EUR/USD lost a lot of ground on the ongoing Italian crisis and US Dollar strength. Will this continue? The upcoming week features GDP figures and quite a few other indicators. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Italy insists on its 2.4% budget deficit while the European Commission insists this will not stand. The stand-off continues and the heightened rhetoric weighs on Italian bonds and on the Euro. The European Central Bank left the policy unchanged and conveyed a balanced message: highlighting rising employment and wages, expressing confidence in inflation reaching its goal, but also warning about protectionism and of the incompleteness of the monetary union. Global stocks continued the downtrend. The risk-off atmosphere supported the safe-haven US Dollar and Japanese yen. US housing data was mixed and so were durable goods orders.

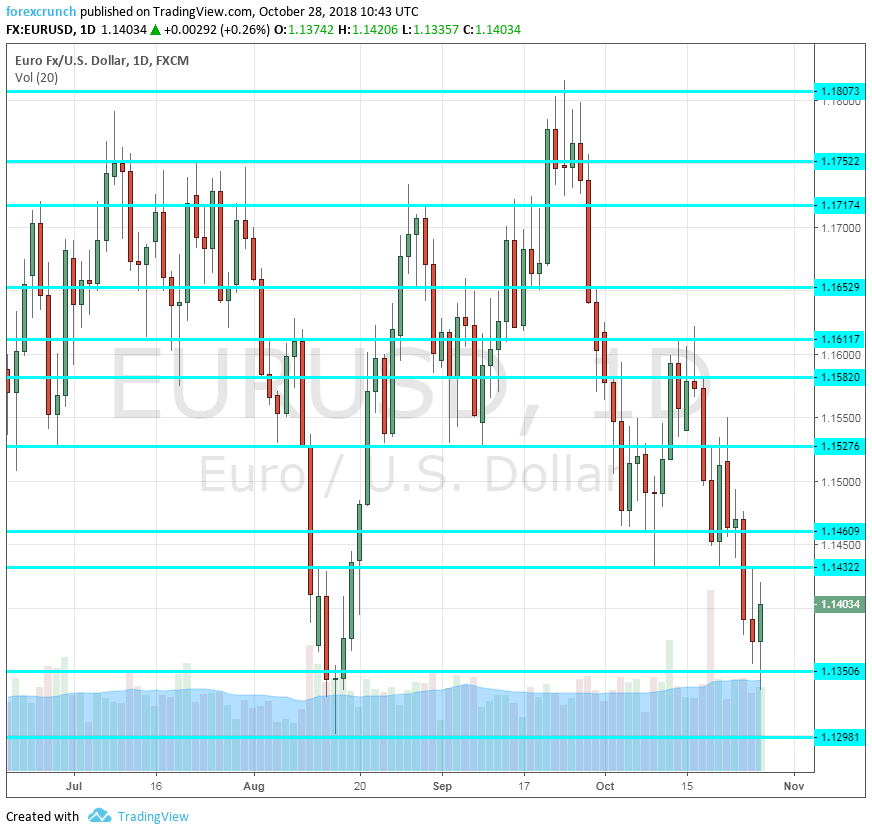

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- French Flash GDP: Tuesday, 6:30. The euro zone’s second-largest economy saw mediocre growth in Q2: only 0.2%, a slowdown after seeing better growth beforehand. The French figure feeds into the all-European number later in the day. A rise of 0.4% is projected.

- German CPI: Tuesday, during the European morning with the final figure at 13:00. The euro zone’s largest economy saw a significant increase in its consumer prices back in September: 0.4%. However, things were more moderate on a yearly basis. We will now get the preliminary numbers for October. An increase of 0.1% is on the cards.

- French Consumer Spending: Tuesday, 7:45. French consumers ratcheted up their spending back in August, with an increase of 0.8%. Consumption is September is forecast to drop by 0.4%.

- Spanish Flash CPI: Tuesday, 8:00. The euro area’s fourth-largest economy had a topline inflation rate of 2.3% in September, above the currency bloc’s average. Spain’s input also feeds into the euro-zone number. A repeat of 2.3% is on the cards.

