EUR/USD reached new highs but was unable to sustain them. What’s next? PMI data stands out in the first week of September. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Conflicting headlines about Italy’s willingness to breach euro-zone budget rules somewhat weighed on the euro. The US and Mexico reached a deal that cheered markets, sent stocks higher and the greenback lower. US GDP beat with 4.2% in the second release for Q2 while consumer the CB confidence reached the highest levels since 2000, helping the greenback recover.

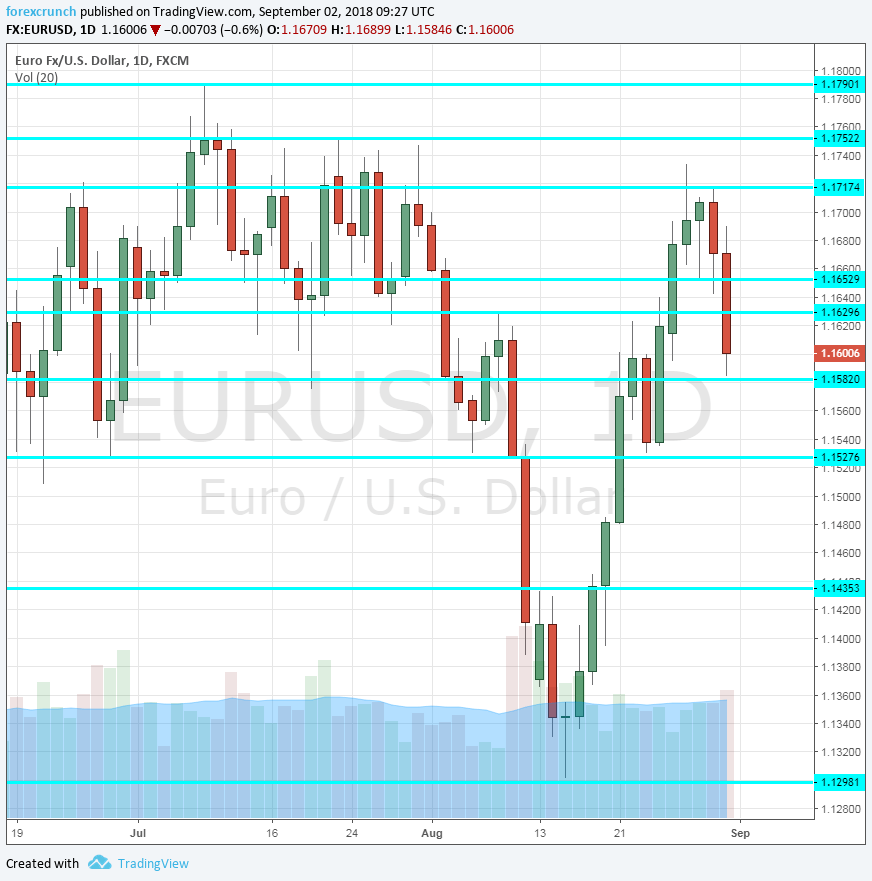

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Manufacturing PMI’s: Monday, 7:!5 for Spain, Italy at 7:45, final French figure at 7:50, final German number at 7:55, and the final euro-zone figure for August is due at 8:00. Spain, the fourth-largest economy, had a score of 52.9 points in July, only slightly above the 50-point threshold that separates expansion from contraction. A score of 52.5 is expected for August. Italy had a lower score of 51.5 points and 5.12 is on the cards now. According to the preliminary estimate for August, France had 53.7, Germany a more robust 56.1, and the euro-zone 54.6 points. The final readings are expected to confirm the flash PMI’s.

- Spanish Unemployment Change: Tuesday, 7:00. Spain saw a drop of 27.1K in the number of the jobless in July. The figure for July will likely be similar, at the peak of the tourism season.

- PPI: Tuesday, 9:00. Producer prices eventually feed into consumer prices and are eyed by the ECB. An increase of 0.4% was seen in June and we will now get the figures for July. An increase of 0.3% is projected.

- Services PMI’s: Wednesday, 7:!5 for Spain, Italy at 7:45, final French figure at 7:50, final German number at 7:55, and the final euro-zone figure for August is due at 8:00. Spain saw a score of 52.6 in July with 52.1 predicted now. Italy had a better 54 points and 53.2 is forecast now. The flash estimate for France stood at 55.7, Germany at 55.2, and the euro-zone at 55.2 points. The final figures for August will probably confirm the initial numbers.

- Retail Sales: Wednesday, 9:00. While France and Germany have already published their retail sales numbers, the all euro-zone read can provide surprises. The volume of sales increased by 0.3% in June. A slide of 0.1% is expected.

- German Factory Orders: Thursday, 6:00. Despite being a volatile figure, the long-term trends matter for Germany, the locomotive of the continent, and for the euro-zone. A sharp drop of 4% was seen in June. A bounce of 1.6% is projected for July.

- German Industrial Production: Friday, 6:00. The related figure also fell in June, but only by 0.9%. We may see a bounce back also here. An increase of 0.2% is estimated for July.

- German Trade Balance: Friday, 6:00. Germany has a broad trade surplus, a factor that keeps the common currency bid in quiet times. The surplus dropped below 20 billion euros in June and stood at 19.3 billion euros. A marginally narrower trade deficit of 19.1 billion is on the cards now.

- French Industrial Production: Friday, 6:45. Contrary to Germany, France enjoyed an increase in its industrial output in June: 0.6%. A more modest change could be seen now. An increase of 0.2% is expected.

- French Trade Balance: Friday, 6:45. France has a chronic trade deficit which expanded to 6.2 billion back in June. A narrower deficit is likely for JulyÑ 5.7 billion is projected.

- GDP: Friday, 9:00. Q2 GDP has already been upgraded from 0.3% to 0.4% q/q. The updated estimate will likely confirm the 0.4% growth rate which was also the level in Q1. An increase of 0.4% is on the cards.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar moved higher but failed to hold above the 1.1720 level mentioned last week.

Technical lines from top to bottom:

1.1850 was the peak on June 14th, before Draghi sent the euro down. 1.1795 was a swing high back in July.

1.1750 held the pair no less than four times in July and remains a powerful level.

1.1720 is a veteran line that worked in both directions, last seen in November. 1.1650 was a swing low in late August and is very closely followed by 1.1630 which held the price down in mid-August.

1.1580 worked as support in late August. 1.1530 supported the pair twice in August, making it an important line. 1.1435 held the EUR/USD down when it was trading around the yearly lows.

1.1300 is a round number that held the pair in mid-August and also held the pair down in June 2017.

I am bearish on EUR/USD

The summer is over and perhaps the correction with it. Monetary policy divergence between the hawkish Fed and the dovish ECB joins a trade war between the US and China which is beneficial to the US Dollar.

Our latest podcast is titled Brexit summer blues, trade troubles

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!