factory orders jumped to 2.9% in October, well above expectations. However, analysts are braced for a downturn in November, with a forecast of -1.2%.

- Inflation Report: Thursday, 10:00. Headline CPI continues to flounder and has posted five straight declines. No relief is forecast for December, with an estimate of -0.2%. Core CPI is expected to remain at 0.2% for a third successive month.

- Retail Sales: Thursday, 10:00. Retail sales is the primary gauge of consumer spending. The October release came in at 1.5%, but November is expected reverse directions, with an estimate of -3.4%.

- ECB Monetary Policy Meeting Accounts: Thursday, 12:30. The ECB will release the minutes of its November policy meeting. With inflation at very low levels, investors will be looking for any hints as to whether the ECB plans additional easing early next year.

- German Industrial Production: Friday, 7:00. This manufacturing indicator jumped to 3.2% in October, marking a 4-month high. The forecast for November stands at 0.7%.

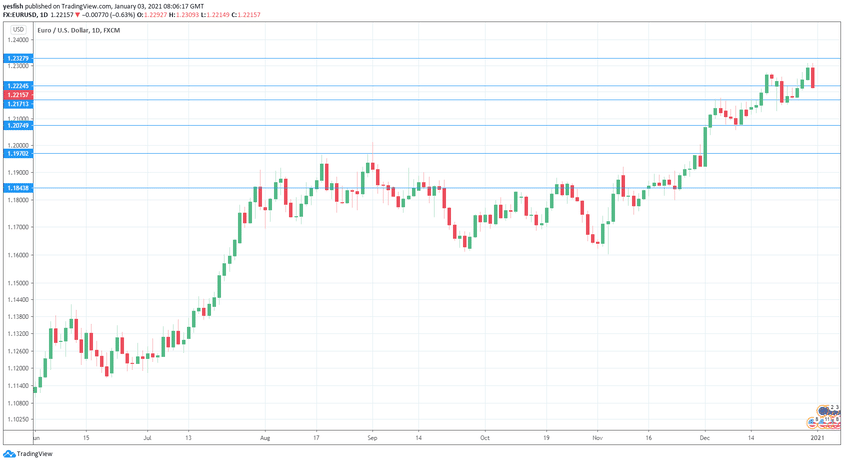

EUR/USD Technical analysis

Technical lines from top to bottom:

1.2478 was last tested in resistance in February 2018.

1.2328 is next.

1.2224 has held in resistance since April 2018.

1.2171 is a weak support level.

1.2074 is next.

1.1970 (mentioned last week) since early December.

1.1844 is the final support line for now.

.

I am neutral on EUR/USD

December was a banner month for the euro, which posted gains of 2.45% percent. Will the euro continue its ascent this week? The runoff election in Georgia on Tuesday will determine which party controls the US Senate, which could affect the movement of the dollar.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!