EUR/USD continued suffering from Italian politics once again after a short respite. What’s next? The upcoming week features a mix of data PMI, retail sales, and industrial output data. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Italy’s President rejected the Euroskeptic candidate for Finance Minister, Paolo Savona triggering widespread anger also against the EU. Fears of early elections that would be a de-facto vote on euro-zone membership triggered a quick yet powerful crisis. Italian bond yields soared, the odds of an “Italexit” rose, stocks crashed, and EUR/USD fell to the lowest levels in 10 months. Eventually, the two coalition parties and the President found a compromise on the composition of the government. This provided calm. A political crisis in Spain had little impact as the common currency as Spain is staunchly pro-European. Upbeat German retail sales and a much-needed rise in inflation (1.9% on the headline and 1.1% on the core) also supported the common currency. In the US, data was mixed.

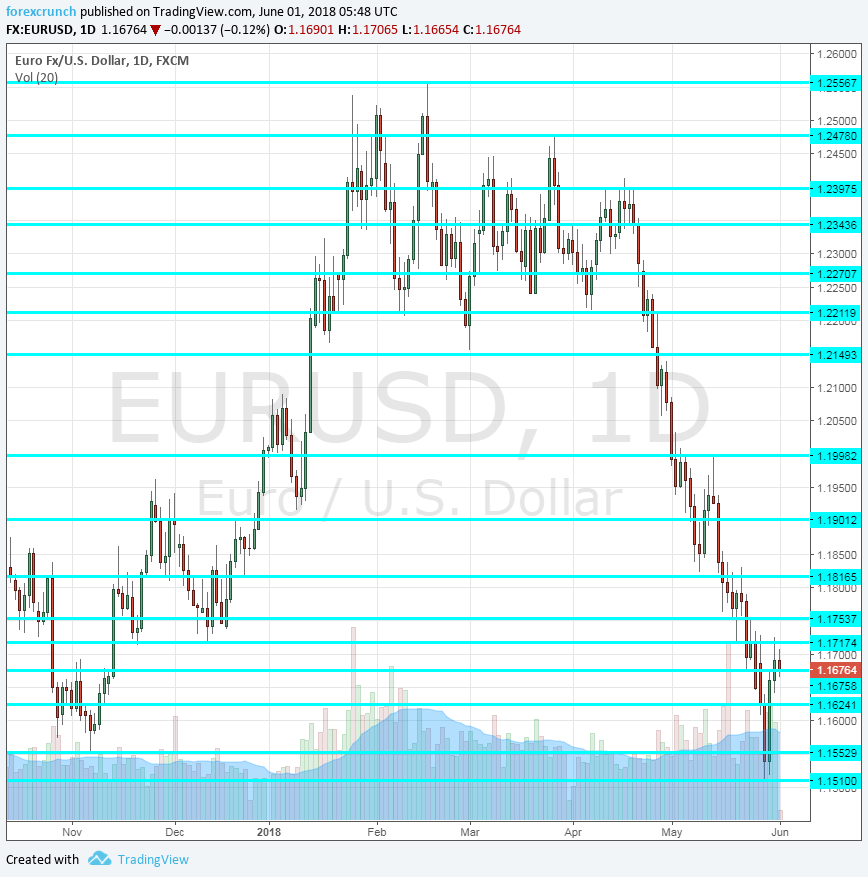

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Spanish Unemployment Change: Monday, 7:00. The fourth-largest economy in the euro-zone saw its labor market recovery stall as the unemployment rate has risen. The early report of the change in the unemployment is watched. Back in April, 86,700 people left the ranks of the unemployed. Another drop is likely now, as the tourism season picks up. A drop of 105.7K is on the cards.

- Sentix Investor Confidence: Monday, 8:30. This survey of around 2,800 analysts and investors fell short of expectations in the past four months, hitting a low of 19.2 points in May. A drop to 18.6 is on the cards.

