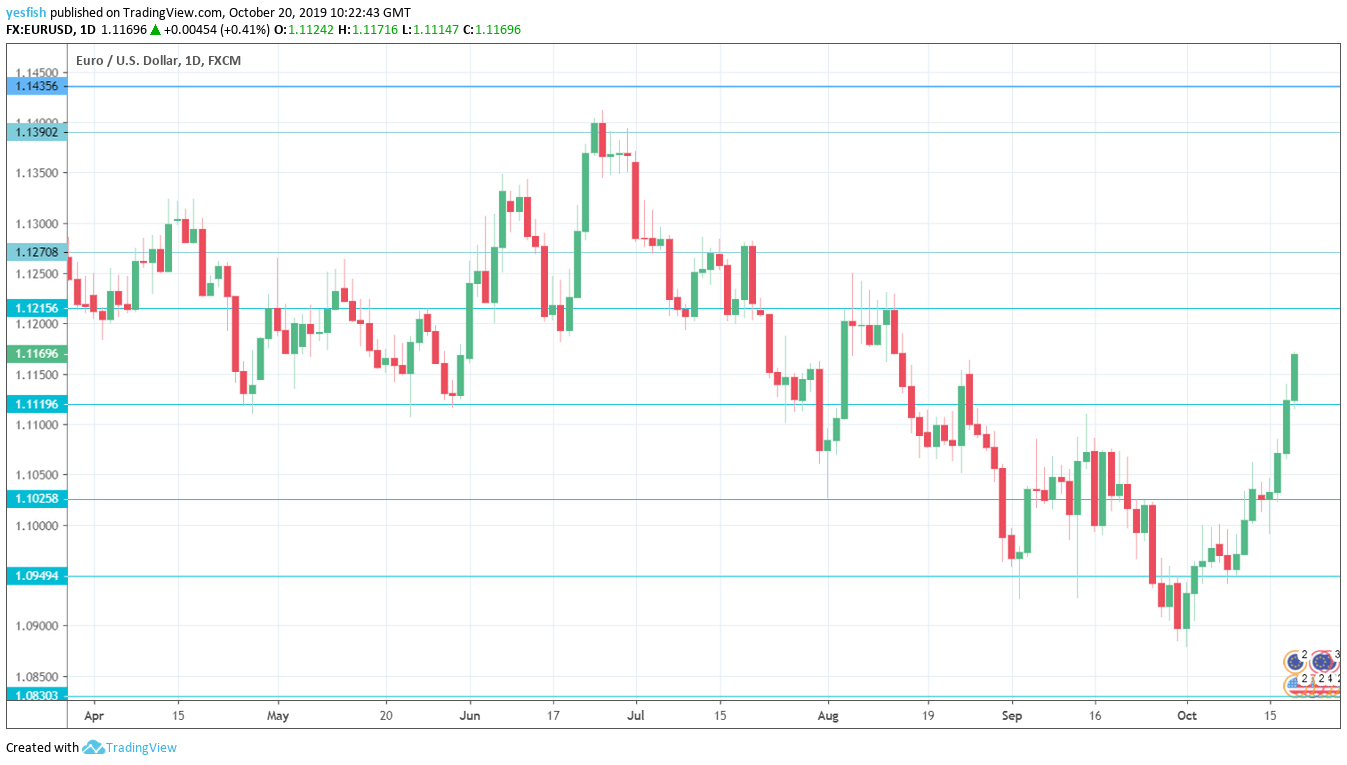

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Consumer Confidence: Wednesday, 14:00. The eurozone consumer remains pessimistic about the economic outlook. The indicator has come in at -7 for five successive readings and no change is expected in the upcoming release.

- PMIs: Thursday, 7:15 for France, 7:30 for Germany, euro-zone number at 8:00. These are the initial releases for services and manufacturing PMIs. In France, both PMIs dipped in August, with readings of 51.6 and 50.3, respectively. Little change is expected in September. Germany’s manufacturing PMI slipped to 41.1, pointing to deep contraction. The estimate for September stands at 52.0. The services PMI dropped to 52.5 points and is projected to dip to 52.0. The eurozone releases mirrored the German data, with the services PMI slowing to 52.0, while the manufacturing PMI dropped to 45.6 points. The manufacturing PMI is forecast to improve to 46.0, while the services PMI estimate stands at 51.9.

- ECB Rate Decision: Thursday, 11:45. The ECB is expected to maintain monetary policy and keep the main financing rate pegged at 0.00%. Mario Draghi’s tenure at the ECB draws to a close at the end of October, and investors aren’t expecting any significant remarks from the ECB chair.

- German GfK Consumer Climate: Friday, 6:00. Consumer climate improved to 9.9 in September, up from 9.7 a month earlier. The October forecast stands at 9.8 points.

- German Ifo Business Climate: Friday, 8:00. The September release improved slightly to 94.6. Business Climate has been on a slow but steady decline – in September 2018, the index stood at 103.7 points. The estimate for October is 94.5 points.

EUR/USD Technical analysis

Technical lines from top to bottom:

We begin with resistance at 1.1515, which was a high point at the end of January. 1.1435 was a low point at the beginning of February.

1.1390 was a stepping stone on the way up in late January and capped EUR/USD earlier. 1.1345 is next.

1.1290 has held in resistance since the first week of July.

1.1215 is under pressure in resistance.

1.1119 (mentioned last week) is providing support. 1.1025 is next.

1.0950 is providing support.

1.0829 has held in support since April 2017.

I remain bearish on EUR/USD

Sentiment towards the euro remains weak, as the U.S. economy continues to outperform the eurozone. Soft global conditions have hampered the manufacturing sector in Germany and the rest of the bloc.

Follow us on Sticher or iTunes

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!