- The EUR/USD recovers from its monthly low amid Fed caution.

- The US Dollar shows bearish signs as markets prepare for a hawkish FOMC decision.

- A spokesman for the ECB dismissed Omicron’s inflation and wage problems.

- Traders will be watching the FOMC meeting minutes and rate decisions.

The EUR/USD forecast is mixed as the recovery halts around the key mark of 1.1300 while the Fed caution and ECB continue to stretch. As markets brace for the Fed’s verdict after a two-day downtrend, the EUR/USD bears are taking a breather around 1.1300.

–Are you interested to learn more about ETF brokers? Check our detailed guide-

In contrast to the ECB’s recent inflation concerns, the US Federal Reserve’s (Fed) dovish expectations give EUR/USD bears hope.

Nevertheless, sluggish yields and a fall in the US dollar from a three-week high are challenging the pair’s short-term moves ahead of major market events.

Nonetheless, the US Dollar Index (DXY) fell from a three-week high on Tuesday, falling as low as 95.95. Moreover, the US 10-year Treasury yield is hovering at 1.78%, which is hardly positive after falling over the past five days.

In addition to Fed worries, recent low yields may reflect geopolitical tensions in Russia and Ukraine, as well as a disappointing economic outlook from the International Monetary Fund (IMF).

The stronger IFO data from Germany and the Eurozone, coupled with weak CBR consumer sentiment and the Richmond Fed manufacturing index, pushed EUR/USD higher yesterday. However, optimistic inflation expectations in the US, based on the 10-year breakeven inflation rate provided by the St. Louis Federal Reserve (FRED), later kept sellers in check.

Philip Lane, the Chief Economist of the European Central Bank (ECB), dismissed Omicron’s inflation concerns, impacting EUR/USD rates. Omicron Coronavirus will not be an important factor affecting activity levels throughout the year, said the policymaker.

This week, traders may be entertained by US housing and trade data as markets look to Fed Chair Jerome Powell for hints of a March rate hike and/or normalization of the balance sheet. Moreover, the Fed’s decline continues, and its end in February could also be called a bearish factor for EUR/USD.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

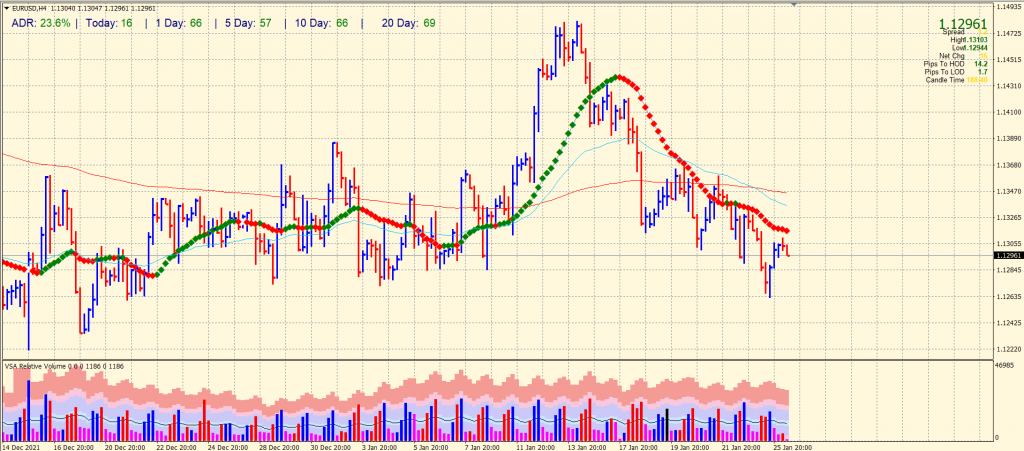

EUR/USD price technical forecast: Recovery stalls at 1.1300

The EUR/USD price recovery stalls at 1.1300 ahead of the 20-period SMA on the 4-hour chart. The bearish crossover between 50 and 200 SMAs continues to support the bears. However, the recent recovery started with a rising volume which could help the pair gain momentum beyond 1.1300. On the flip side, 1.1260 is the next support ahead of 1.1200.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.