EUR/USD rocked and rolled, ending the week slightly higher. Will it pick a new direction in the last week of March? Preliminary inflation numbers stand out. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Further signs of a peak in euro-zone showed up with PMI data all falling below expectations, and also the German Economic Sentiment dropped sharply. We may see the result of these forward-looking indices later on. In the US, the Fed raised rates as expected but left the projection for 2018 unchanged at three hikes. Powell voiced concerns about businesses from trade policy, which became an issue for the greenback later on, as Trump imposed tariffs on China. This weighed on stocks and the dollar.

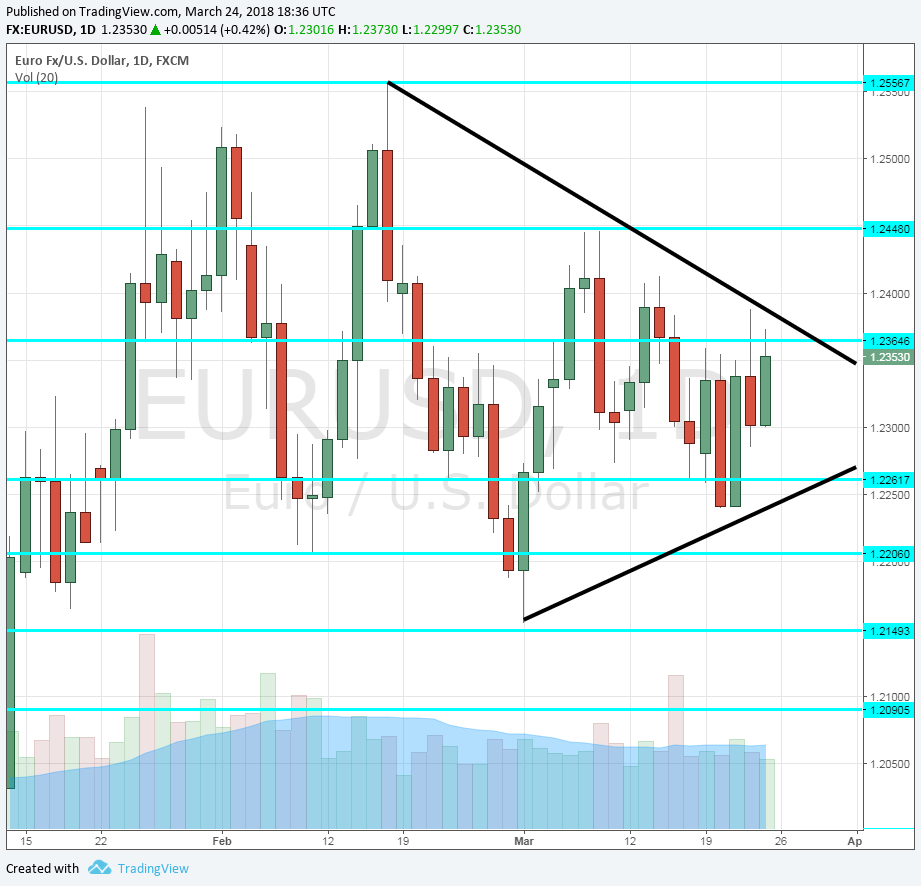

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Jens Weidmann talks Monday, 9:30. The President of the German central bank, the Bundesbank, speaks in Vienna and the topic is “New Momentum for Europe”. Weidmann is seen as the leading candidate to replace Mario Draghi at the helm of the ECB next year and any policy ideas may impact the pair.

- German Import Prices: Tuesday, 6:00. Prices of imported goods serve as another gauge of inflation. Back in January, they increased by 0.5% and a setback is on the cards now: a drop of 0.3%.

- Spanish Flash CPI: Tuesday, 7:00. The fourth-largest economy saw significant changes in its inflation and beforehand deflation. After seeing an annual rise of 1.1% in CPI in February, the preliminary release for March is expected to show a rise to 1.5%.

- Monetary data: Tuesday, 8:00. The amount of money in circulation, M3 Money Supply, is increasing at a robust clip of 4.6% according to the data for January. However, it is slightly slower than beforehand. The same pace is predicted for February. Private loans have accelerated to 2.9% as of January and another small acceleration is projected for February, 3%.

- German GfK Consumer Climate: Wednesday, 6:00. This survey of some 2000 consumers has dropped from the highs and scored 10.8 points in February, still a high level. Another slide to 10.7 points is forecast for March.

- German Prelim CPI: Thursday: the German states publish the data during the morning and the all-German number is out at 12:00. Monthly prices increased by 0.5% in February, but they were not that robust on a yearly basis. Another such monthly increase is estimated for the initial publication for March and this would already raise also the y/y figure. The data feeds into the all-European number due after the Easter weekend.

- German Unemployment Change: Thursday, 7:55. The German labor market continues its ascent with consistent monthly drops in the numbers of the jobless. After a slide of 22K in January, a fall of 15K is predicted for February.

- French Prelim CPI: Friday, 6:45. The second-largest economy in the euro-zone has seen prices stagnate in February and a jump of 0.8% m/m is on the cards for March.

- French Consumer Spending: Friday, 6:45. Consumers have reduced their spending in January with a disappointing drop of 1.9%. An increase of 2.2% is on the cards now.

- Italian Prelim CPI: Friday, 9:00. The third-largest economy closes the list of initial inflation data. A repeat of the minor rise of 0.1% is projected. The country data and the all-European figures are usually released in the same week and the Easter holiday separates them this time.

* All times are GMT

EUR/USD Technical Analysis

Once again, euro/dollar kicked off the week by clinging to the 1.2360 level discussed last week. It then dropped to around 1.2240 before rebounding and closing just above the previous close.

Technical lines from top to bottom:

1.2650 is where the long-term downwards resistance level dating from 2008 meets this month’s levels. Further below, the recent swing high of 1.2555 may serve as resistance.

1.2450 was a swing high in March 2018. 1.2360 provided support to the pair in early February and now switches to resistance.

1.2260 was a support line in mid-February. 1.22 is a round number and also a level of comfort in February. 1.2155 was the low point in early March.

The 2017 peak of 1.2090 remains essential. 1.20 is the obvious round level and also worked as resistance in September.

1.1950 was the high level seen in November and a stepping stone towards 1.20. 1.1860 capped the pair in August and in October while working as support in September.

I turn from neutral to bullish on EUR/USD

While euro-zone growth has peaked, the prospects for the US are worse: the Fed’s dovish hike accompanied by trade wars weigh on the US dollar. At the moment, the euro-zone trades with everybody. Slightly higher inflation may add to the gradual climb.

Our latest podcast is titled Fed Day and Underwhelming Oil

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!