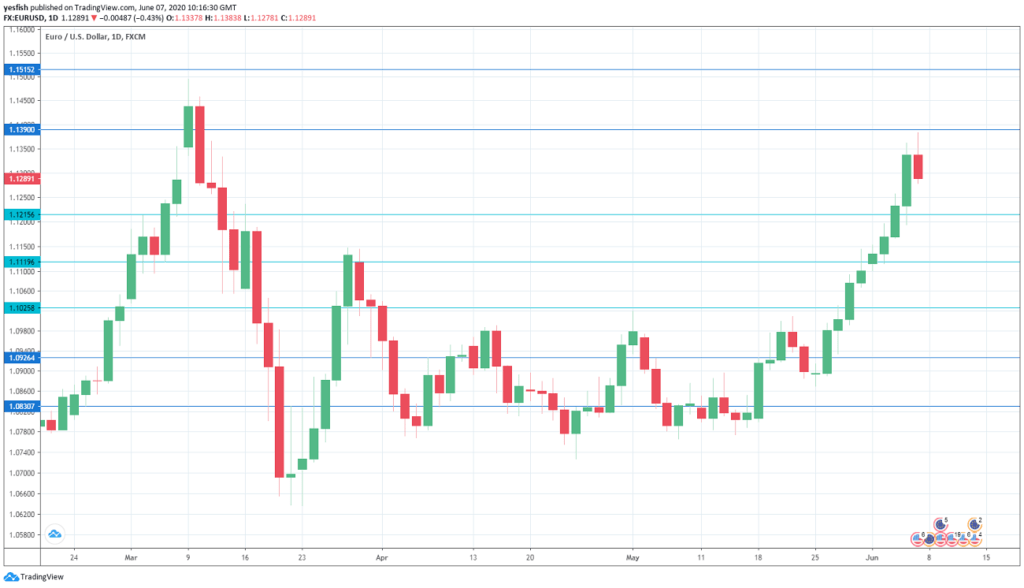

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Industrial Production: Monday, 6:00. Industrial production sank in March, with a decline of 9.2 percent. This figure was worse than the forecast of 7.3 percent. A much sharper drop is expected in April, with an estimate of -16.0 percent.

- Eurozone Sentix Investor Confidence: Monday, 8:30. Investor confidence has evaporated in recent months, with a reading of -42.9 in April and -41.8 in May. The pessimism is expected to ease in June, with a forecast of -22 points.

- German Trade Balance: Tuesday, 6:00. German exports have ensured that Germany continues to record trade surpluses. In March, the surplus fell to 12.8 billion euros, short of expectations and its lowest level since 2011. The downtrend is expected to continue in April, with an estimate of 11.9 billion euros.

- Eurozone Revised GDP: Tuesday, 9:00. GDP declined by 3.8 percent in Q1, as the eurozone has buckled under the economic meltdown due to Covid-19. The third read is expected to confirm this reading.

- French Final CPI: Friday, 6:45. Inflation in the eurozone’s second-largest economy remains low. CPI has posted only one gain in the past four months and came in at a flat 0.0% in May. This figure is expected to be confirmed by the upcoming second reading.

- Eurozone Industrial Production: Friday, 9:00. The manufacturing sector has been hit hard by the economic downturn, and industrial production plunged 11.3% in March. Analysts are braced for a huge drop of 20.0% in April.

EUR/USD Technical analysis

Technical lines from top to bottom:

With EUR/USD posting strong gains last week, we start at higher levels:

1.1620 has held in resistance since early October 2019.

1.1515 was a high point at the end of January. 1.1435 was a low point at the beginning of February.

1.1390 was a stepping stone on the way up in late January and capped EUR/USD earlier.

1.1215 has switched to a support role, after holding in resistance since mid-January. 1.1119 is next.

1.1025 (mentioned last week) has some breathing room after sharp gains by EUR/USD last week.

1.0920 is the final support level for now.

.

I remain neutral on EUR/USD

The eurozone remains in poor economic shape, but the euro has managed to take advantage of the U.S. dollar, which has shown broad losses in recent weeks. We can expect further volatility from EUR/USD in the coming weeks, as both the U.S. and Europe continue to grapple with economic uncertainty.

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week