- German Unemployment Change: Tuesday, 8:55. Germany enjoys a consistent drop in the number of unemployed. The figure that was seen in August was especially impressive: a slide of 23K. Another drop is likely in September: -12K.

- Euro-zone GDP: Tuesday, 10:00. The initial read of GDP tends to have the most significant impact, even though it does not include data from Germany. Back in Q2, the first read showed a growth rate of 0.3% but this was later upgraded to 0.4% and the 19-country economic bloc grew by 2.1% y/y. Similar growth rates, which are OK but not exciting, are likely now. 0.4% is on the cards.

- German Retail Sales: Wednesday, 7:00. Consumers in Germany did not shop as economists had forecast in the past few months. The volume of sales dropped by 0.1% in August. An increase of 0.5% is on the cards for September.

- French CPI: Wednesday, 7:45. France saw a surprising drop in consumer prices in September: 0.2%. The data from France is the last significant input towards the all-European release. A monthly increase in prices is likely in the preliminary number for October: 0.1% is projected.

- Spanish Flash GDP: Wednesday, 8:00. Among Europe’s larger countries, Spain enjoyed a higher rate of growth. However, this slowed down in Q2 with a quarterly increase of only 0.6%. The nation is unlikely to return to higher growth rates in the flash read for Q3: 0.6% is expected now.

- CPI: Wednesday, 10:00. Headline consumer price index is around the ECB’s target, standing at 2.1% y/y in September. However, underlying price pressures remain weak. Core CPI rose by only 0.9% y/y. It will need to accelerate in order to convince the ECB that inflation is genuinely sustained at around 2% and that the increase is not only related to the annual increase in oil prices. The headline number is predicted to rise by 2.1% while core CPI carries expectations for a mini-acceleration to 1%.

- Unemployment Rate: Wednesday, 10:00. The unemployment rate in the euro-zone is dropping quite nicely since it peaked above 12% in 2013. The jobless rate stood at 8.1% in August. The figures for September are due now and the same 8.1% level is on the cards.

- Manufacturing PMI’s: Friday morning: 8:15 for Spain, 8:45 for Italy, the final French figure at 8:50, final German number at 7:55, and the final euro-zone measure at 9:00. Markit’s forward-looking indices have shown a significant slowdown, especially in the manufacturing sector. While the numbers remain above the 50-point threshold separating expansion from contraction, a continuation of the trend may send them below these figures. Spain had a score of 51.4 points in September and a slide to 51 is projected. Italy’s number stood at 50 points and it is expected to fall to contraction territory at 49.7 points. According to the flash read for France for October, the second-largest economy had a score of 51.2 points, Germany had 52.3, and the whole euro area had 52.1 points. The preliminary numbers are expected to be confirmed, but surprises are quite common.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar was under pressure from the outset and the drop under 1.1422 (mentioned last week) proved decisive.

Technical lines from top to bottom:

1.1815 was the high point in September. 1.1750 held the pair no less than four times in July and remains a powerful level.

1.1720 is a veteran line that worked in both directions and it capped the pair in mid-September. 1.1650 was a swing low in late August and is very closely followed by 1.1615 which played a pivotal role.

1.1570 was the low point as September came to an end 1.1530 supported the pair twice in August, making it an important line.

1.1460 was the low point in the initial drop in October 2018. 1.1422 was the low point in mid-October.

1.1365 temporarily cushioned the drop in EUR/USD on its way down. 1.1300 is a round number that held the pair in mid-August and also held the pair down in June 2017.

Lower, we are back to levels last seen in 2017. 1.1220 and 1.1100 are notable.

I remain bearish on EUR/USD

While Draghi wasn’t extremely dovish, the monetary policy divergence continues playing a decisive role in pushing the pair lower. The ECB is exiting its stimulus program very cautiously while the Fed is keen on raising rates. In addition, Italy’s woes will likely continue weighing on the euro while stocks are unlikely to enjoy a reprieve, further supporting the greenback.

Our latest podcast is titled Are stocks free falling or is it a buying opportunity?

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!