EUR/USD dropped to the lowest in 7 years before recovering and ending the week on a balanced note. Where will it go next? The Italian elections provide a strong start to the week after Germany will have a grand coalition. The ECB decision will gain attention later on. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Euro-zone inflation ticked down to 1.2% y/y as expected and core inflation is stable at 1%. Other figures were mixed, with manufacturing PMI data coming out as expected, German retail sales disappointing but German employment data beating expectations. There was greater drama in the US: Fed Chair Powell hinted that the Fed may raise rates four times this year, expressing a cautiously optimistic tone. Yet, later on, President Trump announced tariffs on steel and aluminum, sending stocks and bond yields lower, allowing EUR/USD to recover. The EU threatens to retaliate.

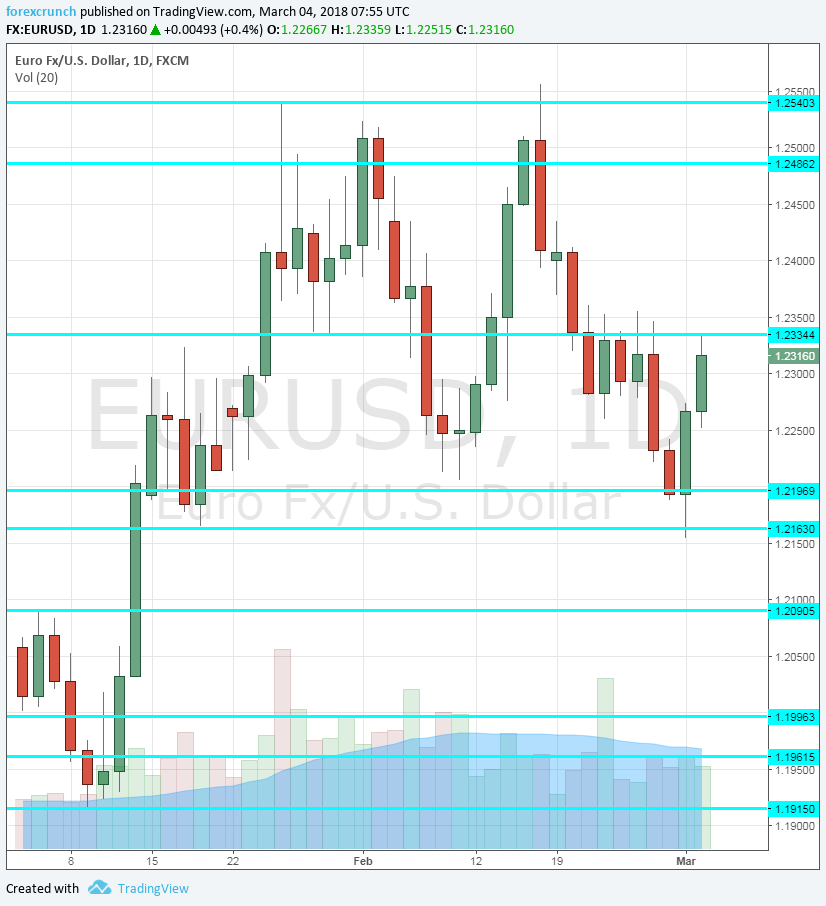

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Italian elections: Sunday, first results from 22:00 GMT, when markets open. Italians go to the polls under a new electoral system and amid high uncertainty, as 30% were undecided the last time that polls were allowed to be published. The most likely scenario is a hung parliament, which would then lead to another grand coalition under incumbent PM Paolo Gentiloni. Such an outcome would be favored by markets. Another possible option is an outright majority for the right-wing alliance led by former PM Silvio Berlusconi. In this case, the PM would either be the mainstream Antonio Tajani, favorable for markets, or Matteo Salvini of The League, a populist that would be unfavorable for markets. The more remote options are a victory for the 5-Star Movement, the biggest party according to polls, and that would be negative for the euro and another possibility is a victory for the center-left PD, which would be favorable for the euro but seems very unlikely. The full results may become known only in the European morning. Note that Germany’s SPD party decided approve a new Grand Coalition with Angela Merkel, with 66% in favor.

