EUR/USD was on the back foot as the US Dollar stormed the board amid growing worries. The ECB Meeting Minutes stand out in the first full week of 2019. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Apple sparked a flash crash by issuing a revenue warning and blaming a Chinese slowdown. It came on top of weak Chinese PMI’s and stock markets jitters. While the euro did not suffer the same fate of the Aussie, it certainly stumbled. Mediocre euro-zone PMI’s and fears of an Italian recession did not help.

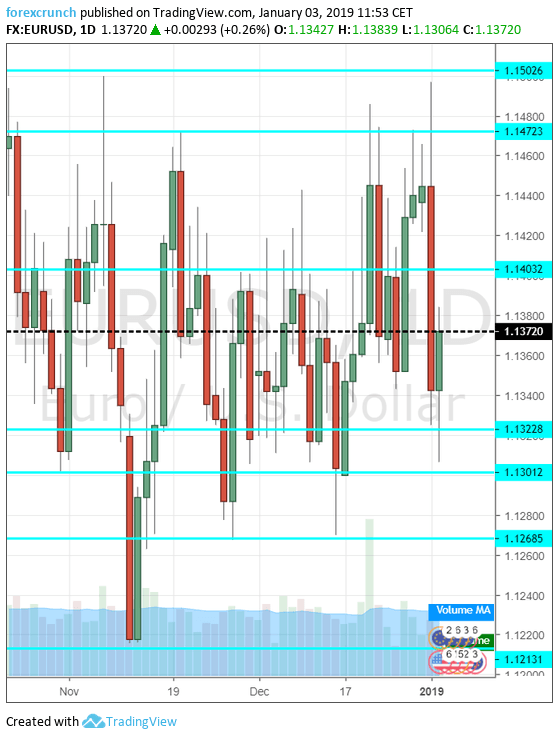

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Factory Orders: Monday, 7:00. Germany is considered the “locomotive” of the euro-zone. Its factory orders are recovering with an increase of 0.3% in October. Will we see another improvement in November? A drop of 0.2% is forecast.

- Sentix Investor Confidence: Monday, 9:30. The 2,800- strong survey of analysts and investors fell sharply in December to -0.3 points, thus reflecting pessimism for the first time in four years. Another downfall within negative territory cannot be ruled out. A slide to -2 point is on the cards.

- Retail Sales: Monday, 10:00. Despite coming out after the German and French data will have been released, the overall figure can surprise. A modest increase of 0.3% was seen in October. Another minor increase of 0.2% is projected.

- German Industrial Production: Tuesday, 7:00. Contrary to factory orders, industrial output dropped by 0.5% in October, falling short of expectations. We could see an increase in the report for November: 0.3% is expected.

- French Trade Balance: Tuesday, 7:45. The euro zone’s second-largest economy has a chronic trade deficit. However, the deficit narrowed to 4.1 billion euros back in October. It may widen again this time. A deficit of 4.9 billion is predicted.

- German Trade Balance: Wednesday, 7:00. Germany continues enjoying a broad trade surplus, but it has been shrinking from data seen in previous years. The figure stood at 17.3 billion in October and November will probably see a similar number: 17.6 billion is forecast.

- Unemployment Rate: Wednesday, 10:00. After a persistent fall, the jobless rate got stuck at 8.1% in the past three months as the euro-zone economies slowed down. A similar outcome is likely for the month of November. No change is expected.

- French Industrial Production: Friday, 7:45. The euro area’s second-largest economy enjoyed a substantial jump in its industrial output back in October: 1.2%. An increase of 0.1% is expected.

- ECB Meeting Minutes: Thursday, 12:30. The European Central Bank concluded 2018 by ending the QE program, as expected. ECB President Mario Draghi was slightly cautious in his comments about the economy, expressing concern about protectionism but maintaining the expectations for a rate hike in 2019. The minutes will provide further detail.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar kicked off the new year on high ground but dropped to 1.1300 (mentioned last week) quite quickly before stabilizing.

Technical lines from top to bottom:

1.1650 was a swing low in late August and is very closely followed by 1.1615 which played a pivotal role.

1.1500 is a very round level and also capped the pair’s advance in early November. 1.1475 was a high point in mid-November. 1.1415 capped EUR/USD in early December.

1.1325 was a low point in mid-November. 1.1300 is a round number that held the pair in mid-August and late October |double-bottom) and also held the pair down in June 2017. 1.1270 served as support late in November and is now a double bottom.

1.1215 is the low point it reached in November. Lower, we are back to levels last seen in 2017. 1.1110 was a low point back in June. 1.1025 was a stubborn cap back in May 2017.

I remain bearish on EUR/USD

Even if the Fed halts its rate rises, the ECB will likely be more dovish given the slowdown in the euro-zone. It is hard to see any improvement on the horizon.

Our latest podcast is titled What to expect from the Fed, trade, and the Brexit saga

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!