EUR/USD tried to move higher but eventually closed the week on the lower ground. Where will the pair go now? Final euro-zone CPI stands out. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The European Central Bank’s meeting minutes did not add any clarity on the timing of the ECB’s rate hike next year but remained dovish in general. In the US, inflation is picking up as expected and the central bank remains bullish. Fed Chair Jerome Powell says he “sleeps well at night”. The US is readying new tariffs on $200 worth of Chinese goods, but the sides may resume negotiations. The US Dollar took advantage

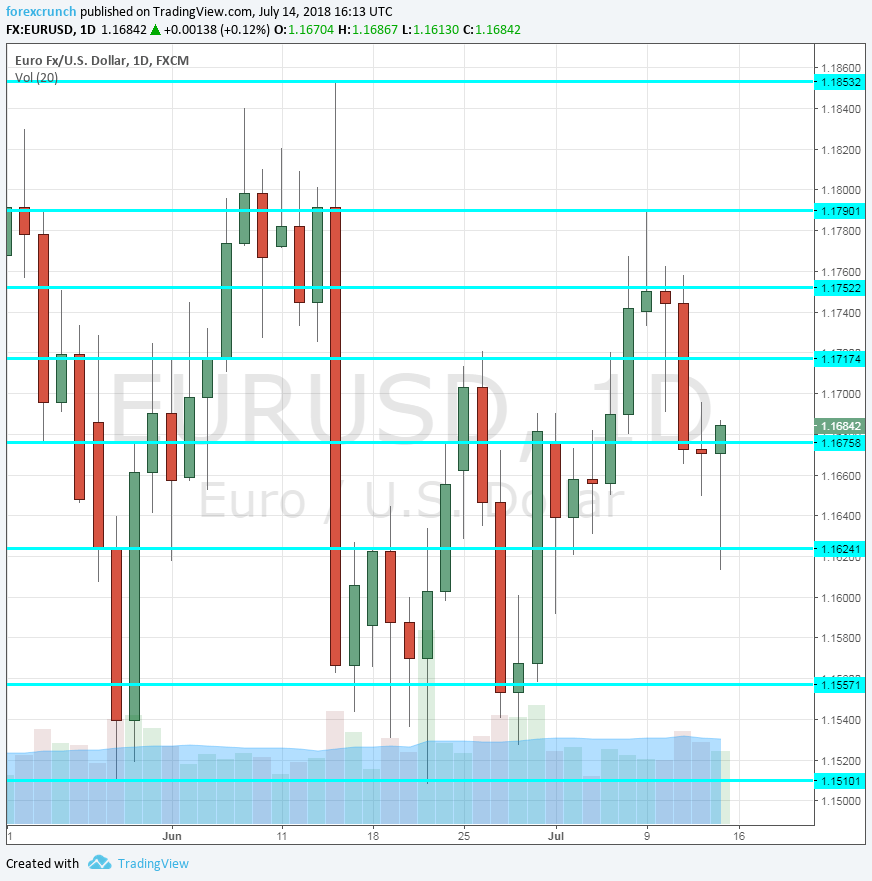

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Trade Balance: Monday, 9:00. The euro-zone enjoys a wide trade surplus, thanks to German exports. However, this surplus is set to continue shrinking in the report for May: to 17.6 billion from 18.1 billion beforehand. The impact of the trade wars will only be seen in the following week.

- Final CPI: Wednesday, 9:00. The initial CPI report for June showed a growing divergence between headline inflation and core inflation. Headline CPI stood exactly at the ECB’s target of 2% while core CPI was stuck at only 1%. Rising oil prices are responsible for a rapid rise in prices. The final figure will likely confirm the initial figures.

- German PPI: Friday, 6:00. Producer prices feed into consumer prices. Inflation at factory gates, or in the pipelines, rose by 0.5% m/m in May and is forecast to advance at a more moderate pace of 0.3%.

- Current Account: Friday, 8:00. Similar to the narrower trade balance report, the euro-zone’s current account is positive, It reached 28.4 billion in April and is predicted to squeeze down to 27.2 billion in May.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar kicked off the week with a move to the upside, temporarily breaching the 1.1740 level mentioned last week. It then turned south.

Technical lines from top to bottom:

1.2060 was the low point in late April and it is the last barrier before the round number of 1.20.

The round number of 1.19 is also notable as a pivotal line in the range and it also temporarily held the pair back in late 2017. 1.1845 was the high point in early June.

Further down, the 1.1820 level was a stubborn support line in late 2017. 1.1790 capped the pair in mid-July 1.1750 is a low point recorded in mid-May.

1.1720 is a veteran line that worked in both directions, last seen in November. 1.1676 was a temporary low point in late May.

Lower, 1.1630 was a pivotal line in November and 1.1550 was the trough around that time.

Below, 1.1510 is the new 2018 low and also a ten-month trough. Further down, 1.1480 served as support back in July 2017.

I remain bearish on EUR/USD

Monetary policy divergence favors a stronger dollar and a weaker euro. With Trump still on course to further fight trade wars, it is hard to see the euro making any meaningful recovery.

Our latest podcast is titled Festive Fed, Dovish Draghi, and a global trade war

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!