EUR/USD remained depressed in the week, this time more due to trade than to Draghi’s words. The last week of June features inflation figures, the EU Summit, and other events. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The US is contemplating imposing tariffs on no less than $200 billion of Chinese goods, and this worsened the mood in financial markets, weighing on the euro. ECB President Mario Draghi hosted a conference in Sintra, Portugal with his American peer. Both central bankers had already had their say on markets beforehand and did not rock the boat too much.

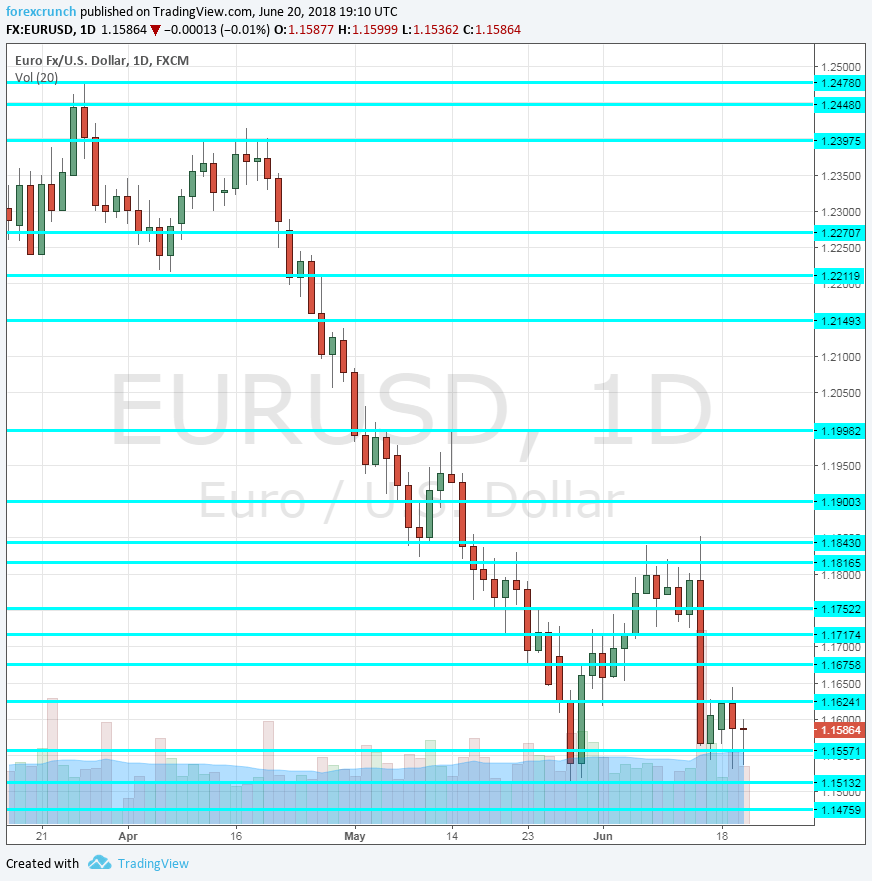

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Ifo Business Climate: Monday, 8:00. IFO is Germany’s No. 1 Think-Tank and the publication impacts the euro. Back in May, the Business Climate number stood at 102.2 (according to the new formula). The earlier ZEW publication pointed to a slowdown, but IFO could also surprise on the upside.

- Monetary data: Wednesday, 8:00. The M3 Money Supply is off its highs around 5% but at 3.9% in April, money is still moving nicely around the continent. Private loans rose by 2.9% y/y in April. A small acceleration could be seen in both figures.

- EU Summit: Thursday and Friday. Leaders of the European Union meet to discuss various topics and Brexit tops the agenda. The EU and the UK were expected to reach agreements on the main topics of the Irish border and the Customs Union by this meeting and it seems nothing will be achieved. There is a high likelihood that the can will be kicked down the road to the next EU Summit in October, where everything will need to be discussed ahead of March 29th, 2019, Brexit day. The British Pound will likely remain pressured but a failure to agree on anything may weigh on broader markets as well. In additions, the EU Summit will likely include a discussion on the trade spat with the US.

- German Retail Sales: Thursday, 6:00. The volume of sales in the continent’s largest economy jumped by 2.3% in April, far above expectations and ending four months of declines. For May, we could see a more modest change.

- German GfK Consumer Climate: Thursday, 6:00. This survey of around 2,000 German consumers ticked down from 10.8 to 10.7 points in May. It could remain stable at this time.

- Spanish Flash CPI: Friday, 7:00. The fourth-largest economy in the euro-zone saw year over year inflation jump to 2.1% in May, above the euro-zone figure. High energy prices likely kept it above 2% once again.

- ECB Economic Bulletin: Thursday, 8:00. The European Central Bank publishes the statistics that accompanied its rate decision meeting. It may provide further insights into developments in inflation.

- German Import Prices: Friday, 6:00. Prices of imported goods rose by 0.6% in April. We will now get the number for April. Oil prices had a significant contribution to prices of imports and also to overall inflation.

- French Consumer Spending: Friday, 6:45. The second-largest economy saw a big drop in consumption back in April: -1.5%. A bounce back is likely in May.

- French CPI: Friday, 6:45. France provides the final hint for the all-European CPI release. Prices rose by 0.4% m/m in May, and like in Germany, the monthly change was likely smaller in June.

- German Unemployment Change: Friday, 7:55. Germany continues enjoying a strong labor market that sees continued falls in the number of the unemployed, 11K back in April. Another drop is on the cards.

- German CPI: Thursday, with the all-German number due at 12:00. The month of May saw a robust rise in prices: 0.5% m/m. The preliminary release for June will likely show a smaller rate of monthly change. The year over year figures will be eyed as well. The German inflation number has a significant contribution to the all-European number.

- Euro-zone inflation report: Friday, 9:00. Euro-zone inflation bounced back in May, with the headline reaching 1.9% y/y. While the headline figure was driven by energy prices, the ECB may have comfort that also core prices went back to normal with 1.1%. Small deviations are on the cards in the preliminary read for June.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar struggled early in the week and tackled the 1.1550 area (mentioned last week).

Technical lines from top to bottom:

1.2060 was the low point in late April and it is the last barrier before the round number of 1.20.

The round number of 1.19 is also notable as a pivotal line in the range and it also temporarily held the pair back in late 2017. 1.1845 was the high point in early June.

Further down, the 1.1820 level was a stubborn support line in late 2017. 1.1750 is a low point recorded in mid-May.

1.1720 is a veteran line that worked in both directions, last seen in November. 1.1676 was a temporary low point in late May.

Lower, 1.1630 was a pivotal line in November and 1.1550 was the trough around that time.

Below, 1.1510 is the new 2018 low and also a ten-month trough. Further down, 1.1480 served as support back in July 2017.

I remain bearish on EUR/USD

The value of the euro probably does not reflect the danger from trade wars and the growing concerns about it at the ECB. With upbeat US figures, there is room for more falls.

Our latest podcast is titled Festive Fed, Dovish Draghi, and a global trade war

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!