- PPI: Monday, 9:00. Producer prices eventually reach consumers. Inflation in the pipeline came out at 0.1% in March. The PPI lags the CPI but serves as a projection for the future. A rise of 0.2% is forecast.

- Services PMI: Tuesday: 7:15 for Spain, 7:45 for Italy, the final French figure at 7:50, final German number at 7:55, and the final read for the euro-zone at 8:00. Markit’s score for Spain in April stood at 55.6 points, below expectations and the previous month. A score of 56.4 is on the cards for MAy. Italy had a score of 52.6 points, closer to the 50-point threshold that separates contraction from expansion and 52.9 is predicted. The preliminary figure for France stood at 54.3 points, for Germany at a low of 52.1 and the whole euro-zone had a score of 53.9 points. A confirmation is expected for these initial reads.

- Retail Sales: Tuesday, 9:00. Consumers disappointed expectations in the past three months. In March, a meager growth rate of 0.1% was recorded. Despite being released after the major countries have already published their data, surprises are quite common. A bounce is likely nowÑ 0.5%.

- Mario Draghi talks Tuesday, 13:00. The President of the ECB will speak at the ECB’s 20th-anniversary event with his predecessor Jean-Claude Trichet. Draghi will have the chance to respond to the latest developments and perhaps provide a hint towards the June decision.

- Jens Weidmann talks Tuesday, 17:30. The President of the German Bundesbank will be in Brussels and his speech is titled “Reforms for a Stable Monetary Union”. Weidmann is seen as the leading candidate to succeed Draghi at the helm of the ECB.

- Retail PMI: Wednesday, 8:10. This 1,000-strong survey by Markit dropped to 48.6 points in April, below the level separating expansion and contraction. A small improvement may be seen in May.

- German Factory Orders: Thursday, 6:00. While this gauge of Germany’s industry is volatile, the three consecutive misses of expectations already form a clear trend. A drop of 0.9% was recorded in March and a recovery could be seen now: +0.7% is expected.

- French Trade Balance: Thursday, 6:45. The trade balance deficit of France widened in March and reached 5.3 billion euros, a deeper deficit than predicted. A similar figure is likely for April: a deficit of 5.1 billion.

- Revised GDP: Thursday, 9:00. Current estimations for euro-zone GDP stand at 0.4% in Q1 2018, below 0.6% seen in each of the quarters of 2017. This publication will likely confirm the data.

- German Industrial Production: Friday, 6:00. Contrary to factory orders, Germany’s industrial output increased in March, rising by 1%. We will now get the figures for April and an increase of 0.4% is forecast.

- German Trade Balance: Friday, 6:00. Germany enjoys a broad trade balance and March was no different, with 22 billion. No big changes are on the cards in the read for April. A surplus of 20.3 billion is expected.

- French Industrial Production: Friday, 6:45. France is also expected to enjoy a rise of 0.4% in industrial output. But contrary to Germany, France saw a drop of 0.4% in its output in the previous month.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar jumped higher early in the week but was unable to settle above the 1.1720 level (mentioned last week) and slipped to new lows for the year at 1.1510. From there it staged a recovery.

Technical lines from top to bottom:

1.2060 was the low point in late April and it is the last barrier before the round number of 1.20.

The round number of 1.19 is also notable as a pivotal line in the range and it also temporarily held the pair back in late 2017.

Further down, the 1.1820 level was a stubborn support line in late 2017. 1.1750 is a low point recorded in mid-May.

1.1720 is a veteran line that worked in both directions, last seen in November. 1.1676 was a temporary low point in late May.

Lower, 1.1630 was a pivotal line in November and 1.1550 was the trough around that time.

Below, 1.1510 is the new 2018 low and also a ten-month trough. Further down, 1.1480 served as support back in July 2017.

I remain bearish on EUR/USD

Italy’s new government is unlikely to be friendly to the euro-zone. The trade wars with the US are unhelpful as well. In the US, data is not impressive, but good enough for a hike.

Our latest podcast is titled Truce in trade and dollar domination

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!