- Services PMI: Monday: 8:15 for Spain, 8:45 for Italy, final French figures at 8:50, final German data at 8:55 and final euro-zone numbers at 9:00. Markit’s purchasing managers’ index for Spain stood at 56.9 points in January, well above the 50-point threshold that separates expansion and contraction. IT is expected to slide to 56.5 points now. Italy, the third largest economy, had a score of 57.7 and 57.3 is on the cards for February. The preliminary release for France showed 57.9, for Germany 55.3 and for the euro-zone the flash estimate printed 56.7 points. These final figures are projected to confirm the initial read.

- Sentix Investor Confidence: Monday, 9:30. The survey of around 2800 analysts and investors dropped from the highs in February, standing at 31.9 points. Another slide to 31.1 is on the cards.

- Retail Sales: Monday, 10:00. Consumers reduced their level of spending by 1.1% in December. The new year is expected to see a recovery: an increase of 0.3% in January. However, the disappointing German data may pull the figure lower.

- Retail PMI: Tuesday, 9:10. Markit’s PMI for the retail sector is showing very modest growth in recent months. Back in January, the score stood at 50.8 points. A similar outcome is likely now.

- French Trade Balance: Wednesday, 7:45. France, the second-largest economy, had a deficit of 3.5 billion euros in December. A small widening of this deficit is on the cards for January: 3.7 billion euros. France has a chronic deficit, contrary to Germany, which enjoys surpluses.

- Revised GDP: Wednesday, 10:00. The previous GDP estimates for Q4 stood at 0.6% q/q, a healthy growth rate. This update is expected to confirm the previous releases. Note that changes to y/y figures are more likely than quarterly ones.

- German Factory Orders: Thursday, 7:00. Germany is seen as the locomotive of the euro-zone, making the number important despite its volatility. After an increase of 3.8% in December, a drop of 1.6% is on the cards for January.

- ECB rate decision: Thursday, 12:45, press conference at 13:30. The European Central Bank will probably refrain from making an announcement on QE. The program runs through September, and they have time to announce the next steps. The economy is doing quite well but inflation is not going anywhere fast. This is the reality and the key message from Frankfurt for quite some time. However, ECB President Mario Draghi may certainly move markets, especially if they make minor tweaks to the announcement. They may move to a somewhat more hawkish stance by removing the wording about increasing the QE program if necessary but only lengthening it. That would be a hawkish move, but it may cause the euro to rise, something they do not wish to see.

- German Industrial Production: Friday, 7:00. Contrary to factory orders, industrial output dropped by 0.6% in December. This time, a rise of 0.6% is forecast.

- German Trade Balance: Friday, 7:00. Germany continued having a high trade surplus in December: 21.4 billion euros. A very similar figure is on the cards now: 21.1 billion.

- French Industrial Production: Friday, 6:45. Industrial output increased in France in December by 0.5%. A slide of 0.3% is now projected.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar kicked off the week with a move towards 1.22, mentioned last week. After some hesitation, the pair dropped and temporarily breached 1.2160, but recovered swiftly and took back 1.23.

Technical lines from top to bottom:

1.2650 is where the long-term downwards resistance level dating from 2008 meets this month’s levels. Further below, the recent swing high of 1.2555 may serve as resistance.

1.2537 is the peak in late January 2018 that didn’t hold for a long time. 1.24515 was a temporary cap for the pair in January 2018.

1.2350 provided support to the pair in early February and now switches to resistance. 1.2260 was a support line in mid-February.

1.22 is a round number and also a level of comfort in February. 1.2155 was the low point in early March.

The 2017 peak of 1.2090 remains essential. 1.20 is the obvious round level and also worked as resistance in September.

1.1950 was the high level seen in November and a stepping stone towards 1.20. 1.1860 capped the pair in August and in October while working as support in September.

I remain bullish on EUR/USD

Draghi may try, but fail to talk down the euro. In addition, an ongoing trade war, at least a verbal one, has pushed the pair higher and can continue doing so. In the US, a robust NFP will increase the chances of four rate hikes, but we already learned that from Powell, leaving less room for positive surprises for the USD.

Our latest podcast is titled Crumbling correlations and vulnerable volatility

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!