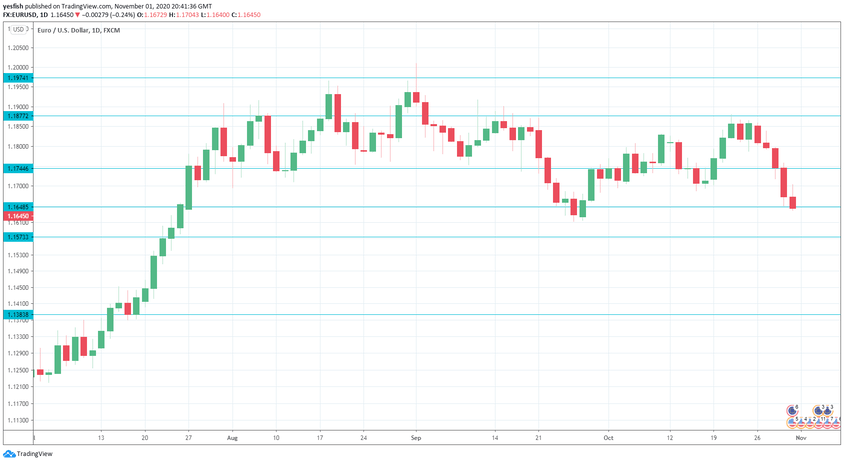

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Manufacturing PMIs: Monday, 8:15 in Spain, 8:45 in Italy, 8:50 in final figure in France, 8:55, final in Germany and final eurozone number at 9:00. German and eurozone PMIs are expected to be well into expansionary territory in October, with estimates of 58.0 and 54.4, respectively. The Spanish release is projected to edge up to 51.0, up from 50.8 points. This is just above the neutral 50-level, which separates expansion from contraction. The French PMI is expected at 51.0 and Italy at 53.9 points.

- Services PMIs: Wednesday, 8:15 for Spain, 8:45 for Italy, final French figure at 8:50, final German one at 8:55, and final euro-zone number at 9:00. The services sector is expected to continue to indicate a contraction in October, with readings below the neutral 50-level. German and eurozone second estimates are projected to confirm the initial readings, at 48.9 and 46.2. respectively. The French second estimate is projected to confirm the initial reading of 46.5. Italy and Spain are expected to dip slightly, with estimates of 47.4 and 40.0, respectively.

- German Factory Orders: Thursday, 7:00. Factory orders improved to 4.5% in August, up from 2.1% beforehand. The September consensus stands at 2.8%.

- Retail Sales: Thursday, 10:00. Retail sales rebounded with a gain of 4.4% in August, up from -1.3% beforehand. However, a decline of 1.4% is expected in the September release.

- German Industrial Production: Friday, 7:00. Industrial Production came in at -0.2% in August, its weakest reading since April. Better news is expected in September, with an estimate of 2.9%.

EUR/USD Technical analysis

Technical lines from top to bottom:

1.1974 is protecting the symbolic 1.20 level.

1.1877 is an immediate resistance line.

1.1744 is providing support.

1.1648 is next.

1.1573 (mentioned last week) has provided support since July.

1.1384 is an important monthly support line. It is the final support level for now.

.

I am neutral on EUR/USD

The euro continues to show volatility and this trend can be expected to continue this week, with all eyes on the US election. The Senate race is extremely tight in some key states, and the specter of a contested election result could add to the volatility.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!