EUR/USD was shaken by US Dollar strength but eventually recovered quietly, a recurring pattern for the pair. What’s next? The ECB decision is the main event of the week. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The final euro-zone CPI read for June included a small downgrade to core CPI, from 1% to 0.9%. This may cause some worries for the ECB. In the US, Fed Chair Powell was bullish as ever on the economy, growth, and jobs, reiterating the message that the Fed will raise rates gradually. On trade, he did his best to dodge questions but said that high tariffs are bad for the economy. US retail sales were OK, not rocking the boat. The EU and Japan signed a free trade deal, serving as s rebuff to Trump. The US has been mulling tariffs on uranium. In a last minute twist, Trump’s comments about the Fed hurt the US Dollar. He said that he prefers low interest rates and that the Fed’s hikes impede his stimulation of the economy. He also wants a weaker USD.

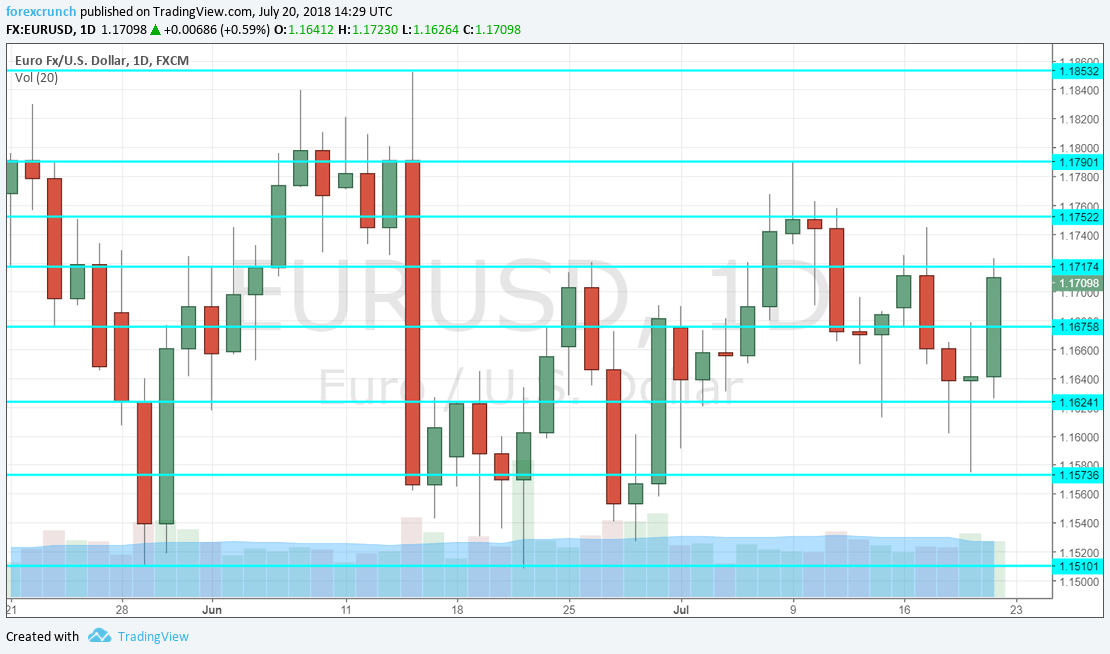

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Bundesbank Monthly Report: Monday, 10:00. Germany’s central bank, the Bundesbank, releases a monthly report about the German economy. Growth has accelerated of late, a source of optimism. However, the threat of tariffs on cars may dampen the outlook moving forward. Germany is the euro-zone’s largest economy.

- Consumer Confidence: Monday, 14:00. Eurostat’s monthly survey of consumers has been steady of late, showing marginal pessimism among consumers. Expectations stand at -1 for July, the same figure as in June.

- Flash PMI’s: Tuesday: 7:00 for France, 7:30 for Germany, and 8:00 for the euro-zone. Markit’s final purchasing managers’ index for the manufacturing sector in June stood at 52.5, above the 50-point threshold separating expansion from contraction, but below previous levels. A small increase to 52.6 is predicted for July. The services PMI is forecast to tick down from 55.9 to 55.7 points. In Germany, the manufacturing PMI was 55.9 in June and is expected to slide to 55.5 points now. The euro-zone is expected to see a drop from 54.9 to 54.7 in manufacturing and a fall from 55.2 to 55 in the preliminary services PMI for July.

- German Ifo Business Climate: Wednesday, 8:00. IfO is Germany’s No. 1 Think-tank. The institution’s wide survey had a score of 101.8 in the topline Business Climate figure. A drop to 101.6 is expected now.

- Monetary data: Wednesday, 8:00. The European Central Bank will receive fresh figures just before its meeting. M3 Money Supply expanded at an annual pace of 4% in May, and the same rate is on the cards for June. Private loans rose by 2.9% and an acceleration to 3% is on the cards now.

- Belgian NBB Business Climate: Wednesday, 13:00. The broad survey was in positive territory in June, but only just. A small drop from 0.6 to 0.4 is expected now.

- German GfK Consumer Climate: Thursday, 6:00. This barometer of consumer sentiment stood at 10.7 points in June and a repeat of the same score is on the cards for the 2,000 strong survey in July.

- Spanish Unemployment Rate: Thursday, 7:00. The fourth-largest economy in the euro-zone had a whopping unemployment rate of 16.7% in the first quarter of 2018. A significant drop to 15.8% is on the cards for Q2. While the levels remain high, they are well below the peak.

- ECB decision: Thursday, 11:45, press conference at 12:30. The European Central Bank sent EUR/USD plunging in its previous decision on June 14th. While they announced the beginning of the end of the bond-buying scheme, they added many conditions to any tightening move and pledged to leave interest rates unchanged “through the summer of 2019”. Since then, various reports about the meaning of this phrase have floated. Any clarification or lack thereof will move the euro. Comments about trade will also be watched very closely.

- French Flash GDP: Friday, 5:30. The second-largest exonomy is the first major economy to publish GDP data. A meager growth rate of 0.2% was reported in Q1 2018, below levels seen beforehand. A small acceleration with 0.3% is projected for Q2 2018.

- French Consumer Spending: Friday, 6:45. Consumers were out and about in May, with sales rising by 0.9%. An increase of 0.6% is on the cards for June, the month that coincided with the beginning of the World Cup.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar initially moved higher, challenging the 1.1750 level (mentioned last week). It then plunged and hit a low of 1.1575 before climbing back up.

Technical lines from top to bottom:

1.2060 was the low point in late April and it is the last barrier before the round number of 1.20.

The round number of 1.19 is also notable as a pivotal line in the range and it also temporarily held the pair back in late 2017. 1.1845 was the high point in early June.

Further down, the 1.1820 level was a stubborn support line in late 2017. 1.1790 capped the pair in mid-July 1.1750 is a low point recorded in mid-May.

1.1720 is a veteran line that worked in both directions, last seen in November. 1.1676 was a temporary low point in late May.

1.1625 provided support to the pair several times in June and July. It is followed by the mid-July trough of 1.1575.

Below, 1.1510 is the new 2018 low and also a ten-month trough. Further down, 1.1480 served as support back in July 2017.

I remain bearish on EUR/USD

The Federal Reserve will likely defend its independence for now and may even turn more hawkish as a result of Trump’s meddling. The ECB meeting will probably serve as a reminder that Draghi is dovish.

Our latest podcast is titled Festive Fed, Dovish Draghi, and a global trade war

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!